Good morning from a bruised, burned, and depressed London.

Except it probably won't be a good morning in the financial markets, where we're braced for another day of losses across Europe.

Asian markets have been deep in the red overnight, as the rout that began a week ago continues. It looks certain that FTSE 100 will drop through the 5,000 point mark for the first time since July 2010 when trading begins at 8am.

The futures market now shows the blue chip index falling around 150 points -- which is actually something of a recovery, as the Footsie was being called down 300 points (!) a couple of hours ago.

The trigger? Last night's dreadful losses on Wall Street - where the Dow Jones industrial average suffered its sixth biggest points-drop ever. President Obama's speech will have cheered anyone who's shorted the Dow, but otherwise did little to raise spirits.

City workers will surely also be affected by the riots in parts of the capital over the last few days. We' don't know the economic damage of the disruption - but it must be dreadful for sentiment.

While much of Britain was sleeping, the Asian markets were having something of a nightmare. At one stage, Hong Kong's Hang Seng index was down more than 7%, and the Japanese Nikkei was down over 4%. In South Korea, trading was again temporarily suspended.

But in the last couple of hours, the situation improved. A bit. The Nikkei has just closed for the day, down 1.7% at 8944.48. That's the first time Japan's main index has been below 9,000 points since March's earthquake.

Banking stocks took another severe pummelling, with HSBC down 8.5% at one stage in Hong Kong, and Bank of China losing 7.6%.

The encouraging news is that the markets did pull back from their lowest points. So the FTSE sell-off may not be quite as bad as previously feared (IG Index are currently forecasting a 140-point decline).

Few of you will be surprised to hear that gold hit another record high overnight. The spot price leapt to $1,771 per ounce, up $50 per ounce.

Analysts used to speculate about whether gold would hit $2,000 per ounce by the end of the year. The new target appears to be $2,500 per ounce, as the scramble for 'save havens' turns into a stampede.

JP Morgan commodity analysts Colin Fenton and Jonah Waxman have upped their forecast for gold from $1,800 to $2,500. Here's why:

In the near term, most commodity markets appear likely to convulse lower, as a growth scare dislodges physical inventories and impairs orders.

These fears could linger in the United States, where private funding costs will likely go up and household balance sheets will be further strained.

They also reckon that raw sugar prices could double.

If you missed last night's drama on Wall Street, here's a recap.

The Dow Jones fell 5.55%, or 634.76 points, to 10,809.85. The worst of the sell-off came after President Obama spoke about the American economy. Although Obama insisted that the US would always be a AAA nation, the immediate reaction from Wall Street was negative - with traders unhappy that more wasn't being done to avoid a recession.

The S&P 500 index fell 6.65%, and every company on the index lost ground.

Financial stocks bore the brunt -- with Bank of America plunging more than 20%. Such losses are reminiscent of the depths of the financial crisis.

The London stock market is open.... and the FTSE 100 has fallen 0.7%, losing 55 points to 5027.

That feels almost like a triumph, given the bleak picture a few hours ago. The City may be holding its nerve better than we, and it, thought.

Good news, the FTSE 100's actually broken into positive territory. 35 points to the good. Instead of crashing through 5000, we've hit 5100.

Mining stocks are driving the rally (the Footsie is so stuffed with commodities giants that they can easily drive the whole index).

Other European markets are also rallying. Spain's IBEX is up 1.78%, the German DAX is 1% higher, and the French CAC is holding into a 1.8% gains.

Just a dead cat bounce? We'll see, but it's reassuring for investors, pension holders, parents with child trust funds...

Another encouraging development this morning -- traders reckon that Wall Street will claw back some of Monday's losses. We're seeing the Dow called up 2.2%, and the S&P 500 2.5% higher, in the last couple of minutes.

That only recovers some of the lost ground, of course.

European Central Bank president Jean-Claude Trichet has confirmed that the central bank is now actively buying bonds in the secondary market and plans to carry on doing this - but he ruled out buying bonds directly from crisis-hit European states.

"This is not what we should do, and not what we can do," he told Europe 1 radio this morning.

Photograph: Kai Pfaffenbach/Reuters

Photograph: Kai Pfaffenbach/Reuters

On Monday, the ECB bought Italian and Spanish bonds to force down the countries' soaring borrowing costs, which hit new record highs last week.

The plan appears to be still working. Italian and Spanish bonds have continued to strengthen today -- the yield on Spanish 10-year debt fell again to 5.05%, with Italian yields around 5.1%.

