SEBASTOPOL, CALIFORNIA—Two things set a one-block stretch of Florence Avenue apart from other American streets. One is the quirky metal sculptures planted in front of most homes; the other is the Internet traffic coursing through recently-strung fiber-optic cables on the block’s utility poles. They offer each house up to one gigabit per second in bandwidth, making this one of the fastest streets in America.

While some other cities can also brag about gigabit access, in this Sonoma County town it costs only $69.95 a month.

The service comes courtesy of Sonic.net, the18-year-old Internet provider based in the neighboring city of Santa Rosa. And Sonic even throws in two phone lines with unlimited long-distance calling when you sign up.

Despite living on one of the best broadband streets in the country, almost none of the few dozen residents on Florence Avenue bother with the highest-end gigabit service, though. And why should they? Sonic's everyday 100 Mbps fiber offering costs just $39.95 a month, the same price Sonic used to charge for its 20 Mbps DSL connections (It includes unlimited phone, too.)

Compare Sonic’s 100 Mbps price to the two better-known area options for broadband—Comcast's Xfinity Extreme 105 Mbps service runs $199.95 a month, while AT&T's U-Verse tops out at 24 Mbps for $49.95.

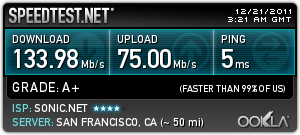

Gigabit access is fast—fast enough at one Sebastopol subscriber's house to perplex Ookla's Speedtest.net. The service incorrectly reported the person’s connection at a mere 134 Mbps. Downloading the current release of Ubuntu Linux didn't help, either; on two different tries, the server simply couldn’t provide the 695-megabyte file as quickly as the connection allowed.

But there was no mistaking the speed of Sonic’s system when I pulled up a YouTube clip and saw the entire video buffer instantly, even on a “mere” 100 Mbps connection.

Even better, Sonic does not place any data caps on its service.

As ISPs often note, people keep using more data; what they usually neglect to mention is that the costs of providing it have dropped dramatically. "It's reasonable to say that consumer bandwidth consumption went up,” Sonic chief executive and co-founder Dane Jasper said when I stopped in for a visit at his Santa Rosa office late last year. “But at the same time, the cost of clearing those bits keeps going down."

Wondering "why can't somebody else do this?" You're asking the right question. But you may not like the answer.

The twilight of DSL

Privately-held Sonic is an unlikely survivor. As a small digital-subscriber-line (DSL) service, one might have expected it to go extinct like most of its brethren after the Federal Communications Commission largely deregulated the DSL business.

The FCC's 2005 decision to reclassify DSL as an "information service" (PDF) came after several bruising years for upstart ISPs that saw overleveraged firms like NorthPoint Communications and Rhythms NetConnections implode, abruptly disconnecting subscribers as they tumbled into bankruptcy. When the FCC ended incumbent carriers’ obligations to sell last-mile access to competing ISPs at regulated rates, things got even worse for independent DSL providers.

Those that survived were stuck with a growing competition problem: they couldn't provide DSL at speeds faster than the incumbents, and they were now more expensive, too.

"We were on this dead-end street all essentially selling the same thing," said Jasper.

One way Sonic could stand out, however, was through customer service. Its consistently high reviews on DSLReports.com speak to its success there. But with cable services getting faster, Sonic had to get more out of DSL technology if it wanted to compete. In 2008, Sonic began rolling out the faster ADSL2+, finally offering speeds competitive with cable to customers who were close enough to a phone company’s central office (prices ranged from 6 Mbps for $45 to 18 Mbps for $80).

The company increased speeds while cutting costs, taking advantage of cheaper upstream connectivity. A year later, the cost of 18 Mbps service fell to $55. Sonic, having obtained a phone service license from the California Public Utilities Commission (PUC) in 2006, added voice calling as an option. It then made voice a standard feature in 2010, with unlimited nationwide calling in a $50, 20 Mbps bundle. (That plan is now down to $39.95.)

The tradeoff for relying on ADSL2+ is limited coverage. The service's reach is fairly extensive in San Francisco but, in towns like Sebastopol and Santa Rosa, it doesn't get far outside the downtown.

Customers beyond that perimeter (about half of Sonic's less-than-50,000 subscribers, Jasper included) can only access the older, slower form of DSL that cable providers like to mock in their ads: 3-6 Mbps for $39.95 (although that's cut to $19.95 for the first year.)

If Sonic were to not just survive but succeed, it needed a plan for the future that wouldn't be tied up in somebody else's copper telephone wire. It settled on fiber.

The jump to fiber

Deploying fiber-to-the-home service is a big step. Sonic kicked off this buildout on favorable ground: a reasonably dense neighborhood in Sebastopol, a compact town of 7,397 that may be best-known as the home of tech-book publisher O'Reilly and Associates. Sonic began contacting DSL subscribers there last year with an absurd-to-resist offer: five times their current speed for the same price.

But why did Sonic also offer gigabit access at only twice the price of its 100 Mbps service? Said Jasper: Why not? "The cost differential between a customer who's connected at all and one who's connected at one gigabit [per second] is nominal." Calling the $69.95 service "a headline product," he noted one key reason for Sonic to offer it: because others can't.

The math behind Sonic's marketing is not so absurd. Once the company moves a DSL customer to fiber, it can stop renting the copper loop from the local phone company office to their home, which costs about $12 a month. From there, the company begins the countdown to recover the "sub-$500" cost to deploy fiber to that home.

"On paper, the model is viable," wrote Diffraction Analysis CEO and co-founder Benoît Felten. He noted Sonic's advantages of being able to start in customer-rich neighborhoods served by cheap overhead lines instead of more expensive to deploy underground conduit. He also emphasized the importance of getting enough customers to upgrade. "If you get in the 40 percent plus [range] it starts to look golden, and if you're in the 60 percent range,” he said, “you've built a cash printing machine."

But expanding on a much larger scale might create financing issues. "On the scale that Sonic.net is currently considering, they can self-finance,” he added, “but if it works and they want to go beyond that, they will need a lot of capital that, as far as I'm aware, they don't currently have."

Jasper confirmed the suspicion; Sonic will have to take on debt if it continues to expand—as it hopes to do so. In a few more months, he said, it will start to advertise the service; by the end of this year, Sonic aims to pass about 2,500 homes in Sebastopol with fiber, plus some 20,000 more in San Francisco's Sunset District.

reader comments

208