Retirement Benefits Schemes Performance in Kenya, & Cytonn Weekly #09/2021

By Cytonn Research, Mar 7, 2021

Executive Summary

Fixed Income

During the week, T-bills recorded an oversubscription, with the overall subscription rate coming in at 141.0% up from 132.0% recorded the previous week due to increased liquidity in the money markets. The highest subscription rate was in the 364-day paper, which increased to 190.2%, from 151.6% recorded the previous week. The subscription for the 91-day paper also increased to 176.1%, from 157.0% recorded the previous week, while the 182-day paper’s subscription rate declined to 77.7%, from 102.3% recorded the previous week. In the primary bond auction, the government is seeking to raise Kshs 50.0 bn for budgetary support by reopening two bonds, FXD1/2019/10 and FXD2/2018/20, with a time to maturity of 8.0 and 17.4 years, respectively. The bonds have coupons of 12.4% and 13.2% and are currently trading at a yield of 12.0% and 13.0%, respectively in the secondary market;

Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for February 2021, which came in at 50.9, a decline from the 53.2 recorded in January 2021, which was the lowest that has been reported over the last eight months. The decline can be attributed to low cash flows in the economy and the increased costs fuels in addition to the VAT Adjustments that happened in January;

The Budget and Appropriation Committee (BAC) presented the report on the Budget Policy Statement (BPS) and the Medium Term Debt Strategy (MTDS) for the 2021/2022 Financial Year to parliament. The BAC report was approved by the National Assembly and some of the notable approvals include: (i) the fiscal deficit was set at the lower of 7.5% of the country’s GDP or Kshs 930.0 bn, (ii) the revenue collections was set to be not less than Kshs 2.0 tn, and, (iii) the approved foreign and domestic debt mix of 43:57 translating to total borrowings for the next financial year at Kshs 530.0 bn foreign debt and Kshs 399.9 bn domestic borrowing;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 1.3%, while NASI and NSE 25 declined by 2.2% and 1.0% respectively, taking their YTD performance to gains of 6.3%, 5.2% and 3.7% for NASI, NSE 25 and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as NCBA, Diamond Trust Bank (DTB-K), and EABL of 5.7%, 3.6%, and 1.8%, respectively. The gains were however weighed down by losses recorded by stocks such as Bamburi, Safaricom and BAT, which declined by 3.9%, 3.7% and 1.8%, respectively. During the week, Equity Group Holdings Plc signed a Kshs 16.5 bn (€125.0 mn) loan facility with the European Investment Bank (EIB) and the European Commission for onward lending to Micro Small and Medium-sized Enterprises (MSMEs). Additionally, during the week, Stanbic Holdings released their FY’2020 financial results highlighting an 18.6% decline in their Core earnings per share to Kshs 13.1, from Kshs 16.1 in FY’2019;

Real Estate

During the week, Acorn Holdings, a real estate developer announced that InfraCo, a United Kingdom funded private infrastructure development group has invested Kshs 1.0 bn to the firm’s real estate investment trust (REIT) intended to support the construction of 10,000 affordable student accommodation units in Nairobi;

Focus of the Week

According to the Kenya National Bureau of Statistics (KNBS) FinAccess Report 2019, pensions industry has witnessed significant growth with the number of registered members growing by a 10-year CAGR of 15.7% to 3.0 mn members in 2019, from 0.7 mn registered members in 2009. Additionally, Assets Under Management have grown by a 10-year CAGR of 15.8% to Kshs 1.3 tn as of December 2019, from Kshs 0.3 tn in 2009. This growth has been attributed to the mass education drives on the importance of retirement savings by the Retirement Benefits Authority and the industry players. This week we shall review the overall performance of the pensions schemes over time with a key focus on the year 2020;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.85%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.87% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills recorded an oversubscription, with the overall subscription rate coming in at 141.0% up from 132.0% recorded the previous week due to the increased liquidity in the money markets as a result of government payments. The highest subscription rate was in the 364-day paper, which increased to 190.2%, from 151.6% recorded the previous week. The increased appetite for the 364-day paper is mainly attributable to growing investor preference for medium-term papers as investors now believe the pandemic has been contained but are still worried about the possible effects of the current rising political temperatures preceding the elections in August 2022. The subscription for the 91-day paper also increased to 176.1%, from 157.0% recorded the previous week, while the 182-day paper’s subscription rate declined to 77.7%, from 102.3% recorded the previous week. The yields on 364-day, 182-day, and 91-day papers rose by 5.7 bps, 4.3 bps, and 9.3 bps to 9.1%, 7.8%, and 7.0%, respectively, as investors sought higher yields as the government’s demand for cash remained high. The government accepted 89.2% of bids received, amounting to Kshs 30.2 bn, out of the Kshs 33.8 bn worth of bids received.

In the primary bonds auction, the government is seeking to raise Kshs 50.0 bn for budgetary support by reopening two bonds, FXD1/2019/10 and FXD2/2018/20, with effective tenures of 8.0 and 17.4 years, respectively. The bonds have coupons of 12.4% and 13.2% and are currently trading at a yield of 12.0% and 13.0%, respectively in the secondary market. Given the tightening liquidity in the market coupled with the under subscription recorded in last month’s issues, we anticipate an under a subscription and a high acceptance rate. The bonds will be on offer from 01/03/2021 to 09/03/2021 and we recommend a bidding range of 12.4%-12.5% for FXD1/2019/10 and 13.4%-13.5% for FXD2/2019/20.

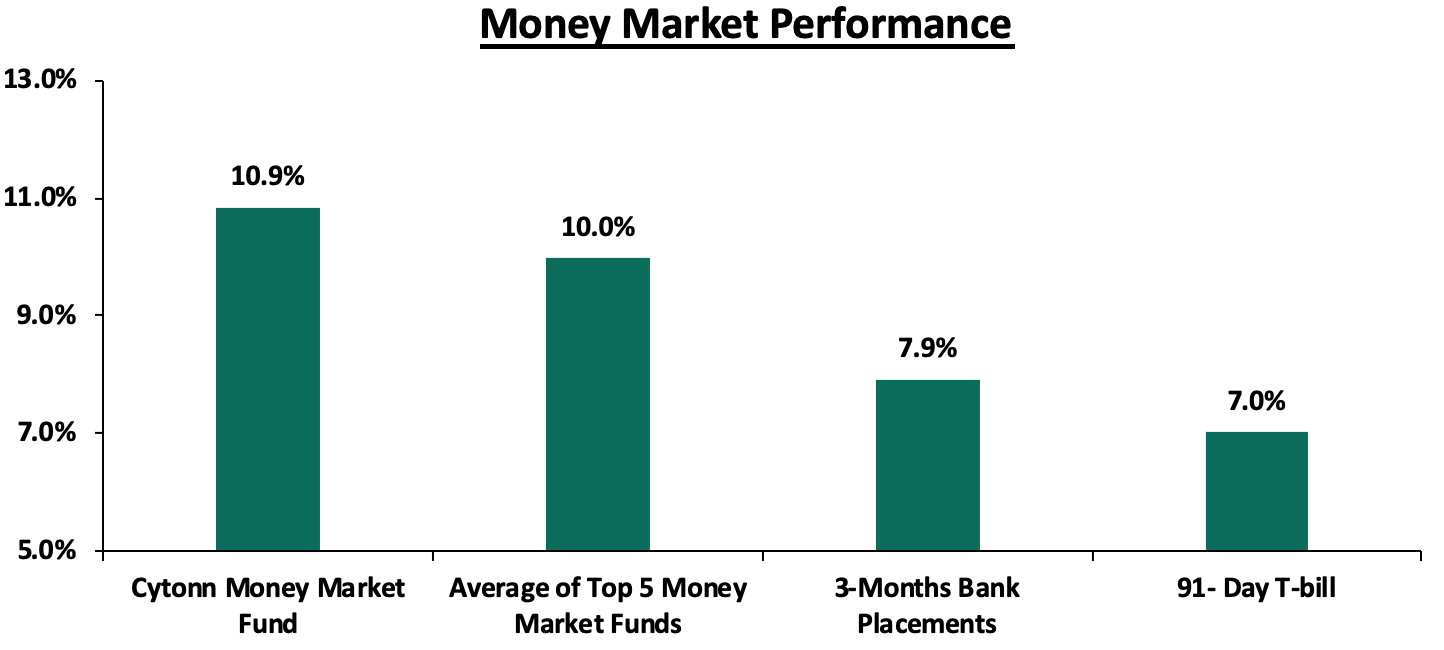

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 9.3 bps to 7.0%. The average yield of the Top 5 Money Market Funds remained unchanged at 10.0% from last week. The yield on the Cytonn Money Market increased marginally by 0.1% points to come in at 10.9%, from 10.8% recorded the previous week.