Trichet urged eurozone governments to lose no time and implement the new emergency bailout measures agreed at the 21 July crisis summit:

What we ask is that all the decisions which were taken on 21 July be put into effect as quickly as possible.

The stock market rally has fizzled out - and FTSE 100 is now hitting new lows. It just slumped to 4976 points, down 92 points or 1.73%.

This is the first time the FTSE 100 has been the wrong side of 5,000 since July 2010.

Yesterday, Louise Cooper of BGC Partners told us she was concerned that the London market has been repeatedly unable to manage a meaningful rally.

It's worrying that the markets cannot sustain a relief rally - every time shares start to rally, they get smacked down by heavy selling.

We're looking at another rout in the City, I'm afraid. The FTSE has tumbled 180 points, or 3.5%, to 4888 points.

Those early predictions of heavy losses are coming true. There's not a single riser on the FTSE 100 -- bank shares are in retreat. Barclays and Royal Bank of Scotland are down 6%.

Richard Hunter, head of UK equities at Hargreaves Lansdown Stockbrokers, told us that those predictions of a strong Wall Street rally have been revised lower:

The underlying story hasn't changed. Concerns around the US and eurozone remain. Volatility and turbulence will continue to be the name of the game in the absence of anything concrete.

Volatility in the stock market has also hit its highest level in two and a half years -- another sign of alarm.

The VIX, commonly dubbed the "fear index", has jumped by 15.4% this morning. It has now more than doubled since the start of the month.

It just gets worse. The FTSE 100 just slumped by 277 points, or nearly 5.5%, to 4791. This was prompted by the news at 9.30am that British factory production fell unexpectedly in June, adding to a glut of disappointing news on the UK economy.

Manufacturing output fell by 0.4% in June, confounding the City's expectation of a 0.2% increase. Car production, chemicals, and paper and publishing all shrank, according to data from the Office for National Statistics.

Industrial output (which includes utilities and mining) fell 1.6% between April and June, worse than the ONS's earlier estimate of a 1.4% decline in the GDP figures.

Separate data released at 9.30am showed that the UK trade deficit was wider than forecast in June, at -£8.873bn. That is the largest gap in Britain's trade with the rest of the world since December. Not good news for the export-led recovery

Update: There's a full story here

At today's lows, the FTSE 100 moved into "bear territory" - defined as a fall of more than 20% from its recent peak (my colleague Nick Fletcher points out). That's important, because once markets enter bear territory they often decline much further.

Giles Watts, head of equities at City Index, says London is suffering a "sell stampede":

Should the FTSE close below the 4884 level, which marks a 20% loss in value from February's 6105 highs, this could signal a longer term bearish trend for the UK Index.

Once again, we have seen an early price rally aggressively sold into and this makes any market rally in the future all the more fragile as investors may continue to use rallies as opportunities to exit stocks at higher levels, before they fall once again.

Any rallies seen in the market will likely have huge question marks hanging over their longevity. So far most market rallies have been incredibly choppy and heavily sold into. This shows a lack of sincerity behind price rallies and investors continue to show signs of panic and running for the hills.

The chatter in the financial markets is that Ben Bernanke, the head of the Federal Reserve, might make an official statement before trading opens on Wall Street (at 2.30pm BST).

Joshua Raymond, chief market strategist at City Index, tweeted that:

@Josh_CityIndex have heard that #Bernanke may make a statement before US market open, between 2pm-2.15pm. only rumours though... #marketcrisis

The Federal Open Market Committee, chaired by Bernanke, is holding a regular meeting this evening. Analysts had wondered if the FOMC might attempt to stimulate the markets with a third dose of quantitative easing.

Given the reaction to Obama's speech last night, Bernanke would need to say something concrete or he might make things worse. Unfortunately it's too early to get through to the Fed, but our Wall Street colleagues will be tasked with hunting this rumour down.....

Time for a round-up of the financial markets. Egypt's stock market has been suspended, after falling over 5%, and all the major indexes are down:

• The FTSE 100: down 128 points, or 2.5% at 4939

• The DAX: is down 331 points, or 5.59%, at 5591

• The CAC: down 120 points, or 3.8%, at 3005.

• The IBEX: down 221 points, or 2.5%, at 8237.

• The FTSE MIB: down 373 points or 2.5% at 15,266.

