Kenya Real Estate Developers Regulatory Board, & Cytonn Weekly #38/2020

By Cytonn Research, Sep 20, 2020

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 70.4%, down from 84.1% the previous week with the 91 day being the preferred option receiveing 151.3% subscription rate. The yields on all three papers remained unchanged at 6.3%, 6.7% and 7.6%, respectively. The three issued bonds were oversubscribed with total subscription rate coming in at 163.5%. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th September 2020 to 14th October 2020. Petrol prices have increased by 1.3% to Kshs 105.4 per litre from Kshs 104.0 per litre previously, while diesel prices have decreased marginally by 0.1% to Kshs 94.5 per litre from Kshs 94.6 per litre. Kerosene prices also decreased marginally by 0.6% to Kshs 83.2 per litre from 83.7 per litre, previously;

Equities

During the week, the equities market was on a downward trajectory, with NSE 20, NASI and NSE 25 all recording losses of 1.5%, 0.7% and 0.5%, respectively, taking their YTD performance to losses of 15.7%, 21.0%, and 30.4%, for NASI, NSE 25 and NSE 20, respectively. The performance was driven by declines recorded by banking stocks, with the highest declines being recorded in Diamond Trust Bank (DTB-K), Equity Group, and NCBA Group, which declined by 3.8%, 2.3% and 1.6%, respectively. During the week, the Capital Markets Authority (CMA) published guidelines to Collective Investments Schemes on the Valuation, performance measurement and reporting, which will be effective 1st January 2021, we shall be doing a note on this in the coming weeks;

Real Estate

During the week, the Ministry of Tourism released the Tourism Performance August 2020, highlighting that the number of international arrivals came in at 13,894 for the month of August, 91.4% lower than the 161,723 arrivals recorded during the same period last year. Nairobi Metropolitan Services Director of Housing Charles Sikuku announced that 1,562 low-cost housing units within the government’s affordable housing Pangani Estate were set for completion in December 2020. Kenya Mortgage and Refinance Company (KMRC), a treasury backed lender, announced plans to lend approximately Kshs 37.2 billion of its mobilized funds of approximately Kshs 40.0 bn, to Kenyans seeking affordable housing units. In the retail sector, Tuskys, a local retail chain, shut down two of its outlets, at Juja City Mall and Greenspan Mall due to rent arrears;

Focus of the Week

In July 2020, a committee appointed by the Principal Secretary, State Department for Housing and Urban Development, recommended the establishment of the Real Estate Developers Regulatory Board, “REDRB”, by October 2020 through an executive order subject to the Cabinet’s approval. The establishment of the board is aimed at promoting a transparent, efficient and competitive real estate sector, protecting the interest of the sector players and restoring investor confidence through safeguarding buyers’ deposits as well as providing a speedy dispute resolution mechanism between developers and home buyers. In this week’s topical, we look into the functions of the Board, expected benefits and challenges and lessons Kenya can learn from other countries that have successfully regulated real estate developers through either an authority or a board.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.6%. To invest or withdraw, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 12.6% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 70.4%, down from 84.1% the previous week.The highest subscription rate was in the 91-day paper, which came in at 151.3%, down from 180.7% recorded the previous week as it remained attractive on a risk adjusted basis compared to the others. The subscription for the 182-day paper fell to 19.2%, from 76.0% recorded the previous week, while that of the 364-day paper increased to 89.2% from 53.5% recorded the previous week. The yields on all three papers remained unchanged at 6.3%, 6.7% and 7.6%, respectively, The acceptance rate increased to 100.0%, from 92.6% recorded the previous week, with the government accepting Kshs 16.9 bn worth of bids received.

There was high demand for the months bond offers as the overall subscription rate for the three bonds was at 163.5%, government received bids worth Kshs 81.7 bn, higher than the Kshs 50.0 bn offered. The three re-opened auctions were, FXD2/2010/15, FXD1/2020/15 and FXD1/2011/20 with fixed coupons of 9.0%, 12.8% & 10.0% and effective tenors of 5.3 years, 14.5 years and 10.7 years, respectively. It is clear that investors are happy with longer term bonds as FXD1/2020/15 had the highest subscription rate coming in at 99.6%, Kshs 49.8 bn, compared to the Kshs 50.0 bn offered. Yields on the bonds came in at 10.6%, 12.5% and 12.0%, for the FXD2/2010/15, FXD1/2020/15 and FXD1/2011/20, respectively. The government rejected high bids only accepting Kshs 64.2 bn out of the Kshs 81.7 bn worth of bids received, translating to an acceptance rate of 78.6%.

