Nadia & myself were invited in Stuttgart for the 7th RBVC workshop that was focusing this year on Blockchain and AI. I delivered the opening keynote yesterday and recorded it in 360° thanks to a Giroptic IO camera. Here is the result, best experienced with the Youtube mobile app or any compatible VR headset.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

Your new post is loading... Your new post is loading...

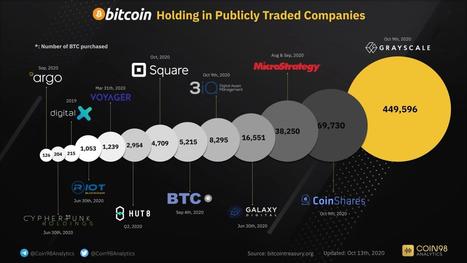

Digital currency bitcoin has emerged as a rival to gold and could trade as high as $146,000 if it becomes established as a safe-haven asset, investment bank JPMorgan (JPM) said on Tuesday.

Philippe J DEWOST's insight:

Bitcoin getting closer to digital gold looks like a possible crack in the trust for the financial system. After all it started after Lehman’s demise in 2008.

The total market capitalization of Bitcoin (BTC) has exceeded that of Mastercard’s today, placing the cryptocurrency on the 16th spot among the world’s largest companies, according to tracking platform AssetDash. Bitcoin’s market cap amounts to nearly $338 billion while the coin’s price hovers around $18,270. According to AssetDash’s data, Bitcoin’s capitalization increased by 3%—enough to push payment giant Mastercard back to 17th place as its market cap lost 0.6%.

Philippe J DEWOST's insight:

Who said a $100k target was not unreasonable ?

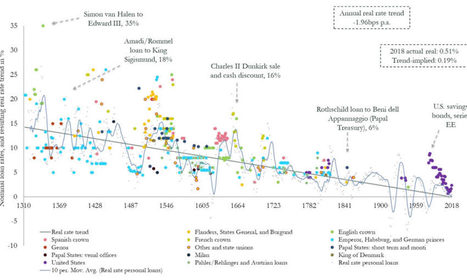

How far can interest rates fall?

Currently, many sovereign rates sit in negative territory, and there is an unprecedented $10 trillion in negative-yielding debt. This new interest rate climate has many observers wondering where the bottom truly lies. Today’s graphic from Paul Schmelzing, visiting scholar at the Bank of England(BOE), shows how global real interest rates have experienced an average annual decline of -0.0196% (-1.96 basis points) throughout the past eight centuries. The Evidence on Falling RatesCollecting data from across 78% of total advanced economy GDP over the time frame, Schmelzing shows that real rates* have witnessed a negative historical slope spanning back to the 1300s. Displayed across the graph is a series of personal nominal loans made to sovereign establishments, along with their nominal loan rates. Some from the 14th century, for example, had nominal rates of 35%. By contrast, key nominal loan rates had fallen to 6% by the mid 1800s.

Starting in 1311, data from the report shows how average real rates moved from 5.1% in the 1300s down to an average of 2% in the 1900s.

The average real rate between 2000-2018 stands at 1.3%. Current TheoriesWhy have interest rates been trending downward for so long? Here are the three prevailing theories as to why they’re dropping: 1. Productivity GrowthSince 1970, productivity growth has slowed. A nation’s productive capacity is determined by a number of factors, including labor force participation and economic output. If total economic output shrinks, real rates will decline too, theory suggests. Lower productivity growth leads to lower wage growth expectations. In addition, lower productivity growth means less business investment, therefore a lower demand for capital. This in turn causes the lower interest rates. 2. DemographicsDemographics impact interest rates on a number of levels. The aging population—paired with declining fertility levels—result in higher savings rates, longer life expectancies, and lower labor force participation rates. In the U.S., baby boomers are retiring at a pace of 10,000 people per day, and other advanced economies are also seeing comparable growth in retirees. Theory suggests that this creates downward pressure on real interest rates, as the number of people in the workforce declines. 3. Economic GrowthDampened economic growth can also have a negative impact on future earnings, pushing down the real interest rate in the process. Since 1961, GDP growth among OECD countries has dropped from 4.3% to 3% in 2018. Larry Summers referred to this sloping trend since the 1970s as “secular stagnation” during an International Monetary Fund conference in 2013. Secular stagnation occurs when the economy is faced with persistently lagging economic health. One possible way to address a declining interest rate conundrum, Summers has suggested, is through expansionary government spending.