Liquidity:

During the week, liquidity in the money market tightened, with the average interbank rate increasing to 4.9% from 4.2% recorded the previous week, as the government payments were offset by tax remittances. The average interbank volumes declined by 24.7% to Kshs 11.6 bn, from Kshs 15.3 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin released on 5th March 2021, commercial banks’ excess reserves came in at Kshs 13.5 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the week, the yields on Eurobonds were on a downward trajectory. According to the Central Bank bulletin, the yields on the 10-year Eurobond issued in June 2014, the 10-year and 30-year Eurobonds issued in 2018, and the 7-year and 12-year Eurobonds issued in 2019 all declined by 0.1% points to 3.2%, 5.3%, 7.3%, 4.6%, and 6.3% respectively, from 3.3%, 5.4%, 7.4%, 4.7%, and 6.4%.

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

29-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.8% |

6.1% |

|

26-Feb-2021 |

3.3% |

5.4% |

7.4% |

4.7% |

6.4% |

|

01-Mar-2021 |

3.3% |

5.3% |

7.3% |

4.6% |

6.3% |

|

02-Mar-2021 |

3.1% |

5.3% |

7.3% |

4.6% |

6.3% |

|

03-Mar-2021 |

3.1% |

5.3% |

7.3% |

4.6% |

6.2% |

|

04-Mar-2021 |

3.2% |

5.3% |

7.3% |

4.6% |

6.3% |

|

Weekly Change |

(0.1%) |

(0.1%) |

(0.1%) |

(0.1%) |

(0.1%) |

|

Monthly Change |

(0.4%) |

(0.0%) |

0.1% |

(0.2%) |

0.2% |

|

YTD Change |

(0.7%) |

0.1% |

0.3% |

(0.3%) |

0.4% |

Source: CBK Bulletin

Kenya Shilling:

During the week, the Kenyan shilling appreciated by 0.3% against the US dollar to Kshs 109.7, from Kshs 109.8 recorded the previous week. This was mainly attributable to market participants anticipating a positive economic recovery from the coronavirus crisis coupled with the arrival of vaccines in the country during the week. On a YTD basis, the shilling has depreciated by 0.4% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect continued pressure on the Kenyan shilling due to:

- A slowdown in foreign dollar currency inflows due to reduced dollar inflows from sectors such as tourism and horticulture, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.4 bn (equivalent to 4.5-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 19.7% y/y increase to USD 299.6 mn in December 2020, from USD 250.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation.

Weekly Highlights:

A: The Monthly Purchasing Managers’ Index (PMI)

During the week, Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for February 2021, which came in at 50.9, a decline from the 53.2 recorded in January 2021, attributable to marginal growth in output, the modest increase in new order volumes and weak cash flow which limited household and client spending. Key to note, readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 indicate a deterioration. This was the first decline recorded after an eight-month run of consecutive growth, following the initial impact of the COVID-19 outbreak. Slower sales were attributed to cash flow constraints in some sectors of the economy, leading to reduced customer spending and travel. New orders from foreign clients recorded modest growth, experiencing the lowest growth since June 2020. Employment numbers increased albeit marginally in February while some businesses cut workers’ salaries to maintain current staff levels, leading to the fastest drop in average wage costs in seven months. Cost burdens were driven higher by a sharp increase in purchase prices, attributable to the recent hike in VAT, material shortages, and increased fuel prices. In line with the decline in some of the leading economic indicators, we maintain a cautious outlook in the short term owing to the increasing inflation levels in the country coupled with an increase in COVID-19 infections globally. The speed in distribution and inoculation of the vaccines in some of the key trading partners will affect the number of exports being demanded.

B: The Budget and Appropriations Committee (BAC) report on the 2021/22 Budget Policy Statement

During the week, the Budget and Appropriation Committee (BAC) presented the report on the Budget Policy Statement (BPS) and the Medium Term Debt Strategy (MTDS) for the 2021/2022 Financial Year to parliament. The BAC report, which was approved by the National Assembly on 4th March, set limits on the fiscal deficit to the lower of 7.5% of the country’s GDP or Kshs 930.0 bn, for the FY’2021/2022 financial year. The committee raised the concern that the existing expenditure pressures and revenue enhancement measures proposed by the BPS are similar to those that have been unsuccessful in the past, and therefore the set target of reducing the fiscal deficit to 4.5% of GDP by 2023/24 may not be achieved. The BAC, therefore, outlined recommendations that would restructure and limit government borrowing in the coming financial year in line with the aim of reducing the fiscal deficit.

Key take-outs from the report include;

- The committee recommended that the National Treasury should review ongoing government projects and consider deferment of new projects by one financial year in order to enable adequate funding of stalled projects before the finalization of budget estimates for FY’2021/2022. This will ensure that ongoing projects are completed before embarking on new ones,

- State-Owned Enterprises (SoEs) should be restructured, especially the highly indebted ones, with a view of privatizing some of them by the end of FY’2021/2022. This will in turn enhance transparency and efficiency of the enterprises while also improving service delivery,

- The revenue collection target for FY’2021/2022 to be set at no less than Kshs 2.0 tn, with the ordinary revenue target being set at Kshs 1.8 tn,

- The fiscal deficit (including grants) approved by the National Assembly for FY’2021/2022 is capped at the lower of Kshs 930.0 bn or 7.5% of GDP. This will ensure fiscal discipline and efficiency in the utilization of government resources since parliament will not approve an increase in the fiscal deficit beyond the set limit,

- The ceiling for foreign loans that the treasury can take be limited to Kshs 530.0 bn and the ceiling for domestic debt be set at Kshs 399.9 bn for the financial year starting July 1st, 2021. This is to limit the government’s increased appetite for foreign debt and ensure that additional borrowing made by the government is low-cost and with minimal currency risk. The committee also set the approved debt mix ratio to 43:57 external to domestic debt, compared to the current debt mix of 52:48 foreign to domestic debt, and,

- The National Treasury should stick to its aim of reducing the stock of Treasury Bills by Kshs 200.0 bn and report to the National Assembly how this has been achieved thirty days after the approval of the report by the National Assembly.

- The move by the BAC is a commendable one, as the government’s debt, which currently stands at Kshs 7.3 tn, has been growing at a rapid rate, increasing at a 10-year CAGR of 17.1% to Kshs 7.3 tn from Kshs 1.5 tn in 2011. The move to set the debt mix at 57:43 domestic debt to external will also help alleviate increasing debt service obligations arising from servicing debt denominated in foreign currency. The debt ceiling will also enforce fiscal discipline as the government attempts to bridge the fiscal deficit.

Rates in the fixed income market have remained relatively stable but we have seen an upward trend in the short end due to increased borrowing by the government. The liquidity in the money market, coupled with the discipline by the Central Bank as they reject expensive bids has continued to check the rate of the rates increasing. The government is 13.1% behind its prorated borrowing target of Kshs 374.5 bn having borrowed Kshs 325.3 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021, thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 1.3%, while NASI and NSE 25 declined by 2.2% and 1.0% respectively, taking their YTD performance to gains of 6.3%, 5.2% and 3.7% for NASI, NSE 25 and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as NCBA, Diamond Trust Bank (DTB-K), and EABL of 5.7%, 3.6%, and 1.8%, respectively. The gains were however weighed down by losses recorded by stocks such as Bamburi, Safaricom and BAT, which declined by 3.9%, 3.7% and 1.8%, respectively.

Equities turnover declined by 32.6% during the week to USD 19.5 mn, from USD 29.0 mn recorded the previous week, taking the YTD turnover to USD 198.2 mn. Foreign investors turned net sellers, with a net selling position of USD 2.5 mn, from a net buying position of USD 0.1 mn recorded the previous week, taking the YTD net selling position to USD 2.5 mn.