And a flavour of the mood in the City from Gary Jenkins, head of fixed income research at Evolution Securities, on why the crash began last week:

Were the massive market moves due only to the downgrade of the US or was it a case of investors having been through all the shenanigans regarding the debt ceiling, Greek bail out, general Euro fiasco and the downgrade and then saying well after all that, where's the beef?Where is the economic growth? Maybe it was a late reaction to the jobless numbers which were touted as being better than expected, which they were, but they were still pretty awful and indicative of an economy that is still facing serious headwinds even after QE1 and 2.

Germany is feeling the heat from the crisis today. Not only is its DAX index the worst performer of the major European indexes, but the cost of insuring German government debt has risen above the UK equivalent.

Data just in from Markit shows that the CDS contract on German debt rose to 84 basis points, compared with 82.5bp for the UK.

In practice, that means it costs €84,000 per year to insure €10m of German bonds. So Bunds are still seen as pretty safe. The Greek CDS contract, in contrast, was trading at 1,600bp (so it costs €1.6m to insure €10m of Greek debt).

Germany is still the strongest financial link in the eurozone - any deals to rescue Italy and Spain are ultimately based in its ability, and willingness, to fund them.

Despite losing its AAA rating (with S&P at least), US debt remains as secure as Fort Knox. The US CDS contract dropped to just 55.5bp this morning.

We mentioned earlier that the US Fed might announce another dose of quantitative easing. But after two slugs of QE (where central banks buy up debts with newly created electronic money), would a third really have the same impact?

Louise Cooper, markets analyst at BGC Partners, reckons not:

Louise Cooper: "QE no longer packs the same punch". Photograph: Oliver Woods

Since the end of QE2, chaos has ensued. So will the Fed surprise us this afternoon with more money printing? President Obama must be pretty unhappy after American debt was downgraded this weekend, and remember it is election year for him in 2012. Ben Bernanke is an expert on the Great Depression and will want to avoid the policy mistakes made in that era. So, watch out for markets getting excited about Ben and the FOMC meeting today.

But will QE work (even if we do get it). Well expect a whip saw rally if it is announced, with probably more to come. But there is one rule of economics that is relevant here -the theory of marginal returns. Essentially the idea that adding more and more of one resource, adds less and less to additional productivity. QE3 may not not pack quite the same punch that QE2 and QE1 did.

Jean-Claude Trichet. Photograph: Georges Gobet/AFP/Getty Images

Jean-Claude Trichet. Photograph: Georges Gobet/AFP/Getty Images

Markets are getting a bit calmer (for now), with the news that Wall Street is expected to recover some of yesterday's severe losses. The Dow Jones is being called up 100 points. That's helped to pull the FTSE 100 well away from its lowest levels -- now down just 3 points at 5065. Traders must be getting dizzy with all this volatility.

Incidentally, we mentioned that Jean-Claude Trichet took to the French airwaves this morning. We neglected to mention one killer quote, though, about the scale of the crisis, and about how things could have been even worse:

It is the worst crisis since World War II and it could have been the worst crisis since World War I if leaders hadn't taken the important decisions.

European markets have continued to rally, and are now mostly up for the day [FTSE100 up 8 whole points at 5077, so maybe hold back the bunting]

Mike Lenhoff, chief strategist at Brewin Dolphin, argued earlier today that the rout on stock markets today and yesterday had the feel of a "climax sell-off". Many stocks, he argues, now look pretty cheap - but that doesn't mean the markets won't keep falling.

Lenhoff explains:

Value and fundamentals may not count for much in a crisis of confidence but, for investors with a strategic focus, that is when they matter most. The difficulty is establishing what they are and, in the meantime, momentum is likely to be the more persuasive feature. But that can change!

Yesterday's action had the feel of a climax sell-off and so does this morning's. At the time of writing the FTSE 100 had retraced half of what it gained between the financial crisis low of March 2009 and this year's peak (that level being around 4800).Given the extreme oversold condition of equity markets, a rebound is due even if it provides little more than momentary relief from the panic selling.

While the odds of a US recession may have risen, the likely outcome is still modest growth but, even allowing for earnings downgrades, the prospective PE ratios are back to where they were ahead of the recovery in equity markets in the spring of 2009. The bond-equity earnings yield ratio is back to its low point during the financial crisis.

These metrics can be no more than indicative. Still, they illustrate in some sense the dichotomy that has arisen for the developed economies between a floundering in political leadership to confront the issues and the corporate world in which earnings are growing strongly. It's all down to conviction. If you believe in the earnings story, as we do, equity markets offer value!