Philippe J DEWOST's insight:

Fascinating visuals sustaining deep research and thinking. Must read.

Silvio Gesell hated money. A German entrepreneur who moved to Argentina for business in the late 19th century, he witnessed a massive financial crash in 1890 that convinced him that money was behind the world's economic problems: poverty, inequality, unemployment, stagnation. The problem, Gesell believed, was that money served two roles that often came into conflict: It was a way for people to store wealth, and it was the thing everybody needed to conduct business. The fact that money could store wealth meant its holders had a reason to cling to it, especially in crises like the one he saw in Argentina, when opportunities to safely put that money elsewhere looked grim. It was a typical story. When people got scared, they hoarded cash and brought business to a standstill. It led, Gesell said, to a situation of "poverty amid plenty." Gesell wanted to create a new kind of money — a money that would "rot like potatoes" and "rust like iron" so no one would want to hoard it, a money that was "an instrument of exchange and nothing else." And the crazy part is that he did create it. Through a series of pamphlets, articles and books, Gesell inspired a worldwide movement that introduced a completely new form of money. It's one of the most fascinating, and largely forgotten, stories in economic history. But after 70 years of obscurity, Gesell is making a comeback. All of a sudden, this obscure radical from another age has his name and ideas popping up in unlikely places — like speeches of leaders at the U.S. Federal Reserve, research papers of the International Monetary Fund and the pages of the Financial Times. As the industrialized world grapples with stagnation and as markets signal another recession, policymakers are struggling to figure out what to do. Could Gesell provide an answer?

Philippe J DEWOST's insight:

Money with an expiration date was designed by Silvio Gesel as a money that no one would want to hoard, so it would be "an instrument of exchange and nothing else." The crazy part of the story is that he did create it.

La loi Pacte a été définitivement adoptée ce jeudi par les députés. Une double disposition permet aux assureurs de mettre, via des fonds professionnels spécialisés, des crypto-actifs dans l'un des produits d'épargne préférés des Français. Les FPCI sont également concernés par la mesure.

Du bitcoin dans les contrats d'assurance-vie ? C'est pour bientôt. Selon nos informations, grâce à la loi Pacte votée ce jeudi à l'Assemblée nationale, les assureurs peuvent désormais proposer des contrats d'assurance-vie exposés aux cryptomonnaies. Une première pour un produit aussi populaire en France. « Ce n'était pas l'objectif premier de Pacte, mais les assureurs pourront effectivement offrir des produits basés sur des crypto-actifs. Ils le pourront via des fonds spécialisés », confirme le député LREM et rapporteur du budget, Joel Giraud. Le nouveau cadre sera opérationnel après la publication des décrets d'application. Deux dispositions de la loi PacteLe dispositif a été rendu possible par l'adoption de deux textes de la loi Pacte, en discussion depuis 18 mois. L'article 21 de Pacte a modifié le Code des assurances pour permettre de placer des fonds professionnels spécialisés (FPS) en unités de compte d'assurance-vie. Si l'article insère des conditions quant à la situation financière ou l'expérience de l'épargnant, qui seront justement précisées par décret, il n'y a plus de limite quant aux actifs dans lesquels les FPS éligibles à l'assurance-vie peuvent investir. « Les FPS ont été encore assouplis », explique Emilien Bernard-Alzias, avocat chez Simmons & Simmons LLP. Dans le même temps, l'article 26 bis de Pacte a modifié les dispositions du Code monétaire et financier relatives aux actifs éligibles à l'investissement par des FPS. Désormais, tout « bien » faisant l'objet d'une « inscription dans un dispositif d'enregistrement électronique partagé », autrement dit une blockchain, pourront composer l'actif d'un FPS. « Avec ces deux dispositions, il est écrit noir sur blanc que les FPS peuvent investir dans des crypto-actifs comme le bitcoin », souligne Emilien Bernard-Alzias. Les Fonds de placement en capital investissement (FPCI) sont également concernés par la mesure.

La Chine envisage d'interdire le minage de cryptomonnaies, une activité extrêmement consommatrice d'énergie. Depuis 2017, Pékin a considérablement renforcé l'encadrement du Bitcoin, contraignant des nombreuses sociétés à délocaliser à l'étranger.