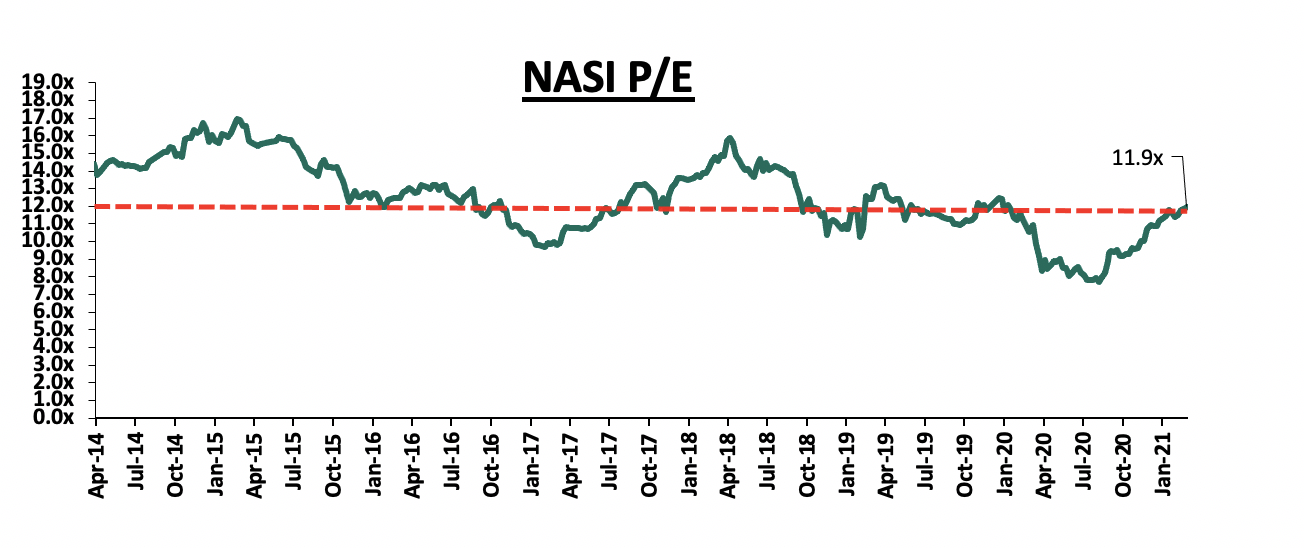

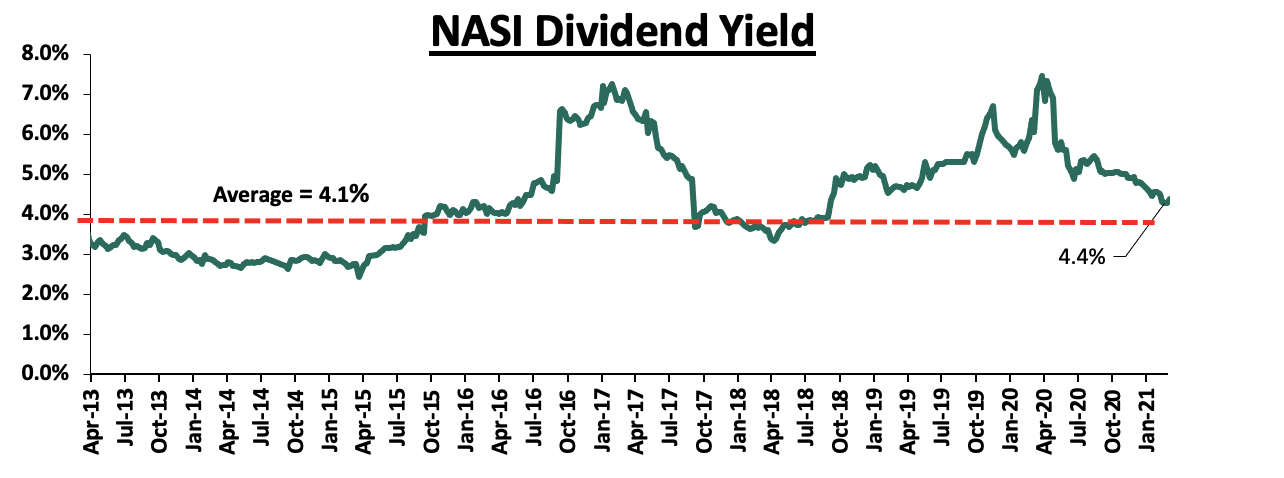

The market is currently trading at a price to earnings ratio (P/E) of 11.9x, 7.6% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.4%, 0.1% points above the 4.3% recorded the previous week, and 0.3% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe that there are pockets of value in the market for investors with a higher risk tolerance. The current P/E valuation of 11.9x, is 55.1% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Weekly Highlight:

During the week, Equity Group Holdings Plc signed a Kshs 16.5 bn (€125.0 mn) loan facility with the European Investment Bank (EIB) and the European Commission for onward lending to Micro Small and Medium-sized Enterprises (MSMEs), in line with its commitment to continually support the sector. This is the third tranche for Equity Group which has collectively earned approximately Kshs 33.0 bn to boost credit flows and liquidity to MSMEs in under 6 months after signing two other loans; USD 50.0 mn (Kshs 5.5 bn) with IFC in September 2020 and a USD 100.0 mn (Kshs 11.0 bn) with Proparco in October 2020. This is in line with the bank's efforts to raise up to Kshs 50.0 bn from foreign lenders over the next three years, as it aims to improve its liquidity and capital positions through a combination of long and medium-term debt. As of Q3'2020, Equity’s loan book had expanded by 30.1% to Kshs 453.9 bn, from Kshs 348.9 bn in Q3’2019, an indication of how it was helping its customers navigate the tough operating environment amid the pandemic. Notably, during the period under review, MSME’s contributed the largest portion of the Non-Performing Loans with an NPL ratio of 17.4%. Despite the commendable effort to lend to the MSMEs during this period, we believe that risks abound the banks’ asset quality on account of the elevated credit risk and the lenders exposure in SMEs.

During the week, Liberty Holdings Limited (Liberty), a financial services and property holding company announced plans to buy an additional 84.2 mn shares in Liberty Kenya Holdings Plc (LK), which represents 15.8% of the company. The deal entails a private sale of 49.5 mn ordinary shares from the Kimberlite Frontier Africa Master Fund (KFAMF), representing 9.2% of Liberty Kenya's issued share capital and a further 34.6 mn ordinary shares from Coronation Africa Frontiers which owns 6.5% of the company's stock. The planned acquisition will increase the company’s stake to 73.5% (393.6 mn ordinary shares) from the current 57.7% (309.3 mn ordinary shares), retaining Liberty’s status as the biggest shareholder of the insurer. The total cost of this transaction is Kshs 926.6 mn, with Liberty Holdings Limited buying each share at Kshs 11.0 while Liberty Kenya Holdings is currently trading at Kshs 8.1 indicating an undervaluation of 35.8%. For the 15.8% acquisition, Liberty Holdings limited will pay a cash consideration at completion of the transaction using an estimated price to book multiple of 0.1x. The stock is currently trading at a price to book of 0.6x, lower than the 0.8x industry average. Further, the agreement shall be subject to approval in different regulations, including the Capital Markets Authority (Kenya), and will be concluded on the fifth day after the date on which the last conditions applicable are fulfilled in accordance with the sale of shares agreement. We expect this move by Liberty Holdings to cause a rally in the share price as it shows their confidence in the company. Additionally, the buyback would lower capital holdings of the firm while increasing earnings per share, as at the end of the period there will be less shares in the market.

Earnings Release:

During the week, Stanbic Holdings released their FY’2020 financial results. Below is a summary of their performance;

|

Stanbic Holdings FY'2020 Key Highlights |

|||

|

Balance Sheet |

FY'2019 |

FY'2020 |

y/y change |

|

Net Loans and Advances |

191.2 |

196.3 |

2.7% |

|

Total Assets |

303.6 |

328.6 |

8.2% |

|

Customer Deposits |

224.7 |

260.0 |

15.7% |

|

Deposits per Branch |

8.6 |

10.4 |

20.3% |

|

Total Liabilities |

254.6 |

276.9 |

8.7% |

|

Shareholders' Funds |

49.0 |

51.7 |

5.5% |

|

Income Statement |

FY' 2019 |

FY'2020 |

y/y change |

|

Net interest Income |

13.3 |

12.8 |

(4.1%) |

|

Net non-interest income |

11.4 |

10.4 |

(8.7%) |

|

Total Operating income |

24.8 |

23.2 |

(6.2%) |

|

Loan loss provision |

(3.2) |

(4.9) |

54.8% |

|

Total Operating expenses |

(13.9) |

(12.1) |

(12.8%) |

|

Profit before tax |

7.7 |

6.2 |

(19.2%) |

|

Profit after tax |

6.4 |

5.2 |

(18.6%) |

|

Core EPS |

16.1 |

13.1 |

(18.6%) |

|

Key Ratios |

FY' 2019 |

FY'2020 |

% point change |

|

Yield on Interest Earning Assets |

7.9% |

7.2% |

(0.7%) |

|

Cost of Funding |

3.3% |

3.0% |

0.3% |

|

Net Interest Margin |

5.2% |

4.7% |

(0.5%) |

|

Non-Performing Loans (NPL) Ratio |

9.6% |

11.8% |

2.2% |

|

NPL Coverage |

57.1% |

60.6% |

3.5% |

|

Cost to Income with LLP |

56.2% |

52.2% |

(4.0%) |

|

Loan to Deposit Ratio |

85.1% |

75.5% |

(9.6%) |

|

Cost to Income Without LLP |

43.5% |

31.2% |

(12.2%) |

|

Return on Average Assets |

2.1% |

1.6% |

(0.5%) |

|

Return on Average Equity |

13.6% |

10.3% |

(3.3%) |

|

Capital Adequacy Ratios |

FY'2019 |

FY'2020 |

% point change |

|

Core Capital/Total Liabilities |

18.4% |

18.5% |

0.1% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

10.4% |

10.5% |

0.1% |

|

Core Capital/Total Risk Weighted Assets |

15.2% |

16.0% |

0.8% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

4.7% |

5.5% |

0.8% |

|

Total Capital/Total Risk Weighted Assets |

18.3% |

18.1% |

(0.2%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.8% |

3.6% |

(0.2%) |

|

Liquidity Ratio |

58.4% |

56.4% |

(2.0%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

38.4% |

36.4% |

(2.0%) |

Key take-outs from the earnings release include;

