for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreRADNOR, Pa. – February 10, 2016 – At the T3 Advisor conference in Fort Lauderdale, Florida today, eMoney Advisor (“eMoney”), a leading provider of wealth-planning technology for financial professionals, will unveil its enhanced client experience.

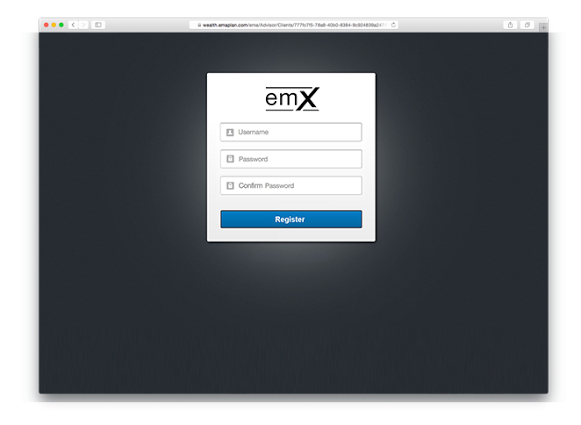

Featuring many of the emerging technology tools that investors find most useful about digital advice-platforms within its advisor-centric portal, eMoney’s new client experience includes enhancements that save time and improve ease-of-use. These include self-registration and an automated onboarding process.

A screenshot of eMoney’s new self-registration page.

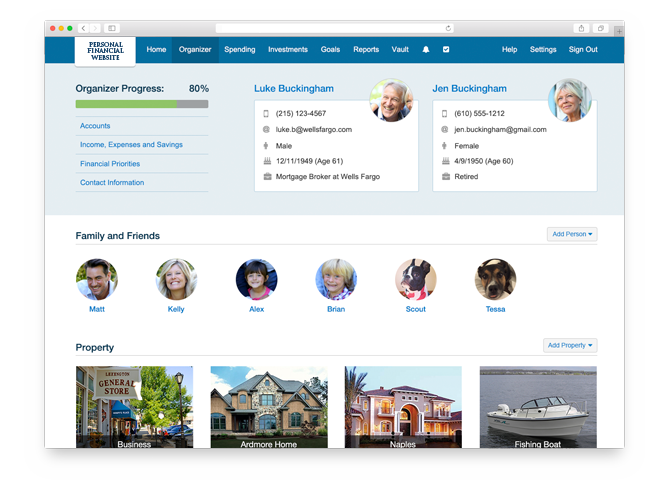

eMoney’s new Organizer as shown through a sample client.

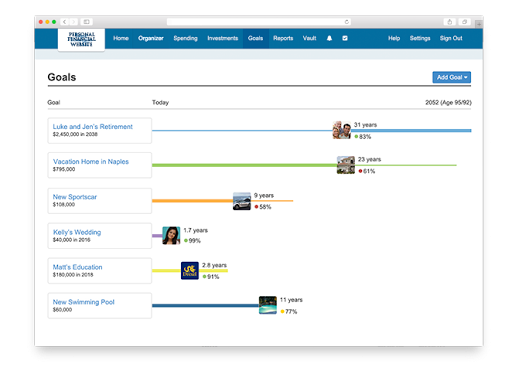

It also offers new features to foster collaboration between advisors and clients, and takes a more personalized, goal-centric approach to help end-clients visualize the value their advisor adds within the context of key financial milestones.

A screenshot of eMoney’s new Goals page.

“The experience matters,” says Drew DiMarino, eMoney’s executive vice president and head of sales, who is scheduled to address a room of 500 advisors attending the two-day T3 event. “At eMoney, we believe you offer your clients the best experience by combining your expertise and advice with a planning-focused technology that’s easy-to-use, interactive, and engages clients in a way that builds trust.”

First launched in 2001, eMoney’s client portal has been the go-to advisor-led personal financial management (PFM) solution for the industry’s top advisors and firms, providing a platform for end-clients to monitor their financial accounts, track progress toward goals, evaluate spending and budgets, collaborate with their advisor, and more. The portal connects seamlessly to eMoney’s advisor tools, which further improves the system’s technology-driven wealth-planning capabilities and puts the advisor at the center of the relationship.

And the numbers confirm that. A third-party survey of eMoney clients found that 70% of participants selected eMoney’s client website as the tool most useful to their businesses. Of those individuals: 70% reported that they have attracted new clients or retained existing clients; roughly half have increased the number of financial plans and reported increased net new assets; and 90% said they increased client satisfaction and retention by implementing eMoney’s client website to organize their clients’ financial lives.

“There’s no shortage of self-guided, online financial tools available at a person’s fingertips, often for free,” says Perry Moore, director of wealth planning at Payne Wealth Partners, Inc. and a member of the beta group testing the new portal. “But you could hand me the keys to a 747 and without an experienced pilot by my side, I wouldn’t get very far. What’s most significant about eMoney’s portal is how it’s positioned around the advisor/client relationship. We’re completely connected. That’s the real differentiator, not only for advisors as we think about how to best grow our businesses, but also for clients who have the benefit of working with a firm that offers the best of both worlds.”

“There are a growing number of forces putting pressure on you and your clients,” DiMarino explains. “A shifting regulatory environment, disruptive technology, an increasingly competitive landscape and the need to differentiate. By providing an advisor-driven, planning-rich client experience that pairs innovation with advice, eMoney is helping advisors stay relevant.”

Recently, eMoney expanded its product offering to deliver three distinct solutions—emX Pro, emX, and the emX Select Platform. With added choice and flexibility, the expanded capabilities better accommodate eMoney’s diverse, growing client base with a solution that aligns with the needs of individual advisors and RIAs, as well as one that can be more appropriately scaled across large institutions.

DiMarino is also scheduled to preview several other initiatives eMoney has on the horizon, including:

The enhanced version of eMoney’s new client experience will roll out later this month. Attendees of the T3 conference can learn more about it, as well as the other initiatives in development, by visiting eMoney at booth 300 in the exhibitor’s hall. For the latest information on eMoney, also visit www.emoneyadvisor.com and the eMoney Blog, or connect on Facebook, Twitter and LinkedIn.

For media inquiries regarding this announcement, contact emoney@ficommpartners.com.