Philippe J DEWOST's insight:

Une évolution qui pourrait impacter le prix des crypto monnaies de manière difficilement prévisible : d'un côté baisse des capacités de minage, de l'autre meilleure répartition géographique.

This piece originally appreared in McSweeney’s new issue, The End of Trust, a collection featuring over 30 writers investigating surveillance, technology, and privacy, with special advisors the Electronic Frontier Foundation. Over the last five years, Edward Snowden and I have carried on an almost daily conversation, most of it unrelated to his legal troubles. Sometimes we meet in person in Moscow over vodka (me) and milkshakes (him). But our friendship has mostly taken place on secure messaging platforms, a channel that was comfortable and intuitive for him but took some getting used to for me. I learned to type with two thumbs as we discussed politics, law, and literature; family, friends, and foster dogs. Our sensibilities are similar but our worldviews quite different: I sometimes accuse him of technological solutionism; he accuses me of timid incrementalism. Through it all, I’ve found him to be the clearest, most patient, and least condescending explainer of technology I’ve ever met. I’ve often thought that I wished more people — or perhaps different people — could eavesdrop on our conversations. What follows is a very lightly edited transcript of one of our chats. In it, Ed attempts to explain “blockchain” to me, despite my best efforts to cling to my own ignorance.

Philippe J DEWOST's insight:

"mechanically, we’re discussing a very, very simple concept, and therefore the applications are all variations on a single theme: verifiable accounting." - Brilliant

SAN FRANCISCO — A concentrated campaign of price manipulation may have accounted for at least half of the increase in the price of Bitcoin and other big cryptocurrencies last year, according to a paper released on Wednesday by an academic with a history of spotting fraud in financial markets.

Philippe J DEWOST's insight:

Confusion between a public token based infrastructure and an exchange market for such token can go both ways. You shall invest only in what you understand. And for me it is still a Hold.

From

www

Philippe J DEWOST's insight:

BaaAWS = Blockchain as an Amazon Web Service ?

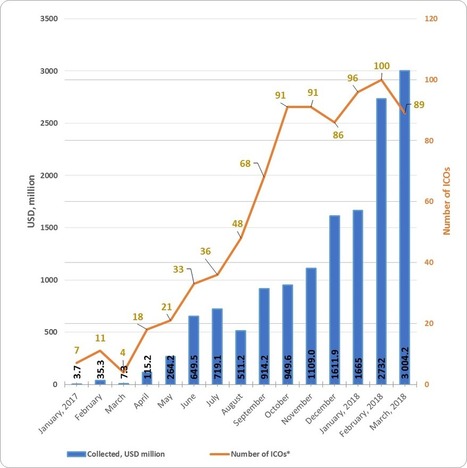

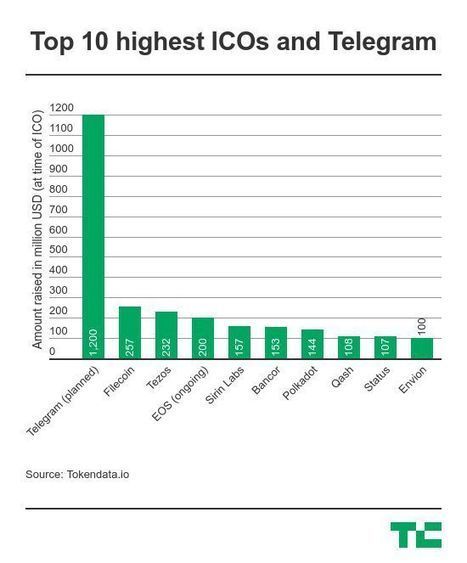

Right now, based on preliminary assessments, it can be said that more than $7.4 billion has already been collected, which is more than during all of 2017, and this despite a threefold fall in the entire cryptocurrency market over the first quarter. The total funds collected in 2017 equaled around $6.9 billion.

The growth in collected funds in 2018 took place despite the introduction of a number of changes and restrictions in this area related to regulation processes and the types of tokens being issued (for example, regulation of the issue of tokens by the US Securities and Exchange Commission (SEC) and restrictions on security tokens).

Despite the ban on initial coin offerings in certain countries (China, South Korea), and the need to perform KYC (Know Your Customer) verification procedures, some ICO projects have established mandatory preregistration, limitations on the minimum and maximum amount of tokens purchased, a digital queue for the right to purchase tokens, etc.