- Core earnings per share declined by 18.6% to Kshs 13.1, from Kshs 16.1 in FY’2019, not in line with our projections of an 11.4% decline to Kshs 14.3. The performance was driven by a 54.8% increase in loan loss provision to Kshs 4.9 bn from Kshs 3.2 bn in FY’2019, coupled with a 6.2% decline in total operating income to Kshs 23.2 bn from Kshs 24.8 in FY’2019. The variance in core earnings per share decline to Kshs 13.1 against our expectation of Kshs 14.3 was largely due to the 12.8% decline in total operating expenses to Kshs 12.1 bn, from Kshs 13.9 bn in FY’2019, compared to our 36.7% projected increase,

- The bank’s interest income declined by 3.4% to Kshs 19.7 bn, from Kshs 20.4 bn in FY’2019. This was driven by an 8.7% decline in interest income from loans and advances, which declined to Kshs 14.4 bn, from Kshs 15.7 bn in FY’2019. The decline in the bank’s interest income was however mitigated by a 10.7% increase in income from government securities to Kshs 4.5 bn, from Kshs 4.1 bn in FY’2019,

- The Yield on Interest-Earning Assets (YIEA) declined to 7.2% from 7.9% in FY’2019, largely attributable to the 6.4% increase in average interest earning assets coupled with the 3.4% decline in interest income,

- Interest expense declined by 1.6% to Kshs 7.5 bn, from Kshs 7.7 bn in FY’2019, following an 18.1% rise in Interest expense on customer deposits to Kshs 6.3 bn from Kshs 5.3 bn in FY’2019. Interest expense on placements declined by 59.6% to Kshs 0.6 bn, from Kshs 1.4 bn in FY’2019. Cost of funds declined marginally by 0.3% points to 3.0% from 3.3% recorded in FY’2019, following a 13.5% increase in total interest bearing liabilities coupled with the 1.6% increase in interest expense,

- Net Interest Margin (NIM) on the other hand, declined to 4.7% from 5.2% in FY’2019 due to the 4.1% decline in NII, despite the 6.4% increase in average interest-earning assets,

- Total operating expenses declined by 12.8% to Kshs 12.1 bn from Kshs 13.9 bn in FY’2019, largely driven by a 32.6% decline in Stanbic Bank’s staff costs and other operating expenses to Kshs 7.3 bn, from Kshs 10.8 bn in FY’2019. Loan Loss Provisions (LLP), on the other hand, increased by 54.8% to Kshs 4.9 bn from Kshs 3.2 bn recorded in FY’2019,

- The balance sheet recorded an expansion as total assets grew by 8.2% to Kshs 328.6 bn, from Kshs 303.6 bn in FY’2019. The growth was supported by a 25.0% increase in investment securities to Kshs 87.6 bn, from Kshs 70.1 bn in FY’2019, coupled with a 2.7% loan book expansion to Kshs 196.3 bn, from Kshs 191.2 bn in FY’2019. The increased allocation in government securities was mainly on the back of the lenders cautious lending amid the elevated credit risk,

- Total liabilities rose by 8.7% to Kshs 276.9 bn, from Kshs 254.6 bn in FY’2019, driven by a 15.7% rise in customer deposits to Kshs 260.0 bn from Kshs 224.7 bn in FY’2019. The growth was however weighed down by a 39.7% decline in borrowings to Kshs 5.5 bn, from Kshs 9.1 bn in FY’2019. Deposits per branch increased by 20.3% to Kshs 10.4 bn from Kshs 8.6 bn in FY’2019, with the number of branches decreasing to 25 from 26 during the period,

- Gross non-performing loans increased by 81.4% to Kshs 25.0 bn in FY’2020, from Kshs 19.3 bn in FY’2019. Consequently, the NPL ratio deteriorated to 11.8% in FY’2020, from 9.6% in FY’2019, attributable to the faster 81.4% growth in Non-Performing Loans, which outpaced the 2.7% growth in loans,

- The NPL coverage on the other hand improved to 60.6% in FY’2020 from 57.1% in FY’2019, as general Loan Loss Provisions increased by 54.8% to Kshs 4.9 bn from Kshs 3.2 bn in FY’2019, and,

- Stanbic Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 16.0%, 5.5% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 18.1%, exceeding the statutory requirement by 3.6% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 17.0%, while total capital to risk-weighted assets came in at 19.1%.

For a comprehensive analysis, please see our Stanbic Holdings FY’2020 Earnings Note

Universe of Coverage:

|

Company |

Price at 26/2/2021 |

Price at 5/3/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

69.3 |

71.8 |

3.6% |

(6.5%) |

76.8 |

105.1 |

3.8% |

50.2% |

0.3x |

Buy |

|

I&M Holdings*** |

45.0 |

44.1 |

(2.0%) |

0.2% |

44.9 |

60.1 |

5.8% |

42.2% |

0.7x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.6 |

5.2% |

7.8% |

2.3 |

3.3 |

4.2% |

30.2% |

0.3x |

Buy |

|

KCB Group*** |

38.8 |

38.2 |

(1.4%) |

0.9% |

38.4 |

46.0 |

9.2% |

29.6% |

1.0x |

Buy |

|

Sanlam |

9.6 |

11.2 |

16.4% |

(26.3%) |

13.0 |

14.0 |

0.0% |

25.6% |

0.8x |

Buy |

|

Britam |

7.3 |

7.1 |

(2.2%) |

4.0% |

7.0 |

8.6 |

3.5% |

24.3% |

0.8x |

Buy |

|

Standard Chartered*** |

134.8 |

134.5 |

(0.2%) |

(6.7%) |

144.5 |

153.2 |

9.3% |

23.2% |

1.1x |

Buy |

|

Liberty Holdings |

8.0 |

8.1 |

0.5% |

4.4% |

7.7 |

9.8 |

0.0% |

21.3% |

0.6x |

Buy |

|

ABSA Bank*** |

9.7 |

9.6 |

(1.2%) |

2.1% |

9.5 |

10.5 |

11.5% |

20.8% |

1.2x |

Buy |

|

Jubilee Holdings |

266.0 |

270.0 |

1.5% |

(3.5%) |

275.8 |

313.8 |

3.3% |

19.5% |

0.6x |

Accumulate |

|

Co-op Bank*** |

13.1 |

13.0 |

(0.4%) |

4.0% |

12.6 |

14.5 |

7.7% |

19.2% |

1.0x |

Accumulate |

|

Equity Group*** |

37.9 |

38.1 |

0.4% |

4.6% |

36.3 |

43.0 |

5.3% |

18.3% |

1.1x |

Accumulate |

|

Stanbic Holdings |

83.0 |

84.5 |

1.8% |

(2.4%) |

85.0 |

84.9 |

4.5% |

5.0% |

0.8x |

Hold |

|

NCBA*** |

24.5 |

25.9 |

5.7% |

(7.9%) |

26.6 |

25.4 |

1.0% |

(1.0%) |

0.6x |

Sell |

|

CIC Group |

2.3 |

2.2 |

(3.5%) |

9.0% |

2.1 |

2.1 |

0.0% |

(5.4%) |

0.8x |

Sell |

|

HF Group |

3.5 |

3.5 |

(1.1%) |

11.1% |

3.1 |

3.0 |

0.0% |

(13.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

- Listed Real Estate

During the week, Acorn Holdings, a real estate developer announced that InfraCo, a United Kingdom-funded private infrastructure development group has invested Kshs 1.0 bn to the firm’s real estate investment trust (REIT) intended to support the construction of 10,000 affordable student accommodation units in Nairobi. InfraCo is the anchor investor for the Acorn Development and Income REITS. The development real estate investment trust (D-REIT) is expected to finance the student hostels whereas the Investment real estate investment trust (I-REIT) will be used to acquire properties and hold them for rental income.

The move by Acorn Holdings to focus on I-REITS and D-REITS as the main source of funding for its student housing projects signals that investors continue to explore available structured financing options in the capital markets. Currently, there is a heavy reliance on bank funding as opposed to funding from the capital markets, with 95.0% of business funding in Kenya being sourced from the banking industry and only 5.0% from the latter. 8 years since the inception of the regulatory framework, the REITS market has remained underdeveloped with only one I-REIT, and no D-REIT with the Fusion Capital D-REIT, which was launched in 2016, having failed due to low subscription rates while the Cytonn D-REIT was not progressed by the Capital Markets Authority due to the limited number of approved REIT trustees in the market. The poor performance of the REITs is attributed to (i) the high minimum investment amounts set at Kshs 5.0 mn, (ii) high minimum capital requirement for a trustee at Kshs 100.0 mn, which essentially limits the eligible trustees to only banks, effectively eliminating Corporate Trustees, (iii) sluggish growth in select sectors within the real estate market, and, (iv) lengthy approval process. To jumpstart the D-REIT market, the market needs to confront these challenges.