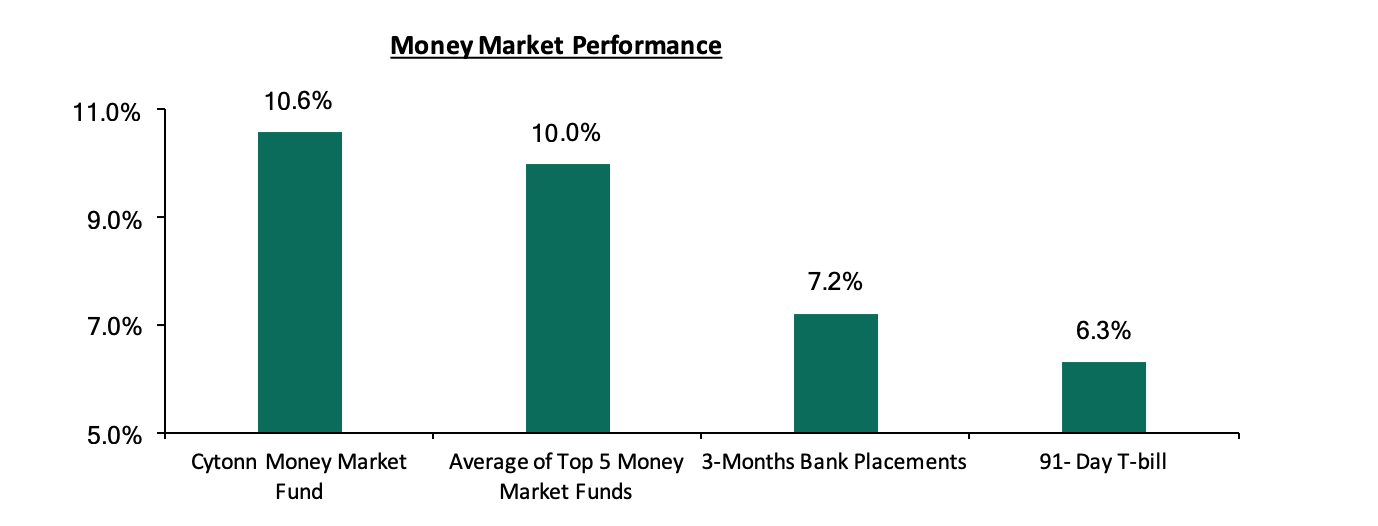

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day T-bill remained unchanged at 6.3%. The average yield of Top 5 Money Market Funds remained unchanged at 10.0%. The yield on the Cytonn Money Market remained unchanged at 10.6%, similar to what was recorded the previous week.

Liquidity:

The money markets remained liquid during the week, with the average interbank rate increasing marginally to 2.7%, from 2.6% recorded the previous week, mainly supported by government payments. The average interbank volumes declined by 11.7% to Kshs 11.1 bn, from Kshs 12.6 bn recorded the previous week. According to the Central Bank of Kenya, commercial banks’ excess reserves came in at Kshs 9.6 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