Philippe J DEWOST's insight:

Figures vs (bad) buzz

A document submitted to the SEC earlier this week states that the money was raised “for the development of the TON Blockchain, the development and maintenance of Telegram Messenger and the other purposes.” The security is described as “purchase agreements for cryptocurrency” and the filing is signed by Telegram CEO Pavel Durov.

This initial sum is most likely the pre-sale stage of the ICO which, as TechCrunch reported on extensively and in detail last month, was targeted at venture capital firms and top figures in the investment community who were given deep discounts to buy Telegram’s Gram token. The pre-sale was originally targeted at raising $600 million, but demand pushed the figure up to $850 million, according to a Bloomberg report.

Telegram initially planned to raise a further $600 million to develop its TON project via a public sale that starts in March, according to documents seen by TechCrunch, but it remains to be seen whether that figure will be adjusted. Bloomberg previously suggested the public sale component would expand to $1.15 billion, bringing the total raised to nearly $2 billion if successful.

Telegram CEO Durov did not reply to an emailed request for comment at the time of writing.

Either way, the sale promises to be the largest ICO seen to date. The pre-sale figure alone tops all other ICOs held by some margin.

Philippe J DEWOST's insight:

ICOs look more and more like the tool of choice when it comes to fund a network effect driven project or platform ; yet Telegram's is unprecedented in many ways and here is why #TheScalabilityEffect

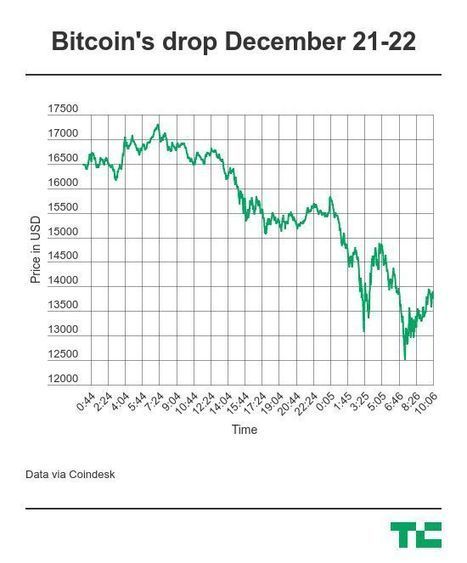

Bitcoin has been on a tear this past with the value of the cryptocurrency jumping from $8,000 to nearly $20,000. Well that run hit an abrupt end today as the price crashed as much as 23 percent on Coinbase. The price briefly dipped below $12,000 on some exchanges at around 7:30 am London time.The drop — which wiped more than $4,000 from the value of bitcoin at one point — was the highest percentage loss of value that bitcoin has seen this year. The cryptocurrency was valued at just $998 on January 1 2017 and it soared to a record high of nearly $20,000 on some exchanges earlier this week.

Philippe J DEWOST's insight:

Most interesting is that nobody really knows either why today’s 23% crash nor why this year’s 15x rally... and the article footnote is hilarious per se.

|

En février, Intel devrait sortir sa puce Bonanza Mine, un processeur Asic spécialement conçu pour miner de la cryptomonnaie. Il est conçu pour être très économe en énergie. Via Philippe Serafin

Insurance company MassMutual just invested $100 mn in bitcoin to get:

Philippe J DEWOST's insight:

Bitcoin devient à la fois un outil de couverture de risque financier (le quantitative easing pourrait impacter les monnaies fiat) et une classe d'actifs permettant de diversifier les portefeuilles.

From

decrypt

In brief

Telegram, the operator of the 400 million-strong messenger app, today announced that it has given up on its upcoming blockchain network, the Telegram Open Network, following a lengthy, protracted dispute with the SEC. "Today is a sad day for us here at Telegram. We are announcing the discontinuation of our blockchain project.” wrote Pavel Durov, co-founder of Telegram, in a blog post. “Telegram’s active involvement with TON is over.”

Since October, the SEC has alleged that Telegram’s $1.7 billion ICO in 2018 for the cryptocurrency that powers the network, Grams, constituted an illegal securities offering. Though Telegram denied the charges, the SEC secured one temporary injunction after another, delaying the launch of the network. Due to a clause in the purchasing agreement for Grams, Telegram promised it would return the tokens if the network didn’t launch by April 30. The network didn’t launch, so Telegram offered to return investors their money. The project folded less than two weeks later.