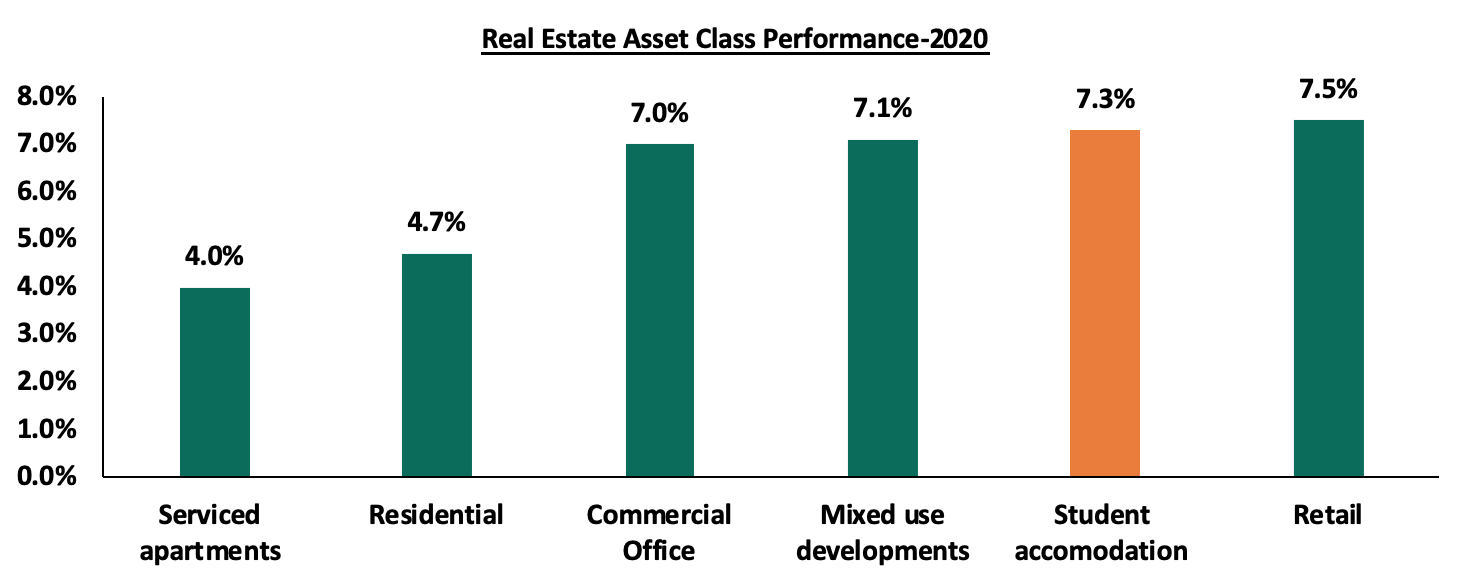

Student accommodation has relatively high yields of 7.4% as per the Cytonn Student Housing Market Kenya Research compared to other real estate sectors like the residential and Mixed-use developments which have an average rental yield of 4.7% and 7.1% respectively as shown below;

Source: Cytonn Research

The above implies that investors are up to benefit from high returns if they invest in these developments amidst the high demand for student accommodation as a result of the growing number of students. As of 2018, the number of available student housing stood at 300,000 against a university enrolment of 520,900 according to the ministry of education with the exclusion of technical colleges. This implies that there is a huge deficit of student accommodation which has been accelerated by i) high land rates, ii) insufficient access to funding, and, iii) inadequate expertise to build and manage student housing.

The continued focus on REITS by Acorn and ability to secure an anchor investor, signals hope for the real estate sector developers to raise funds to finance their investments from the capital markets

According to the Kenya National Bureau of Statistics (KNBS) FinAccess Report 2019, the pensions industry has witnessed significant growth with the number of registered members growing by a 10-year CAGR of 15.7% to 3.0 mn members in 2019, from 0.7 mn registered members in 2009. Additionally, Assets Under Management have grown by a 10-year CAGR of 15.8% to Kshs 1.3 tn as of December 2019, from Kshs 0.3 tn in 2009. This growth has been attributed to the mass education drives on the importance of retirement savings by the Retirement Benefits Authority and the industry players. Financial technology has also played a huge role by; i) making it easier for Kenyans to join and contribute to pension schemes, and, ii) improving the communication between the schemes and members.

This week, we turn our focus to the historical performance and asset allocation of pension schemes in Kenya with a key focus on 2020. We will also analyze some of the asset classes such as offshore investments and alternative investments that pension scheme performances can leverage more on in order to improve the welfare of their members. Therefore, we shall look at the topic in five different sections:

- Introduction to Retirement Benefits Schemes in Kenya,

- Historical Pension Schemes Allocation,

- Performance of Pension Schemes,

- Other Asset Classes that Pension Schemes can take advantage of,

- Challenges affecting Growth in the Pensions Industry in Kenya, and,

- Conclusion and recommendations;

Section 1: Introduction to Retirement Benefits Schemes in Kenya

A retirement benefits scheme is a savings avenue that allows contributing individuals to make regular contributions during their productive years into the scheme and thereafter get income from the scheme upon retirement. There are a number of benefits that accrue to retirement benefits scheme members, including:

- Income Replacement – Retirement savings ensure that your income stream does not stop even when you stop working. After retirement, many experiences a decline in the amount and stability of income relative to their productive years. Retirement savings ensure that this decline is manageable or is non-existent and enables you to be able to live the lifestyle you desire even after retirement,

- Compounded and Tax-free interest – Savings in a pension scheme earn compounded interest which means that your money grows faster as the interest earned is reinvested. Additionally, retirement schemes’ investments are tax exempt meaning that the schemes have more to reinvest,

- Tax-exempt contributions – Pension contributions enjoy a monthly tax relief of up to Kshs 20,000 or 30.0% of your salary whichever is less – this lessens the total PAYE deducted from your earnings,

- Avoid old age poverty – By providing an income in retirement, pension schemes ensure that the scheme members do not experience old age poverty where they have to rely on their family, relatives and friends for survival, and,

- Home Ownership - Savings in a pension scheme can help you achieve your dream of owning a home. This can be done through a mortgage or a direct residential house purchase using your pension savings. A member may assign up to 60.0% of their pension benefits or the market value of the property, whichever is less, to provide a mortgage guarantee. The guarantee may enable the member to acquire immovable property on which a house has been erected, erect a house, add, or carry out repairs to a house, secure financing or waiver, as the case may be, for deposits, stamp duty, valuation fees and legal fees and any other transaction costs required. On the other hand, a pension scheme member may utilize up to 40.0% of their benefits to purchase a residential house directly subject to a maximum allowable amount of Kshs 7.0 Mn and the amount they use should not exceed the buying price of the house.

There are different ways of categorizing pension schemes namely, based on type of membership, mode of investment, contribution and payment at retirement.

Section 2: Historical Pension Schemes Allocation

In Kenya, the Retirement Benefits (Forms and Fees) Regulations, 2000 provides investment guidelines for retirement benefits schemes in Kenya specifically on which asset classes to invest in and what the limits should be. Some of the investments assets include: government securities, fixed deposits, quoted equities and immovable property among others. In line with the regulators’ guidelines, pension schemes formulate their own Investment Policy Statements (IPS) that will act as guidance on how much they can invest in different assets and assists the trustees of the schemes to effectively supervise, monitor and evaluate the performance of the Fund’s investment assets. The IPS of the various schemes vary depending on the risk return profile and expectations largely determined by the demographic of the scheme members and the general economic outlook. For example, a pension scheme with a high ratio of members nearing the retirement age will not be heavily exposed to long-term and illiquid asset classes such as Immovable Property given that the scheme will need to pay out the retirement benefits to those retiring and such illiquid assets may be difficult to dispose. Therefore, such provisions will be reflected in the scheme’s IPS.

The table below shows how Kenyan pension funds have invested their assets in the past:

|

Kenyan Pension Funds Asset Allocation |

||||||||||

|

Asset Class |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

H1'2020 |

Average |

Allowable Limit |

|

Government Securities |

33.8% |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.0% |

36.8% |

90.0% |

|

Quoted Equities |

25.5% |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

14.2% |

20.1% |

70.0% |

|

Immovable Property |

17.2% |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.6% |

18.8% |

30.0% |

|

Guaranteed Funds |

10.3% |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.7% |

13.4% |

100.0% |

|

Listed Corporate Bonds |

4.4% |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.7% |

3.9% |

20.0% |

|

Fixed Deposits |

4.9% |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

3.4% |

4.0% |

30.0% |

|

Offshore |

2.2% |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.4% |

1.1% |

15.0% |

|

Cash |

1.3% |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

1.6% |

1.3% |

5.0% |

|

Unquoted Equities |

0.6% |

1.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.5% |

5.0% |

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

10.0% |

|

REITs |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

30.0% |

|

Commercial Paper, non-listed bonds by private companies* |

- |

- |

- |

- |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

Others e.g. Unlisted Commercial Papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

||

|

Commercial paper, non-listed bonds, and other debt instruments issued by private companies were introduced as a new separate asset class category in 2016 through legal notice No. 107. |

||||||||||

Source: Retirement Benefits Authority (RBA)

Key Take-outs from the table above are:

- Historically, schemes in the country have allocated an average of 56.9% of their members’ funds towards Government securities and Quoted Equities over the period 2013 to H1’2020. The high allocation to government securities, an average of 35.9% over the last 7 years and highest among the asset classes invested in, can be attributed to the fact that pension schemes prioritize on safety of their members’ funds and prefer a high allocation to low risk investments,

- The allocation towards quoted equities declined to 14.2% in H1’ 2020, from 17.6% as of December 2019 as the equities markets were hit hard by the pandemic. This coupled with the increased allocation to government securities to 44.0% in H1’2020 from 42.0% and fixed deposits to 3.4% in H1’2020 from 3.0% recorded in December 2019, highlights capital flight towards safer investments as pension schemes fled the highly volatile equity markets, and,

- Pension schemes’ investments in offshore markets increased by 0.3% points to 1.6% in H1’2020 and 1.3% recorded in December 2019 attributable to the impressive performance of the asset class as it recorded 25.7% returns in the year 2019 as global markets performed better than expected especially in the United States and the currency depreciated as well.