Oil prices have slumped today on growing fears about the world economy. So will petrol prices follow?

Brent crude darted below $100 a barrel, falling $5 at one stage to $98.74, the lowest intraday price since 8 February. US crude touched $75.71, the lowest since September 2010.

Luke Bosdet at the AA told us that "in theory, petrol prices should be coming down". Since 25 July, wholesale prices have fallen below ¢1,000 per metric tonne - which would suggest a 4p drop in prices at the pump.

Some independent retailers already began to lower their prices over the weekend, while Asda announced price cuts of up to 2p a litre on Monday, which could trigger another supermarket price war.

However, Bosdet said supermarkets may be more cautious after getting their fingers burned in late June when Tesco launched a price war. Within ten days markets had talked the oil price back up again, with a $5 increase on 7 July.

With petrol prices still within a penny of the record high of 137.43p reached on 9 May, relief for hard-pressed motorists is coming very slowly, he said.

Will Hedden, our friendly sales trader at IG Index in the City says the trading floor erupted as the markets plunged in early trading, making this morning was even more hectic than yesterday.

"It was really quite mental earlier," he told our own Rupert Neate. "The FTSE 100 opened higher than we expected, and even tipped into positive briefly, but then just after 8:15am it completely disappeared."

The index tipped far below the psychologically important 5,000 points mark. Yesterday, when the FTSE 100 was still hundreds of points above 5,000, Hedden predicted that it would dip below 5,000 before rising above 6,000 (where it traded last month) but he didn't expected it to fall as quickly as it has.

"I didn't think it would go this low this quickly," Hedden said. "Surely we've got to have an up day, but it's not going to happen today. Maybe tomorrow, but it probably won't be until next week. There's only one way it's going today - down."

Hedden is particularly surprised at the continued falls, because he thinks all the bad news should have been "more than priced in". "There has been no new information, but it continues to be a bit crazy and will probably remain weak all week."

"How much longer can we sustain such heavy selling? I just don't know - there's not a lot left to sell."

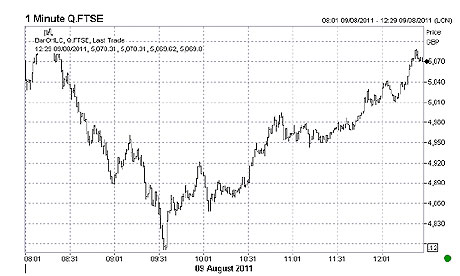

This graph shows how the FTSE 100 has performed today

It hit its lowest point just after 9.30am when the Office for National Statistics reported disappointing industrial output data for June, along with a widening UK trade gap.

Currently the index is trading just 4 points higher. Eyes are turning towards Wall Street....

The disappointing manufacturing data for June is a blow to George Osborne's Plan A, according to economics editor Larry Elliott. The UK's just not growing fast enough:

For the past few weeks, the chancellor has been bragging on about how his tough action to cut Britain's deficit has won the support of the financial markets, preventing the sovereign debt crisis in Europe and America from heading to these shores. But deficit reduction requires two things: fiscal discipline and growth. The markets have started to wake up to the idea that the UK has plenty of the former but precious little of the latter. And they have concluded, rightly, that the deficit is going to come down more slowly as a result.

More from Larry here.

The financial crisis, and the riots in London, are both proof that the global economy is entering a new, dangerous phase dubbed Ice Age 3.

That's the view of Albert Edwards, the famously bearish Société Générale analyst, via FT Alphaville. Edwards reckons that the market slump shows that we are seeing a repeat of Japan's lost decade - as a "fragile recovery undermined by private sector deleveraging collapses as a semi-bankrupt government tries to rein in runaway deficits."

Here's a taste of Edwards' analysis:

I and many others have been pointing out for a long time now the simple fact that the global economy has been living way beyond its means for years. A massive transfer of income to the very rich has occurred while middle class real incomes stagnated. The middle classes only tolerated this because Central Bankers created housing booms to keep the impoverished middle classes borrowing and spending to give them the illusion of prosperity and stop them from revolting.

Central bank polices haven't changed though. Print and print and print. And if that doesn't work, print some more. And as London burns, the point I have always made is that the US and UK are not like Japan in one very special way. Although Japan suffered a decade of pain it is a very homogenous, equal society. The UK and US are not. Some readers may not know that rioting and looting has broken out around London.

While I hear the UK politicians denounce the looters as common criminals (which of course they are), I can't help but think that Louis XVI in 1789 and Tsar Nicolas II in 1917 might have said the same thing.