Philippe J DEWOST's insight:

The biggest ICO worldwide will finally not happen

Philippe J DEWOST's curator insight,

May 13, 2020 11:59 AM

Worlds Biggest ICO has just been canceled, with $1,7 Bn needing to be (partially) refunded

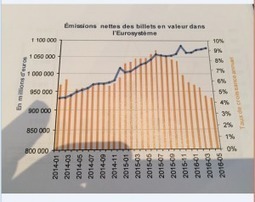

Il est indéniable, que l’agrégat monétaire M1 augmente d’une façon vertigineuse depuis début 2014, si on le compare au PIB. Cela sans que l’on ait besoin de larguer des billets par hélicoptère, comme le suggérait l’économiste Milton Friedman, le Chicago boy ! Cette création fiduciaire pure ne correspond pas bien sûr à une création de valeur.

De l’intérêt de l’accroissement du montant des espèces pour les banques centrales ! Lorsqu’une banque centrale émet de la monnaie, elle porte au PASSIF de son bilan la quote-part (% négocié entre les pays en fonction de leur population, lors de la création de l’euro , la France avait alors très bien négocié) de la valeur des billets en euros émis par l’Eurosystème, cela se nomme « hypocritement » le « revenu monétaire » Il en résulte que les ressources nettes de la Banque sont en hausse d’une fin d’année à l’autre, elles s’établissaient à 317 milliard d’euros en 2014, contre 308 milliards en 2013 . Cette hausse résulte essentiellement de la croissance de la circulation fiduciaire. En 2014 la croissance de la valeur des billets en euros s’est accélérée + 6,3 % d’une fin d’année sur l’autre, en 2015 c’était de l’ordre de 6.5% pour redescendre en 2016 et 2017 à 4%, des pourcentages bien supérieurs à la croissance. Enfin, après avoir mis au passif l’émission de monnaie, les banques centrales portent (à ma connaissance à hauteur de 70%) cette progression fiduciaire, à l’ACTIF de leur bilan c’est là qu’est l’intérêt des banque centrales, car ces 70% sont ensuite matérialisés par l’achat de bons du trésor Américains, Suisse, Japonais etc , appelé hypocritement « réserves de change » qui sont eux normalement générateurs d’intérêts. Mise à jour Informations 2018 Depuis la mise en place du QE Quantitative Easing, les banques centrales de la zone euro, peuvent acquérir des obligations dont des emprunts d’état. La banque de France a profité de cette possibilité et est devenue un grand détenteur de la dette Française. Le Produit net des activités a ainsi progressé de près de 6% pour atteindre plus de Huit milliards d’Euros. Tout ses éléments de technique financière ont généré en 2017, un bénéfice avant impôts de Six Milliards d’euros, soit en hausse de 8%. La banque de France devrait versée à l’Etat un dividende de près de cinq milliards d’Euros.

Conclusion, D’après certaines études, Il semblerait qu’un tiers de cette croissance de masse fiduciaire soit détenue hors de la zone Euro. Il n’empêche qu’aujourd’hui dans la zone euro à l’heure des cartes de crédit dont l’utilisation a progressé de 67% au cours des 10 dernières années, 79% des transactions en points de ventes se font encore en espèces. Pour résumer cet artifice technique des banques centrales, plus il y a d’espèces en circulation, la plus grosse partie, indispensables à la consommation mais dont une faible partie est thésaurisée dans des coffres ou à l’étranger, une autre partie étant utilisée pour l’acquisition et l’exportation de biens acquis grâce aux trafics, plus la banque centrale se voit obligée d’émettre de nouveaux billets, plus elle fait grossir son passif, cela lui permet de faire grossir parallèlement son actif , et donc augmenter les ressources nettes de la banque !

Philippe J DEWOST's insight:

Les paiements en espèces ne disparaîtront pas vous ne pouvez pas deviner pourquoi Aujourd’hui, en France on parle souvent de la fin des paiements en liquide...