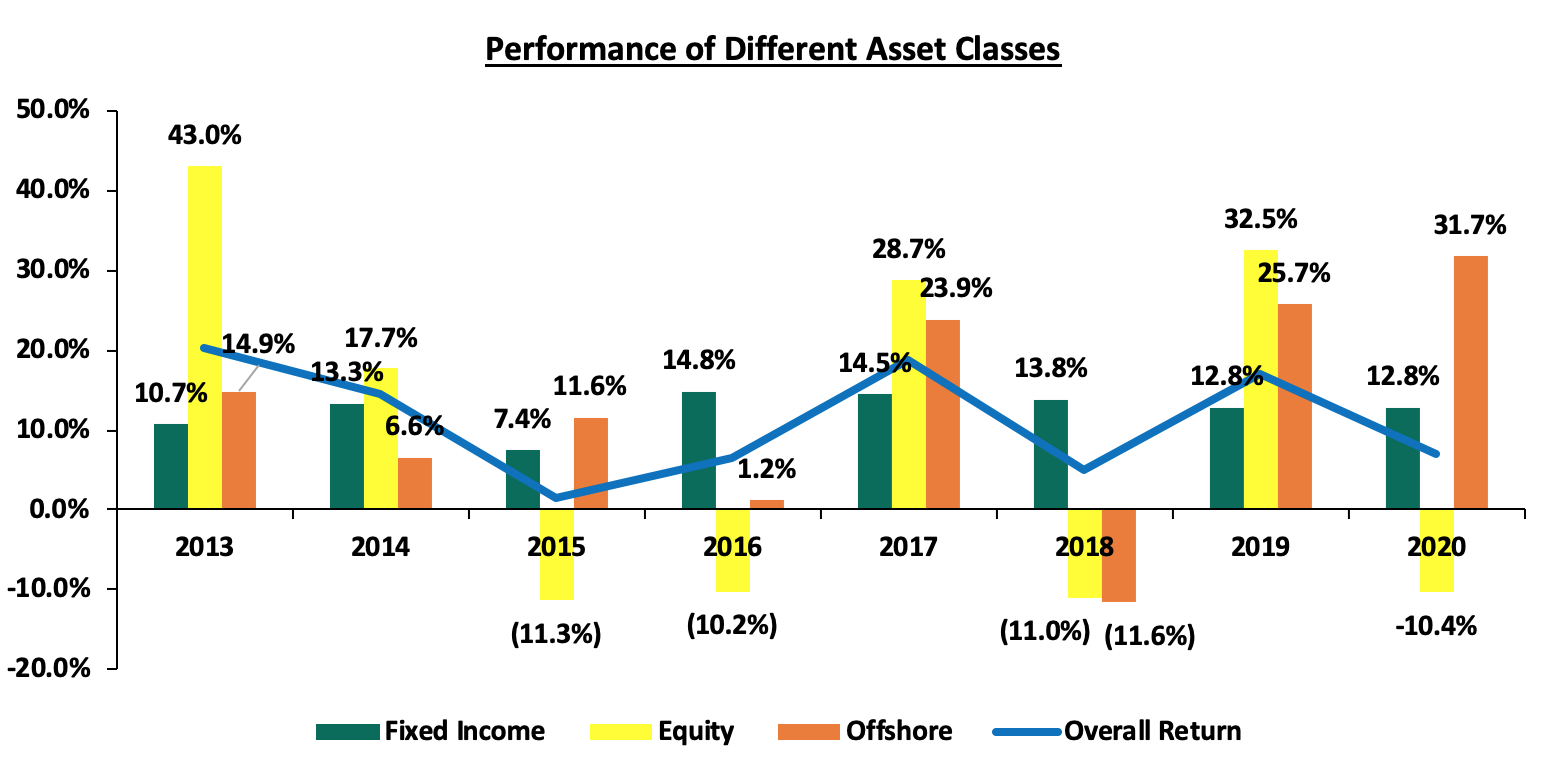

We switch gears now to the performance of the mentioned asset classes grouped in three broad groups, namely; Fixed Income, Equity and Offshore. Below is a graph for the performances over the period 2013 to 2020:

Source: ACTSERV Survey Reports (Segregated Schemes)

Key Take-outs from the graph above are:

- Offshore investments outperformed the other asset classes averaging 13.0% in the period 2013 to 2020 while investments made in fixed income and equity asset categories averaged 12.5% and 9.9%, respectively. Offshore investments recorded an impressive return of 31.7% in 2020, driven by the expected economic recovery, eased monetary policies and discovery of the Covid-19 vaccine coupled with the rally in tech stocks during the third and fourth quarters of the year. As the pandemic spread and made physical socializing and movement harder, many technology platforms became the go-to options for communication, shopping and working, for example, Google, Zoom and Amazon. Such stocks gained a lot of investors’ interest leading to their share prices being pushed up by the high demand. In Q3 and Q4 2020 there was an expectation of markets recovery in the global markets leading again to high demand for various listed shares leading to a bull run,

- Fixed income proved to be the source of stable returns with little volatility over the years, however, there has been a continuous decline of the returns over last 5 years to 12.8% from 14.8% recorded in 2016. This is mainly attributed to the Central Bank of Kenya’s (CBK’s) efforts over the years to maintain a stable interest rate environment. The yields on the 91-day, 182-day and 364-day T-bills declined to 6.9%, 7.4% and 8.3% in 2020 from 7.2%, 8.2% and 9.8% at the end of 2019, respectively, contributing in part to the lower overall pension scheme returns in 2020, as banks shied away from lending to the public due to the increased credit risks, and,

- The volatility of the equity markets was also mirrored in the pension schemes performance as it recorded a high of 43.0% in 2013 to lows of (11.3%) and (11.0%) in 2015 and 2018 respectively bringing the asset classes’ average performance to 9.9%. The continued volatility has led to pension schemes reduce their exposure to this asset class to 14.2% as of H1’2020, from 25.5% recorded in 2013. The poor performance in 2020 is attributed to the adverse effects of the pandemic which saw foreign investors turned net sellers, with a net outflow of USD 280.9 mn in 2020, compared to net inflows of USD 10.7 mn recorded in FY’2019, further exacerbating the negative performance. Notably, in 2020, NASI, NSE 25, and NSE 20 declined by 8.6%, 16.7%, and 29.6%, respectively.