No signs of Ben Bernanke surprising the markets with a statement before Wall Street opens (so that rumour can probably be shelved, alas).

Wall Street is still expected to open higher, and that's helping the FTSE to cling to a few points of gains. Investors are hoping that the Federal Reserve will launch some form of new asset-purchasing scheme later today.

Harvard University economist Kenneth Rogoff reckons the Fed should get the money-printing machines rolling again. He's told Bloomberg that Bernanke will "move more decisively".

Out-of-the-box policies are called for, especially much more aggressive monetary policy, however unpopular that may be.

Unless Bernanke breaks with tradition (we heard a delicious rumour that he would pop up in New York and ring the trading bell, but alas, Deutsche Bank's db-X Group have the honour in a few minutes), the FOMC should release its statement on the economy at 7.15pm BST (2.15pm EST).

Wall Street is open for business, and shares are rising at the start of trading. The Dow Jones is around 1.25% higher, or 135 points, and some banks are bouncing back - Bank of America was being called 7% higher after yesterday's 20% fall.

We'll have a full breakdown once trading is properly underway. On the trading floor, investors are talking about President Obama's underwhelming speech yesterday:

"The lack of clarity and lack of leadership is deterring people from trading into this market," said Jeff Kilberg of Treasurycurve.com, speaking on Bloomberg TV.

It's not the most vigorous rally we've seen, but at least US traders are resisting another selloff. The Dow Jones briefly dipped, but now we're now looking at a 1.46% rise, 157 points to the good at 10,967. The S&P 500 is 1.55% higher.

George Osborne is to address parliament about the state of the UK economy on Thursday, the Treasury has announced.

The chancellor is cutting short his holiday in the United States, and heading back to London. David Cameron announced earlier today that MPs will sit in Westminster for one day on Thursday to debate the London riots -- but until now there was no indication that we'd see other parliamentary business.

Chancellor George Osborne is heading home to update MPs on the economic situation. Photograph: Carl Court/PA Wire/Press Association Images

Chancellor George Osborne is heading home to update MPs on the economic situation. Photograph: Carl Court/PA Wire/Press Association Images

The timing is particularly interesting as the Bank of England will announce its latest quarterly forecasts on Wednesday. It is very likely to cut its economic projections, following the second-quarter GDP data (which showed that the UK economy only grew by 0.2% between April and June).

The heavy losses suffered by stock market investors will also be in the minds of many MPs, we expect.

Osborne has been criticised for being on holiday while the economic crisis raged -- the Daily Mail ran a large photo of the chancellor enjoying a ride at the Jurassic Park log flume at Universal Studios in Los Angeles. However, the Treasury have insisted that the chancellor was in regular contact with other finance ministers, as well as the prime minister and Bank of England governor Mervyn King.

Wall Street's finest are broadly divided about whether Ben Bernanke will smash the champagne bottle and launch QE3. With the Dow up 2% and back over the 11,000 mark and Bank of America, yesterday's biggest faller, up 7%, the pressure is on Uncle Ben to keep the optimism.

A survey by Bloomberg says economists are expecting Bernanke to add to the massive economic stimulus packages he's already dished out.

"By a 52% to 48% margin, respondents in a Bloomberg News survey said the Fed would ease policy this year through monetary tools or statement language," Bloomberg reports.

Excellent news - the FTSE 100 has just closed 95 points higher at 5164, a rise of 1.89%.

Those overnight predictions of a 6% slump proved wide of the mark (they came as Asia's markets suffered their own deepest losses). But it remains one of the most turbulent days on the stock market for some time -- remember, we were down 5.5% just after 9.30am.

Markets analysts warn, though, that the crisis is far from over...

Michael Hewson of CMC Markets, says sentiment in Europe remains "fractured and uncertain".

Josh Raymond of City Index agrees. "There has been no strong individual trigger behind today's reversal from losses to gains. Today's gains of 0.6% need to therefore be taken into context but certainly it helps to provide some relief to investors, albeit today at least."

Things could all change fast if Ben Bernanke is disappointment this evening - the Fed issues its latest policy statement around 2.15 pm Eastern Time (or 7.15pm for UK readers).

Tomorrow we'll hear from Mervyn King, when the governor of the Bank of England releases the quarterly inflation forecasts. Sir Mervyn will also be grilled by the press - so don't miss that!

For now, good evening, and thanks for reading.