A week ago, CRTC Chair JP Blais announced a series of decisions in a speech in my home town – London, Ontario – the cradle of Canadian cable TV. For a week, I have been considering what to write about these decisions. How can I add to the analysis that is already available?

This morning, in a 2000 word essay, Greg O’Brien at Cartt.ca released the most complete analysis and commentary: Why the Super Bowl simsub decision is the beginning of the end of the system, and of vertical integration. I strongly urge you to read it… read it all the way through.

I will just wade into the mobile TV discussion.

Last summer, inspired by the array of flavours at Momma Bear’s in Bracebridge, Ontario, I wrote a piece called “Tiger ice cream and the digital economy“.

Mobile TV has been under examination by the CRTC to see if rules are being broken because people can’t get open internet video streaming for the same effective cost per megabyte as packaged mobile video. Frankly, my initial reaction would be to respond that mobile carriers marketing departments should be free to choose whatever products they want to offer. Some service providers only offer voice and text. Isn’t it up to the service provider to decide whether they offer data and at what speeds?

If you want open internet, here is the price per megabit per second and here are the terms and conditions. If you don’t accept those conditions, please feel free to find another service provider.

We don’t mandate that ice cream stores offer tiger ice cream – although maybe we should – nor do we limit them from offering more than vanilla flavour. We don’t even require them to offer vanilla.

Price discrimination is not against the law, contrary to the views being expressed by many. I saw one piece that said:

Indeed, the CRTC found that a member of the public viewing identical programming would pay $5 if they were a Bell mobile TV customer and $40 (a difference of 800%) if they did not subscribe by way of Bell’s mobile TV service. In these circumstances, how could the CRTC find other than that Bell and Videotron, in their roles as signal transmission providers, had discriminated against the customers of other Internet streaming services available in the mobile market?

It is actually a 700% difference, but that is irrelevant. Massive discounts for subscriptions are the norm as those of us who still like glossy paper know. Consider magazines. It is quite common for annual subscriptions to be priced at 80-90% off the individual cover prices. My newspaper delivery is less per month than I would pay per day at the convenience store.

In “Roadblocks for an innovation economy“, I observed “The UK was concerned that net neutrality regulation might prevent pricing innovation, differentiation of offers and serve to discourage investment in higher-speed access networks.”

In “Roadblocks for an innovation economy“, I observed “The UK was concerned that net neutrality regulation might prevent pricing innovation, differentiation of offers and serve to discourage investment in higher-speed access networks.”

Through the years, carriers have tried various means to encourage adoption of new services, including special flat rate prices for certain services (Canadians have demonstrated an affinity for flat rate over variable pricing).

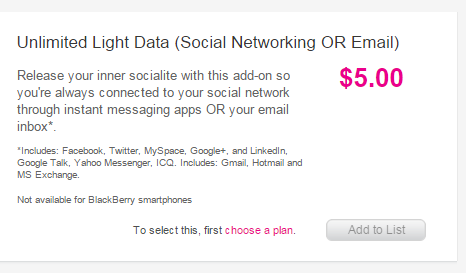

Even today, Mobilicity offers an “Unlimited Light Data” plan that provides unlimited access to certain popular social media websites, but not others.

Such plans were common in the early days of mobile internet, encouraging the adoption of smartphones and getting consumers into the idea of incremental data plans.

But in reference to the Mobile TV decision, in his interview with Cartt.ca, CRTC Chair JP Blais said “this is about an open internet. It’s about making sure that there aren’t fast lanes and slow lanes.”

No data was being slowed down or sped up, so are we to interpret this statement as a ban on bundling data for certain applications?

As such, is Mobilicity’s Light Data add-on next to be shut down?

Should the dairy board be investigating why my ice cream shop charges the same price per scoop for truffle packed ice cream as it does for plain vanilla?

I doubt I would ever find tiger ice cream if my local shops needed to get bureaucratic approval.

The digital economy framework shouldn’t block service innovation and differentiation.

In Canada and the United States, government bodies are increasing their intervention in the internet.

A few weeks ago, I wrote about special pricing plans in a piece called “Zero is better than nothing.” It concluded “Consumers can benefit greatly from creative, competitive, targeted pricing plans. Regulators need to be careful imposing restrictions on the evolution of business models.”

In addition to our annual Regulatory Blockbuster, The 2015 Canadian Telecom Summit [June 1-3 in Toronto] will be presenting a panel of leading economists from both sides of the border to explore the impact on innovation and investment. Early Bird prices are available until the end of February. Register today!

As this piece pulls broadly from the ‘Tiger Ice Cream’ post from last summer, I’ll copy/paste from my own comment there:

“Equating ice cream with mobile (or non-mobile data for that matter) is a straw man argument – there is no actual parallel between these two business types.

It’s simple and cheap for the consumer to move to a different ice cream shop. There are thousands of them, individually they have no market power, and there are no long-term contracts binding people to a single ice cream shop for multiple years.

There is no true option to “switch suppliers” in the current Canadian telecom oligopoly. The big three each offer their own slightly different version of the same thing – without actually offering much of anything different or innovative.”

Frankly, the average Canadian consumer is not interested in competition based on TV shows or special data streams. Given that the networks are all functioning pretty well and can deliver the packets we ask for, what we would really like to see is some competition based on price. In a healthy, competitive market that would be unavoidable, but it appears to be entirely avoidable in this market. And they wonder why we are cynical about their motives?

Gosh Geoff. You must have missed the news. There aren’t long term contracts in Canada’s wireless industry. That was a June 2013 decision. It is simple, and cheap (free) to move to a different wireless provider. You want options in the wireline, wireless, internet or TV market, go shopping. While you claim that “the average Canadian consumer is not interested in competition based on TV shows or special data streams”, there are 1.5M Mobile TV subscribers who were interested – about double the number of Wind Mobile subscribers, and close to 20% of Bell’s total base.

There is price competition already. Last week decision left Canadians with reduced choice and higher prices. It was an attack on the “different or innovative” offers you, among other Canadians, sought.

So buying a $4 ice cream is the equivalent decision for the consumer as signing a 2 year phone contract? It might be an attractive metaphor, but that makes it no less a logical fallacy.

I look forward to seeing the market research that indicates declining monthly mobile charges for the average consumer. That will be truly welcome news.

Where did you get: “So buying a $4 ice cream is the equivalent decision for the consumer as signing a 2 year phone contract?”

From your tone, I don’t think you understand the difference between prices and monthly bills (but you aren’t alone).

As Minister Moore said in his statement today, “prices have fallen on average by 22 per cent”. “Prices” refers to the cost per minute, per text, per MB. At the same time, more of us are buying more of each. His statement is supported by research conducted by the CRTC each year. For that matter, pull out a bill and compare the unit prices you are paying today versus 5 years ago.

We make and receive more mobile calls, we send more texts and use more data. Some are taking data for the first time. As a result, bills are going up (reported as ARPU). That is a sign of health. Consumers are choosing to spend more because the services are delivering greater value.

Among the bigger carriers, we see, in some cases, more dramatic increases in ARPU as some of the lower billing customers move to value-priced brands. It isn’t necessarily caused by price increases or changes in services being purchased. Instead, it is because lower billing customers find a different provider, which raises the overall average.

Mark, your ice cream analogy leaves me cold. I’m with Geoff!