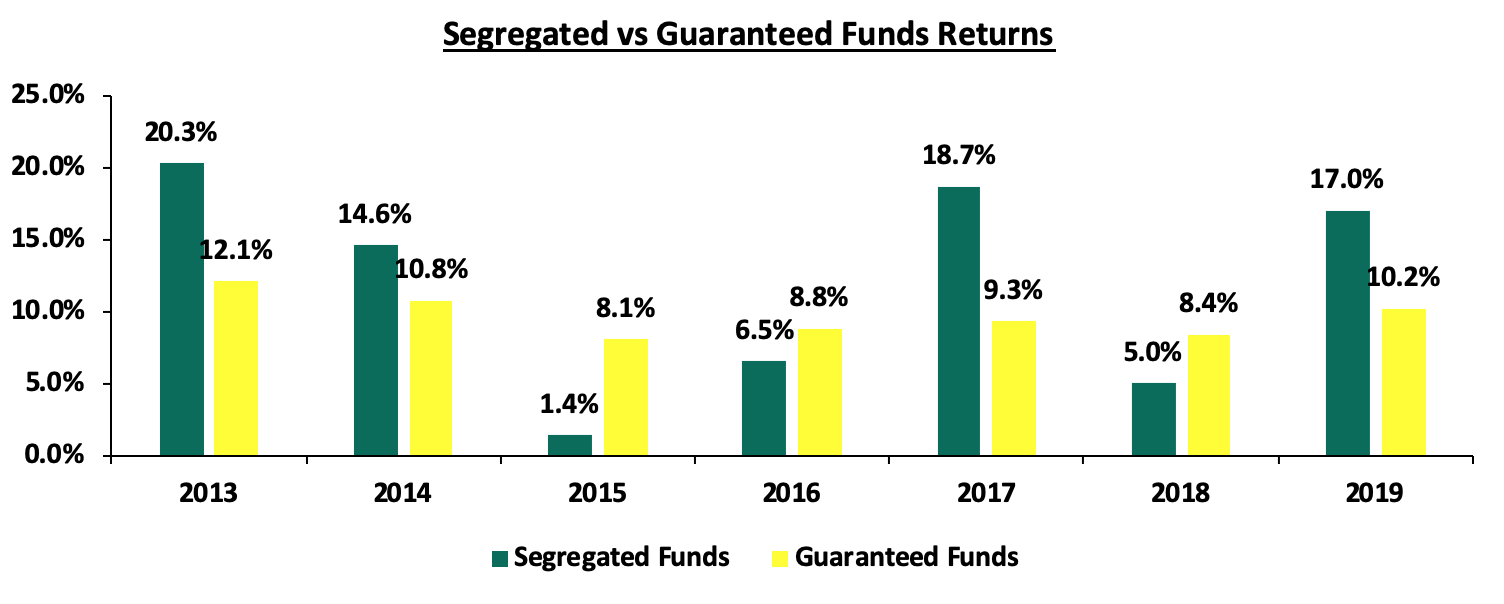

Section 3: Performance of Pension Schemes

The average returns of the Guaranteed Funds over the period 2013 to 2019 was 9.7% whereas Segregated Schemes’ members enjoyed a higher return of 12.0% during the period. Key to note, segregated schemes performance fluctuates over the years reflective of the markets performance whereas guaranteed performance has remained somewhat stable over the years. The stability of returns is attributed to the fact that, unlike segregated funds, guaranteed funds do not have an obligation to distribute all the returns, net of fees, that they attain in a given year; instead they have an obligation to distribute the minimum guaranteed return regardless of their investments performance. The two types of schemes reflect the different risk profiles of Retirement Benefits Scheme members; those with a lower risk appetite prefer to join a Guaranteed Fund due to the fact that it guarantees a minimum return rate while those members with a relatively higher risk appetite can be found in segregated schemes as they are more comfortable with market fluctuations and seek higher interest rates. The chart below highlights the performance of the two types of pension schemes over a 7-year period:

Sources: ACTSERV Surveys, Cytonn Research

The poor performance of the Equity markets and the decline in the Fixed Income markets were mirrored in the Pension schemes’ performance given the high allocation in the two Markets. Some of the key impacts that the pandemic has had on retirement schemes include:

- A decrease in the value of assets in retirement savings accounts from falling financial markets;

- An increase in liabilities for guaranteed and defined benefits schemes – As many Kenyans lost their jobs, there were increased withdrawals to take care of day-to-day needs. This led to pension funds withdrawing some of their investments and in the process crystallize the losses made in the markets;

- A lower capability to contribute to retirement savings plans by individuals, and by both employers and employees. This is mainly attributable to lower disposable income at the hands of Kenyans in 2020 as many lost their jobs while others saw their salaries reduced as firms sought to reduce their expenses. According to the Kenya National Bureau of Statistics Quarterly Labour Force Survey Q2 2020, 1.7 million workers lost jobs in three months to June 2020 as the number of employed Kenyans dropped to 15.9 mn from 17.6 mn reported as of the end of March 2020, when Kenya first introduced lockdowns to curb the spread of Covid-19. It is key to note that employment levels bounced back in Q3 2020 to close at 17.7 mn;

- Low to negative returns which impacts the overall retirement income adequacy. In Kenya, according to the Retirement Benefits Authority, the income replacement ratio at retirement is below 40.0% compared to the recommended ratio of 75.0%. Income replacement ratio is a measure of the adequacy of your pension benefits to replace your last income before you retire. This remains a key concern that can be partly improved by positive returns and faster growth of scheme members’ funds

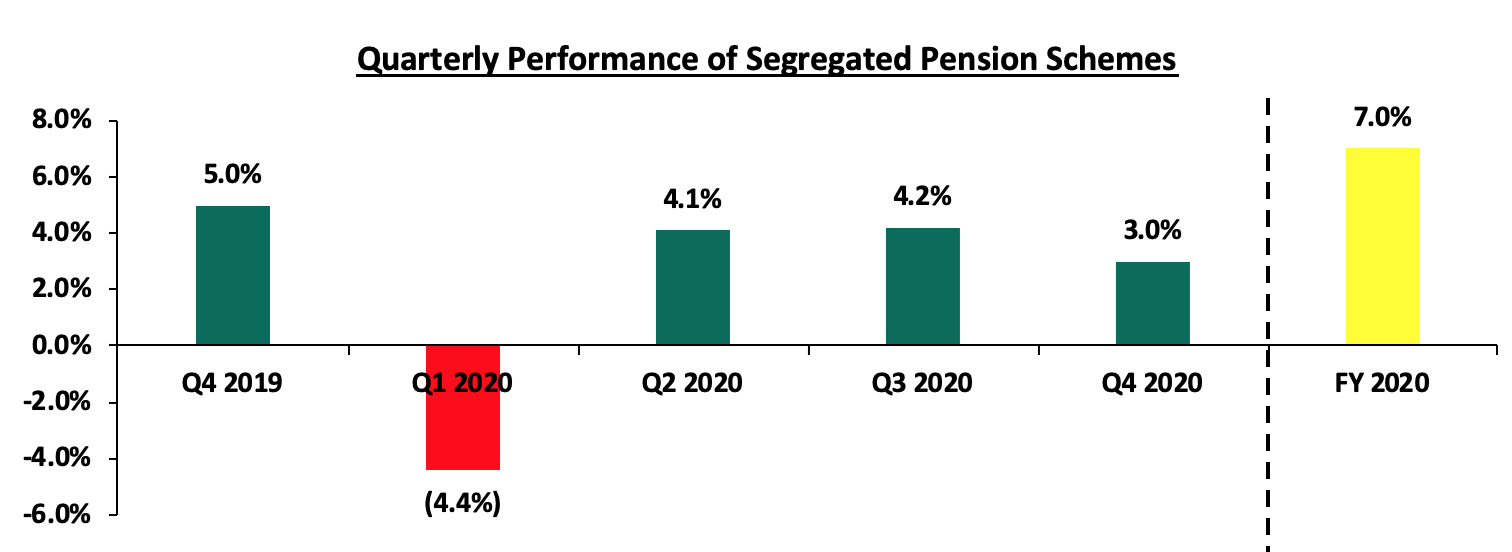

Source: ACTSERV Survey Reports (Segregated Schemes)

The overall return for segregated schemes during the year 2020 dropped to 7.0%, down from the 17.0% recorded in 2019. This was mainly attributable to the effects that the pandemic had on both the equity markets. We expect that as the gradual recovery of the economy as evidenced by the 6.3% YTD gain of the NASI and the upward shift of the yield curve will translate to improved returns for pension schemes in the country especially given the high allocation to equities and government securities.

Section 4: Other Asset Classes that Pension Schemes can take advantage of

Over the years, retirement benefits schemes have skewed their investments towards traditional assets, namely, Fixed Income and Equities Market, averaging 56.9% against the total allowable limit of 100.0% in these two asset classes. In terms of the Alternatives Market i.e. immovable property, Private Equity as well as Real Estate Investments Trusts (REITs), the industry has an average allocation of 18.8% against the total allowable limit of 70.0% in these asset classes. As such, we believe that this is an area that pension schemes can leverage their performance on by increasing allocation to these alternative asset classes.