The Australian man who claimed to have invented cryptocurrency bitcoin has been ordered to hand over half of his alleged bitcoin holdings, reported to be worth up to $5bn. The IT security consultant Craig Wright, 49, was sued by the estate of David Kleiman, a programmer who died in 2013, for a share of Wright’s bitcoin haul over the pair’s involvement in the inception of the cryptocurrency from 2009 to 2013. Kleiman’s estate alleges Wright and Kleiman were partners, and therefore his family is entitled to a share of the bitcoin that was mined by the pair in that time. Wright denies there was a partnership. A US district court in Florida on Tuesday ruled that half of the bitcoin mined and half of the intellectual property held by Wright from that time belongs to Kleiman. One issue is it is not known exactly how much bitcoin Wright holds. It has been claimed that the Kleiman estate could get anywhere between 410,000 and 500,000 bitcoin, putting the value at between A$6.1bn and A$7.4bn as of Wednesday. Wright claimed to the court that he couldn’t access the bitcoin because he doesn’t have a list of the public addresses of that bitcoin. He claimed in 2011, after seeing the cryptocurrency had begun to be associated with drug dealers and human traffickers, he put the bitcoin he mined in 2009 and 2010 into an encrypted file and into a blind trust. The encrypted key was divided into multiple key slices, and the key slices were given to Kleiman who distributed them to people through the trust. Wright said this meant he could not decrypt the file until he gets access to the key from a bonded courier who will arrive in January 2020 – a claim Wright has made before in claiming to be Satoshi Nakamoto, the pseudonymous creator of bitcoin. In the judgment, Judge Bruce Reinhart said Wright had not proved he could not comply and obtain the bitcoin. He said Wright made inconsistent statements and the whole story was “inconceivable” that he’d had a Dr Frankenstein-like revelation when his creation “turned to evil”. “During his testimony, Dr. Wright’s demeanor did not impress me as someone who was telling the truth. When it was favorable to him, Dr. Wright appeared to have an excellent memory and a scrupulous attention to detail. Otherwise, Dr. Wright was belligerent and evasive,” Reinhart said. In 2015, Wright was investigated by the Australian Taxation Office over his involvement with bitcoin with his Sydney home raided by the Australian federal police, leading to speculation he might be Nakamoto. In 2016, Wright claimed he was Nakamoto, but experts questioned the evidencehe provided. He promised to provide further proof, but backed down days later, saying he was “sorry” and did “not have the courage”. Reinhart said at the start of his ruling the court “is not required to decide, and does not decide” whether Wright is Nakamoto, and the court was not required to decide and did not decide how much bitcoin Wright controls today.

Philippe J DEWOST's insight:

"Show me the money" at least, even if you can't prove you are Satoshi, asks a US Court to Australian citizen Craig Wright. And it is a LOT of money...

China’s plan to close local cryptocurrency mining facilities would potentially end the country’s dominance in the energy-hungry, yet lucrative industry

Facebook has made its first acquisition in the blockchain space.

Philippe J DEWOST's insight:

People connected by chains used to be named "slaves"...

David Marcus who was Vice President, Messaging Products, becomes Head of Blockchain (news posted on September 5).

The organizational chart of Facebook displays its 206 main executives including Mark Zuckerberg, David Wehner, Sheryl Sandberg and Sue Taylor

Philippe J DEWOST's insight:

Given what he did with Messenger, we can expect a bold commitment.

HTC is developing a new android phone that will be powered by blockchain technology. The phone, named Exodus, will feature a universal wallet and a built-in secure hardware enclave to support cryptocurrencies and decentralized applications.

Philippe J DEWOST's insight:

I thought cryptocurrencies and Blockchain were powered by hardware and not the opposite ... #StupidTitle

Andreessen Horowitz, one of the leading venture capital firms when it come to investing in digital currencies, is preparing to launch a separate fund to buy and sell crypto assets, Recode has learned. The move could be a significant broadening of the high-profile firm’s mission, and would serve as another big industry moment as investors seek to capitalize on the flurry of activity in cryptocurrencies, which some see as the next wave of innovation. Andreessen Horowitz has invested in blockchain companies like Coinbase, in crypto-specific funds like Polychain Capital and in initial coin offerings, but as a fund, it has not yet publicly traded the actual assets like bitcoin. Andreessen Horowitz declined to comment. Two job listings posted on Andreessen’s website say that the firm is hiring for a “separately managed fund focusing on crypto assets.” Andreessen has so far only invested out of two types of funds: One for early- and late-stage startups, the latest closed in 2016 totaling $1.5 billion; and one for bio investing, which last year equipped the firm with $450 million to invest in a specific class of companies. The job postings did not specify how much this fund would gather under management, or when it would begin investing. Andreessen Horowitz also doesn’t define “assets” in the job postings, so it’s possible that the firm could choose to run its token- and blockchain-related startup investing out of this pool of capital, as well. Plus, the industry could look very different in just a few years. But the listings for a legal counsel and for a finance and operations manager do spell out some details:

