By Sid Sharma

@SidBSharma

The Cynical Desi

A sense of disquiet seems to be in the air of the little startup wonderland known as Silicon Valley. It finally hit me when home cleaning company Homejoy shuttered its doors. How could it burn through $40 million so quickly? The story isn’t any better for larger companies. Twitter has fallen off the pedestal as well – its stock is now lower than its original offering price. And if noted venture capitalist Bill Gurley is to be believed, a lot more bad news is on the way.

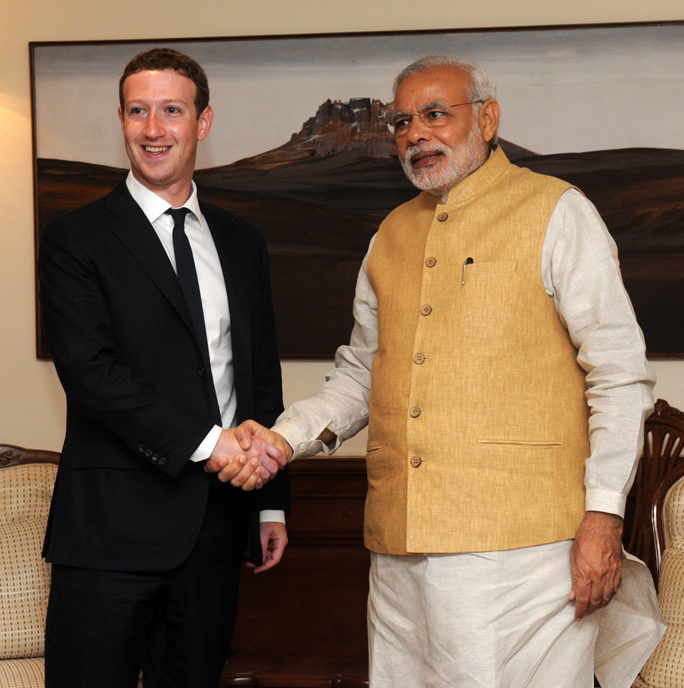

This is the setting for Indian Prime Minister Narendra Modi’s visit to New York & Silicon Valley beginning today. When it was first announced I, like many, thought it was a natural extension of his Make in India campaign. In other words, this is a platform for him to pitch India as a great place to do business. Normally tech companies could afford to throw caution to the wind and invest big in a place like India without caring about the red tape and political log jam. Can these battered companies afford to take such a risk now?

I am very much convinced that Modi’s standard talking points need to be recalibrated to appeal to a wounded Silicon Valley. Namely, this is a place that needs financial help and India can serve as a white knight saving many beleaguered companies. In essence, ask not what Silicon Valley can do for India, ask what India can do for Silicon Valley.

In his Independence Day speech, Modi promised to create a fund for entrepreneurship. India’s 2015 budget set aside more money for funding startups than any other player in the country. It might be a really good idea to take some of this money and invest directly in Silicon Valley as a sovereign wealth fund would.

LATEST STORIES

A sovereign wealth fund is essentially a pile of excess money that a country uses for investment. They could invest in real estate, bonds or any asset class under the sun. In this case, I am calling for an India-based Silicon Valley focused fund that invests in fundamentally good companies but are beset by economic headwinds. An injection of cash and preferential access to the large Indian market would go a long way to help the Valley out of this current malaise.

While such an arrangement is good for the companies, how would it actually help the Indian people? Of course, the country would ideally make money if its investment went public or was acquired. The better thing for long-term development would be bringing these companies to India in away that in trains the next generation of India-based entrepreneurs.

As part of the deal terms, the government of India could ask for these companies to open at least one physical presence in India. These offices would hire entry level workers in the country and provide ways for talented workers to monetize their educations. any firms are already doing this due to the low cost of hiring Indian programmers and other technical specialists. What official government sanction would do is standardize rules and procedures and turbocharge the process.

The best thing that could happen when young Indian workers enter the startup world is to become entrepreneurs themselves. Essentially such an arrangement would be the equivalent of creating new universities. Instead of learning theory-based knowledge, they would instead learn practical things, such as how use metrics to grow a business, how to hire the right kind of people and so on. The results could be dramatic. Imagine if the next Uber or Facebook was created in India.

There are many practical difficulties to this approach. Some of them include finding the right basket of firms that could train the next generation of Indian entrepreneurs. They should be sufficiently early stage that the workers actually get to learn what it feels like to be at an actual startup instead of working at a large, bureaucratically hobbled company. Hard-handed government regulation could destroy the magic and turn these companies into ineptly run state-owned enterprises. But if the government is smart about giving these firms a wide latitude with a narrow provision that they train local workforces, the rewards could be immense and achievable. Finally, we have to appreciate that there is little appetite for creating a sovereign wealth fund in India.

India’s capital markets are developing well, but for the country to truly kick things into high gear, it must inculcate startup culture at the individual worker level. I believe such a program could be quickly brought to scale with the resources of the state committed to the project in a big way. Yes, there will be failures along the way. But in failure or in success, if structured properly, it could train the next founder of a multibillion-dollar enterprise.