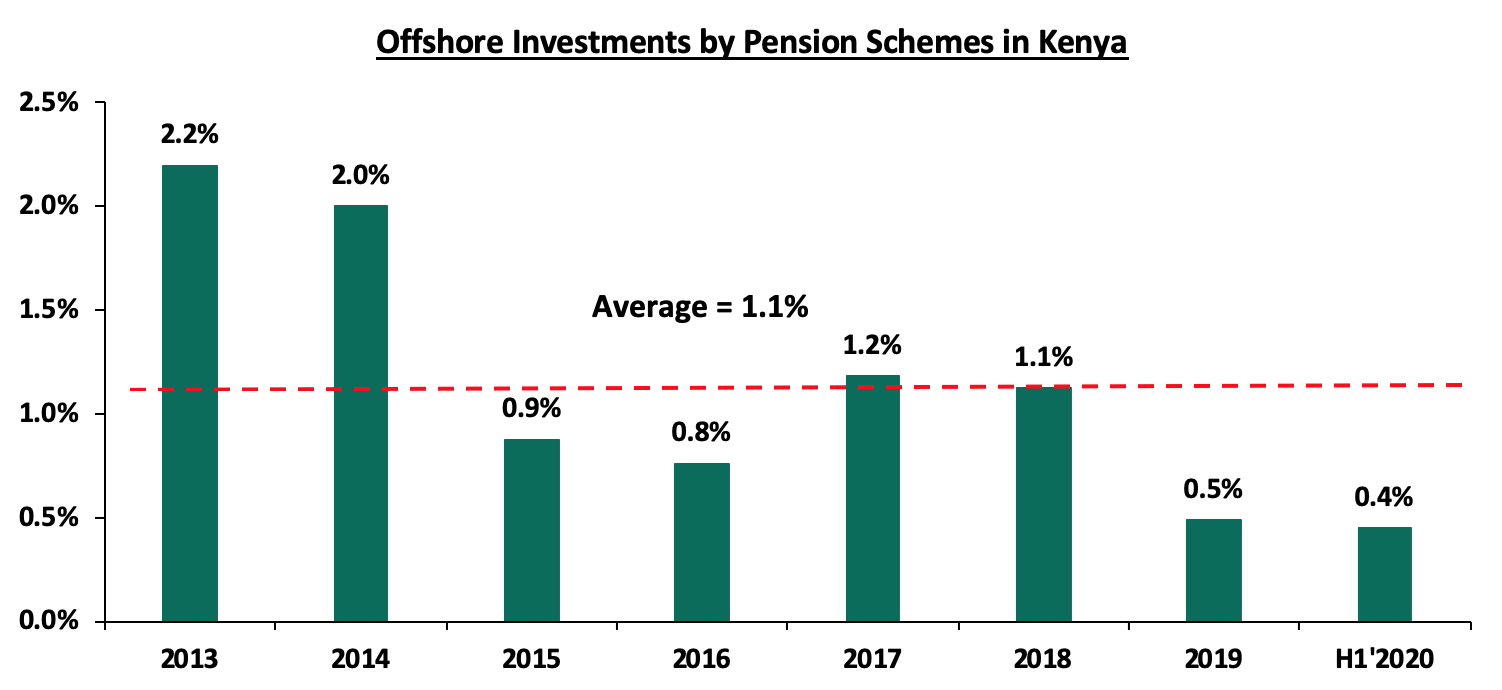

- Offshore Investments

Offshore investments are investments made outside the jurisdiction or country in which the investor resides. The investor may be an individual, corporation or a fund looking to take advantage of tax incentives offered in other countries or to diversify their portfolio. Examples of offshore investments include (i) Mutual Funds, for the risk averse investors, (ii) Private Equity, for the investor with a high risk appetite, and (iii) Purchase of precious metals offshore.

Historically, pension schemes have consistently allocated over 75.0% over their assets in government securities, quoted equities and immovable property leaving alternative asset classes such as private equity, real estate investment trusts and offshore investments with little to work with. The average allocation to offshore investments in the period 2013 to 2019 is a mere 1.2% (Kshs 1.2 bn) of the total Kenyan retirement benefits industry assets. However, the Retirement Benefits Authority allows pension schemes to invest up to 15.0% of their assets in offshore investments in bank deposits government securities, listed equities, rated Corporate Bonds and offshore collective investment schemes reflecting these assets.

Source: Retirement Benefits Authority (RBA)

Key to note, the maximum allowable limit for offshore investments is 15.0%. Some of the reasons for the low allocation in the offshore investments in the pensions industry include; low financial awareness among pension trustees, high risk associated with the asset category and to a lesser extent high bureaucracy in investments decision making. Despite these challenges, we believe diversifying into offshore investments can help pension schemes by bolstering their returns by taking advantage of performances in the global markets and providing a hedge against local markets volatility. The optimal investment horizon is three to five years to fully take advantage of the returns.

Additionally, some offshore countries have laws that prevent the investor from certain legal actions such as seizure of assets and in this way, the offshore investment act as a type of “insurance”. Investing in offshore countries can also help to serve as a hedge against inflation and lower returns offered by asset categories in an investor’s home country.

- Alternative Investments (Immovable Property and Private Equity)

Alternative investments are supplemental strategies to traditional long-only positions in equities, bonds, and cash. They differ from the traditional investments on the basis of complexity, liquidity, and regulations. Alternative investments that pension schemes can invest in include immovable property, private equity and real estate investment trusts. The maximum allowable allocation to these assets is a total of 70.0% but historically pension schemes have allocated an average of only 18.8% in the period 2013 to H1’2020, with the vast allocation to immovable property, an average of 18.8% during the period.

Fund Managers’ low allocation in alternatives can be attributed to lack of expertise and experience with asset classes such as private equity and real estate, as investing in these asset classes requires detailed due diligence and evaluation as well as engaging legal, financial and sector-specific expertise.

We believe that there is value in the alternative markets that pension schemes can take advantage of. Some of the key advantages of alternatives include:

- Superior long term returns - Real Estate investments offer greater returns than traditional assets in the long term which is in line with pension schemes long term view. According to Cytonn Research, the average total return for Real Estate existing properties stands at 13.2% over the five-year period 2016 to 2020, with the government’s continued focus on affordable housing projects to serve the middle- and low-income earners with the aim of increasing home ownership, operationalization and licensing of the Kenya Mortgage and Refinance Company and Kenya’s economic recovery from the pandemic effects expected to be drivers of the industry in 2021. The returns also provide a hedge against the capital erosion brought about by inflationary pressures, and,

- Hedging against volatility – Immovable property has a low but positive correlation with equities and bonds such that in many instances should the traditional assets such as equities perform poorly, the performance of the Real Estate is not equally affected and this can help cushion the effects of the traditional asset’s performance.

Section 5: Challenges affecting Growth in the Pensions Industry in Kenya

As mentioned earlier, the pensions industry in Kenya has experienced commendable growth over the last 10 years. Some of the main factors that have contributed to this growth include:

- Demographic factors - Due to a young, rapidly growing population, the AUM of pension schemes has been growing as there is an almost continuous growth of people joining the workforce and saving for retirement. Further, according to the United Nations’ projections the corresponding population of youth aged 15-24 years and ready to join the workforce will increase from 9.5 mn to 18.0 mn over the period 2015 to 2065. This will likely increase pension scheme membership to a huge extent,

- Social Change - With globalization taking the centre stage, parents are now relieving their children of the burden of having to take care of them in old age. Additionally, more Kenyans are aware of the need to actively save for retirement,

- Legislation - The legislation around Pension funds has been beneficial to the industry driving growth. This includes tax reliefs, house ownership structures, access regulations and strict protection laws. The ability to reduce one’s tax liability by up to Kshs 20,000 or 30.0% of one’s salary by contributing to a pension scheme has served as a great incentive as Kenyans continue to take advantage of the current regulatory environment,

- Financial Awareness and inclusion – Increase in technology advancements, mobile penetration rate and internet connectivity in Kenya have led to more people being financially educated and have increased the ease of contributions and member communication, and,

- Trustees Certification programs – helps improve the management of the pension scheme and better equips the Trustees in carrying out their roles.

However, there still remains persistent challenges that have slowed down the growth rate, namely:

- Market Volatility – The uncertainty of investment returns has led to some Kenyans not being fully persuaded to contribute for their retirement in pension schemes for fear of losing their hard-earned cash. Pension schemes with high allocation to the Equity markets stand to lose as well due to the market volatility and risk of their members’ funds declining in value,

- Slowdown in economic growth and unemployment - According to data by the Kenya National Bureau of Statistics (KNBS) Quarterly Labour Force Survey Q4 2019, 39.8% (4.7 mn) of the 11.9 million Kenyan youth lacked some form of employment as of December 2019. Youth under 35 years are the worst hit by unemployment in an economy plagued with freezing of hires and struggling corporate earning with adults aged 20-34 accounting for 14.2% of the jobless people. This was further worsened by the pandemic in 2020 as millions of workers lost their jobs as many companies were forced to downsize. Reduced income levels hamper pension industry growth as there is reduced ability to save,

- Access of Pension savings before retirement –Employees have in the past opted to withdraw their pension savings immediately after leaving an employer. While withdrawing one’s pension savings especially after losing a job or experiencing financial trouble seems like a rational option, it is more self-defeating and short-sighted as we borrow money from our own future. This will negatively affect the adequacy of pensions upon retirement and lead to a lower quality of life after retiring. Withdrawing from pension schemes also slows down pension industry’s growth as it is money out of the schemes.

Section 6: Conclusion and Recommendations

Over the years, we have seen slight changes in the actual holdings of the retirement benefits schemes, with their allocation being skewed towards traditional assets. It is important for Fund Managers to have a well-balanced portfolio on a risk-return basis to ensure that they offer their members high returns and at the same time protecting their contributions. Ultimately, there are risks that pension funds cannot avoid such as systemic risk, however, diversification into other assets helps mitigate these risk and optimize returns. Overall, given the continued changes in the Retirement Benefits Industry and increased knowledge of investments, the sector is expected to do well both in terms of growth and returns offered to members. This can be further supported through:

- Increased education to Trustees: The RBA has also made it compulsory for Trustees of registered Retirement Benefits Schemes to be certified through the Trustee Development Program of Kenya (TDPK) which is commendable and will improve the trustees’ capability to manage schemes. We believe further education courses especially on the alternative and offshore investments will go a long way in demystifying the asset classes and enable schemes to increase their diversification,

- Increased Competition by the Various Players in the Market: The RBA has continued to issue licenses to new players in the market and this will beef up competition in the industry keeping the Fund Manager on their toes to ensure that they offer higher returns to their members, and,

- Innovation and Product Development: In 2020, the RBA and the Ministry of National Treasury released amendments to the Mortgage Regulations allowing pension scheme members to be able to buy houses using a portion of their benefits, and introduced a new asset class, Public-Private Partnership into the list of allowable list of asset classes to invest in. Through increased member education, we believe that schemes can leverage on these new regulations to the benefit of their members and draw more people into their schemes. Similar actions by the regulator and the continued interaction with the different service providers in the pensions industry will be key to increase the pension penetration rate in Kenya.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.