Venture capital firms have been generally skittish about investing in cryptocurrencies directly, with some saying that their limited partners could very well do so without their help (and avoid the fees that they’d have to pay to the venture capital firms to do it for them). Other conservative limited partners are worried about the regulatory risks of the entire sector. But few funds have a track record in this space like Andreessen Horowitz, which is one of the most active venture capital firms in cryptocurrency investing, under a team led by general partners Chris Dixon and Alex Rampell, who are looked to in Silicon Valley as guiding lights for understanding the asset class. Andreessen Horowitz investments in addition to Coinbase range from well-known companies like Ripple to newer deals like CryptoKitties. That being said, some investors believe there’s a lot more money to be made and faster in the currencies themselves than in the companies that are merely organized around them.

Philippe J DEWOST's insight:

Marc Andreessen once said : "In the fight between the bear and the alligator,the outcome is determined by the terrain.". Andreessen Horowitz is now getting prepared to enter the crypto asset terrain.

It wasn't long ago that your average enterprise wouldn't even mention bitcoin, ethereum, or any number of cryptocurrencies in public. Instead of using the cryptographically secure tokens to streamline workflows - or even talking about doing so - some of the most recognizable enterprises in blockchain have largely confined themselves to uses of blockchain as a new decentralized database, absent any digital assets. Slowly however, over the past several years that has started to change. Executives at large corporations have shown themselves to be increasingly willing to take public stances both for (and against) what is now a $300 billion token market. But if 2017 was the year that companies began talking about crypto, it wasn't until recently that enterprises have been willing to publicly use cryptocurrencies in both early-stage prototypes and live applications. Now, it would seem the floodgates are prepared to open, with the $140 billion IBM revealing to CoinDesk that it has been meeting with executives from commodities trading platforms, large corporations, and perhaps most importantly, central banks, to explore how cryptocurrencies can help save them money and generate revenue. "We're seeing tons of demand for digital asset issuance across the board," said IBM's new head of blockchain development Jesse Lund, who was hired from Wells Fargo earlier this year to help develop the computer giant's cryptocurrency strategy. At the moment, that work is largely being pursued using the public Stellar platform, and its native cryptocurrency, the lumen (XLM), a partnership made public last October. But in interview, Lund said IBM is interested in expanding the business applications of cryptocurrencies in a number of ways.

Philippe J DEWOST's insight:

Thou shall not separate... Big Blue is breaking from enterprise blockchain norms by publicly working with cryptocurrencies in a wide range of projects.

Fewer than 1 percent of bitcoin transactions involve money laundering, according to a new report. FDD and Ellicit, a bitcoin forensics company, claim that money laundering through bitcoin is not the widespread problem some critics of the cryptocurrency believe. “The amount of observed Bitcoin laundering [is] small and darknet marketplaces such as Silk Road and, later, AlphaBay are [generally] the source of almost all of the illicit Bitcoins laundered through conversion services,” the report states. The researchers also claim that illicit bitcoin transactions are five times more likely to happen in Europe than North America

Philippe J DEWOST's insight:

Bitcoin also has its fake news

On Friday, MIT Technology Review published an article on the cryptocurrency IOTA. However, we at the Media Lab have issues with the story. Like for « no fees transactions » : Bitcoin has miners who can perform the proof of work for you, while IOTA users do the proof of work on their own devices, per transaction. However, a Bitcoin user can also mine their own block to get their transactions accepted into the blockchain without paying fees. To put it another way, most people wouldn’t be interested in buying a refrigerator operated by a hand crank, even if the advertisement said “No electricity required!”

Philippe J DEWOST's insight:

When MIT Media Lab & MIT Technology Review differ by a Iota

|

This is probably the first immersive 360° VR Blockchain Keynote, as well as my very last one for @CaisseDesDepots