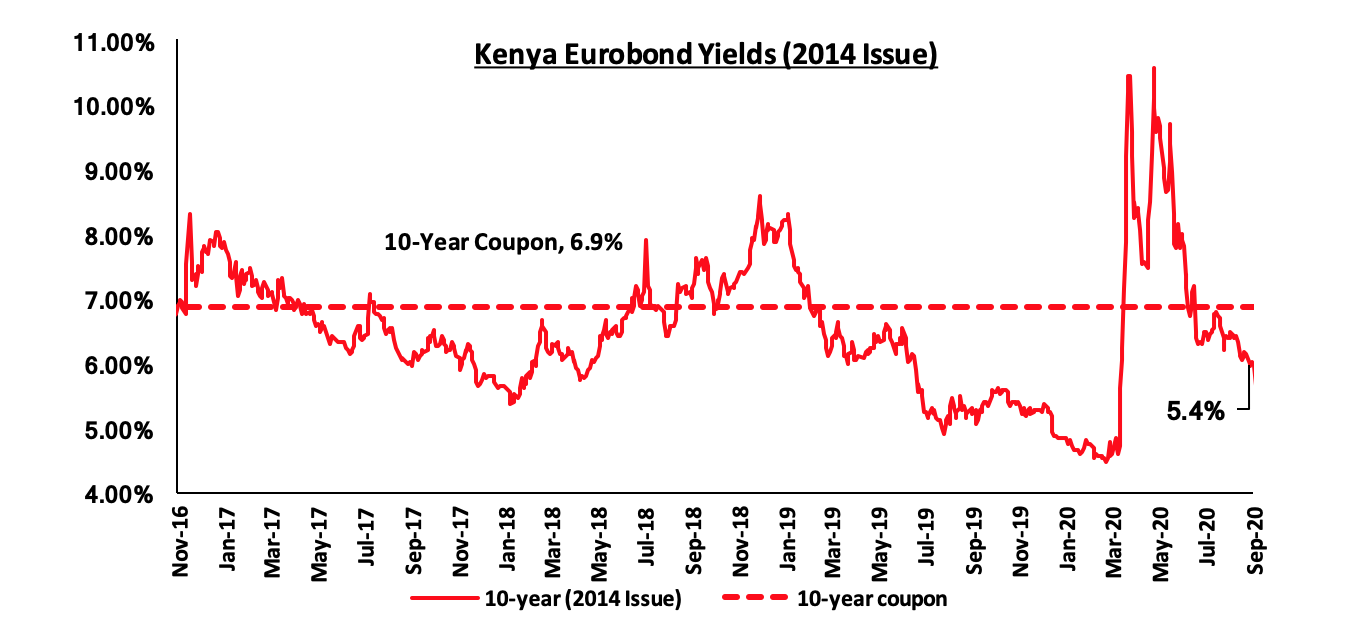

During the week, according to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined marginally by 0.1% points to 5.4%, from 5.5% the previous week.

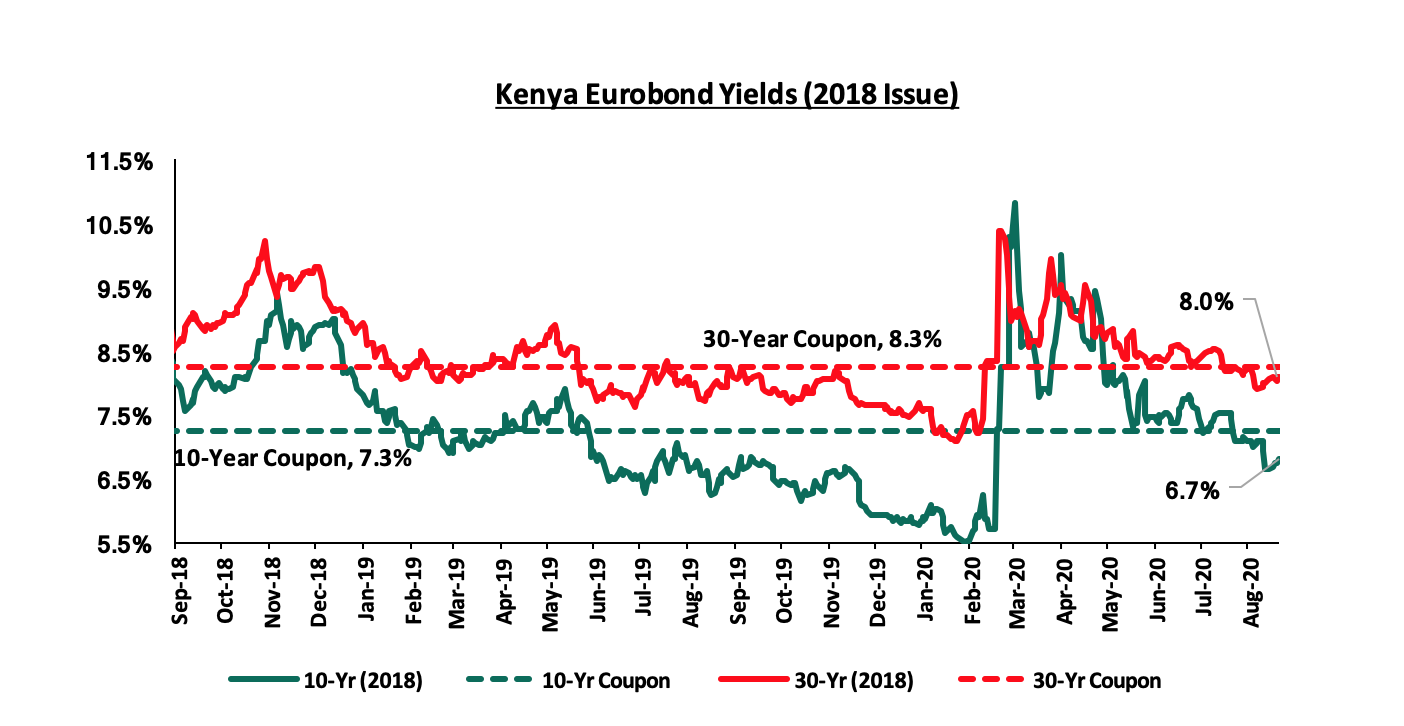

During the week, the yields on the 10-year and 30-year Eurobonds both remained unchanged at 6.7% and 8.0%, respectively, similar to what was recorded the previous week.

