American Express has just announced “Serve,” which the company touts as “a digital payment and commerce platform that gives consumers a new way to spend, send and receive money with services that go beyond the existing global payment networks.”

You set up an account online at serve.com and dump money into it from an existing bank account, credit card or from other Serve users. I took the plunge and signed up for an account—here are my initial thoughts.

It’s very much like PayPal. Serve has the backing of a major financial institution in American Express, which may help some people feel more at ease whereas PayPal has always taken a “we are not a bank” stance. Serve isn’t a bank either, but American Express has a good reputation. I’ve had an Amex credit card for over 10 years and I’ve found the company to be quick with disputed charges and the least screw-jobby when all the credit card companies hiked their rates a couple years back.

Anyhoo…

Setup

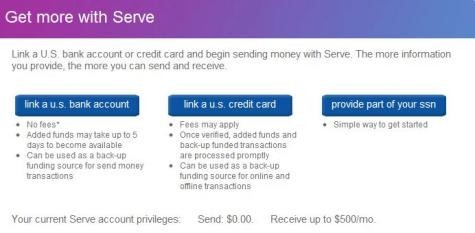

Account setup is quick—less than five minutes. You activate your Serve account via e-mail and then either link it to your bank account, credit card or by providing the last four digits of your social security number.

Depending upon your bank, you can verify your linked checking or savings account instantly or by waiting a few days for Serve to make two tiny deposits, which you then verify back inside your Serve account.

Plastic

You’ll automatically get the “Serve Card” in the mail within a few days. Mine hasn’t shown up yet, of course, but I’ll be able to use it to withdraw money from ATMs and pay for things wherever American Express is accepted.

I have a PayPal debit card, too, which is accepted wherever MasterCard is accepted. From what I can tell so far, the main differences between the PayPal card and the Serve card are that I get one percent back every time I use the PayPal card and if I don’t have sufficient funds in my PayPal account when I use the card, it’ll automatically pull from my bank account.

Serve charges $2 per ATM withdrawal, with the first one being free each month. PayPal charges $1 per ATM withdrawal. Serve’s ATM fees will be waived for the next six months while the program gets off the ground.

Funding

Serve’s card can automatically pull funds too, but the FAQ section of my account says that it’ll pull those funds from a connected debit or credit card—nothing about pulling from the connected bank account.

And here’s where the big difference between PayPal and Serve comes into play. PayPal doesn’t charge you for adding funds to your account, whereas Serve charges 2.9% plus 30 cents if you use a credit card to fund your account. Cash, debit card and bank transfers are free and Serve is waiving the credit card funding charge for the next six months, though.

And PayPal only allows you to add funds from your bank account. Linking a credit card to your PayPal account lets you pay for specifically-priced items but you can’t, for instance, shoot $500 into your PayPal account with your credit card. You can do that with Serve.

Finally, any funds you leave in your PayPal account can earn interest. It’s a paltry 0.10% money market account right now but hey, free money, right?

Subaccounts

Serve lets you set up four subaccounts, so you can give your spouse, kids or anyone else their own Serve logins while setting daily transaction limits. PayPal has a similar offering called Student Accounts, which are a little more limiting as they’re intended for minors between the ages of 13 and 18.

Other Fees

Serve doesn’t charge any fees for payments between Serve users. PayPal doesn’t charge for transfers between personal PayPal accounts when funded directly from account balances or connected bank accounts, but charges 2.9% plus 30 cents when funded from a debit or credit card.

More on TIME.com:

Google Plans to Turn Your Android Phone into an Electronic Wallet