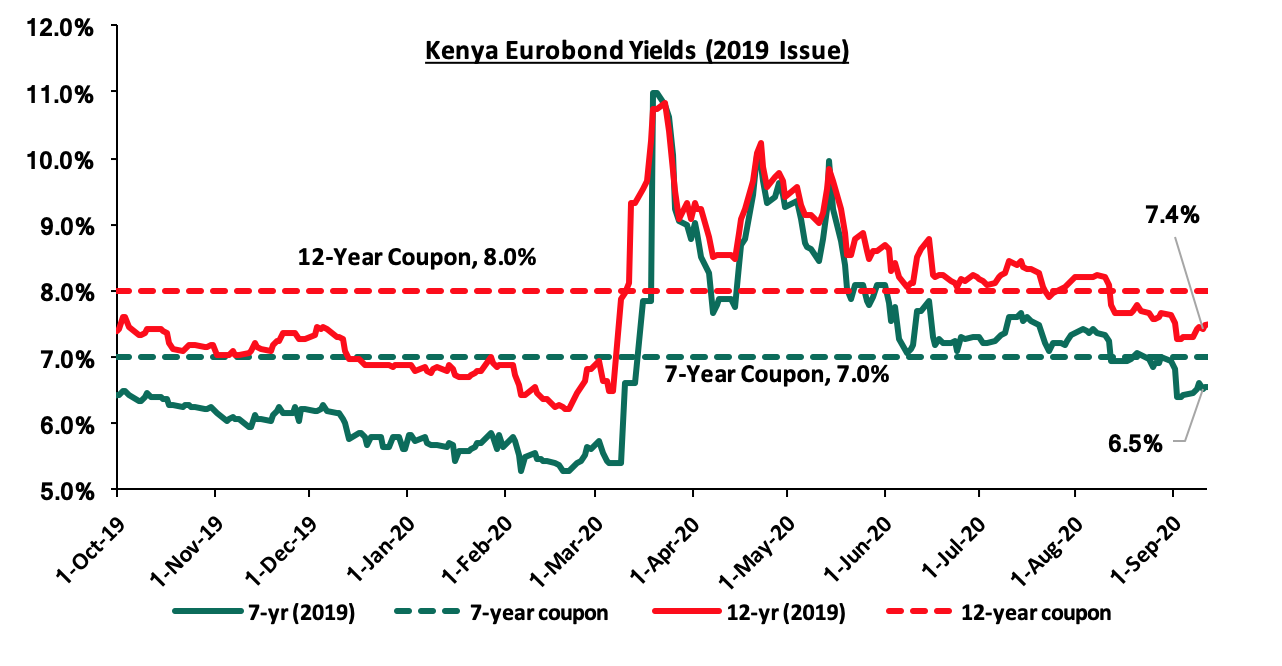

During the week, the yields on the 2019 dual-tranche Eurobond issue with 7-years decreased marginally by 0.1% points to 6.5%, from 6.6% the previous week. The 12-year Eurobond remained unchanged to close at 7.4%, similar to what was recorded the previous week.

Kenya Shilling:

During the week, the Kenyan shilling remained unchanged against the US dollar, to close at Kshs 108.4, mainly attributable to subdued dollar demand from importers. On an YTD basis, the shilling has depreciated by 7.0% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- Though has been decereasing, the high levels of forex reserves, currently at USD 8.9 mn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover;

- Relatively strong Diaspora remittances that increased by 23.4% to USD 277.0 million in July compared to USD 225 million in July 2019, despite being 4.0% lower than the USD 288.5 million in June 2020, leading to the narrowing of the country’s current account deficit to 4.7% of GDP in the 12 months to July 2020, compared to 5.0% of GDP in the 12 months to June.

However, in the longterm, the shilling in expected to be weighed down by:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions,

- A deteriorating current account position, with the current account deficit deteriorating by 10.2% during Q1’2020, to Kshs 110.9 bn, from Kshs 100.6 bn recorded in Q1’2019 attributable to;

- 0% decline in the secondary income (transfers recorded in the balance of payments whenever an economy provides or receives goods, services, income or financial items) balance, to Kshs 124.1 bn, from Kshs 128.0 bn in Q1’2019, and,

- A 67.0% decline in the services trade balance (the difference between the imports and exports of services) to Kshs 20.4 bn, from Kshs 61.9 bn.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th September 2020 to 14th October 2020. Below are the key take-outs from the statement:

- Petrol prices have increased by 1.3% to Kshs 105.4 per litre from Kshs 104.0 per litre previously, while diesel prices have declined marginally by 0.1% to Kshs 94.5 per litre from Kshs 94.6 per litre. Kerosene prices also declined marginally by 0.6% to Kshs 83.2 per litre from 83.7 per litre, previously,

- The changes in prices have been attributed to:

- An increase in the average landing cost of imported of imported super petrol by 2.7% to USD 327.7 per cubic meter in August 2020 from USD 319.2 per cubic meter in July 2020,

- Landing costs for diesel decreased by 1.0% to USD 329.9 per cubic meter from USD 333.3 in July 2020,

- A 2.1% decrease in the landing costs for kerosene to USD 282.1 per cubic meter on August 2020, from USD 288.0 in July 2020,

- A 3.3% increase in Free on Board (FOB) price of Murban crude oil lifted in August 2020 to USD 45.7 per barrel from USD 44.3 per barrel in July 2020, and,

- The Kenyan shilling depreciated by 0.4% against the dollar to close at Kshs 107.9 in August 2020, from Kshs 107.5 in July 2020.

The changes are a reflection of the crude oil prices in the global markets where the months of June and July saw significant gains which seem to have slowed down in the month of August. This was mostly attributable to the reopening of some economies. We expect the changes to have minimal impact on the total consumer price index (CPI) attributable to the netting effect on the kerosene and diesel prices.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 103.3% ahead of its prorated borrowing target of Kshs 112.2 bn having borrowed Kshs 228.1 bn. In our view, the government will struggle to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NSE 20, NASI and NSE 25 all recording losses of 1.5%, 0.7% and 0.5%, respectively, taking their YTD performance to losses of 15.7%, 21.0%, and 30.4%, for NASI, NSE 25 and NSE 20, respectively. The performance was driven by declines recorded by large-cap stocks, with the highest declines being recorded in Diamond Trust Bank (DTB-K), Equity Group, and NCBA Group, which declined by 3.8%, 2.3% and 1.6%, respectively.

Equities turnover increased by 112.2% during the week to USD 47.4 mn, from USD 22.3 mn recorded the previous week, taking the YTD turnover to USD 1.1 bn. Foreign investors remained net buyers during the week, with a net buying position of USD 7.6 mn, from a net buying position of USD 2.0 mn recorded the previous week, taking the YTD net selling position to USD 250.8 mn.

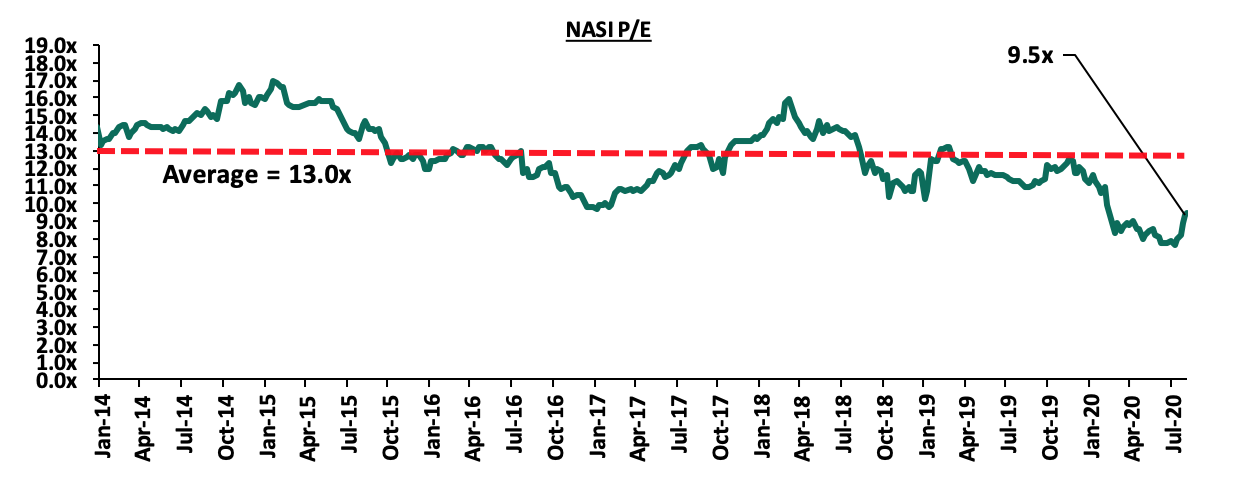

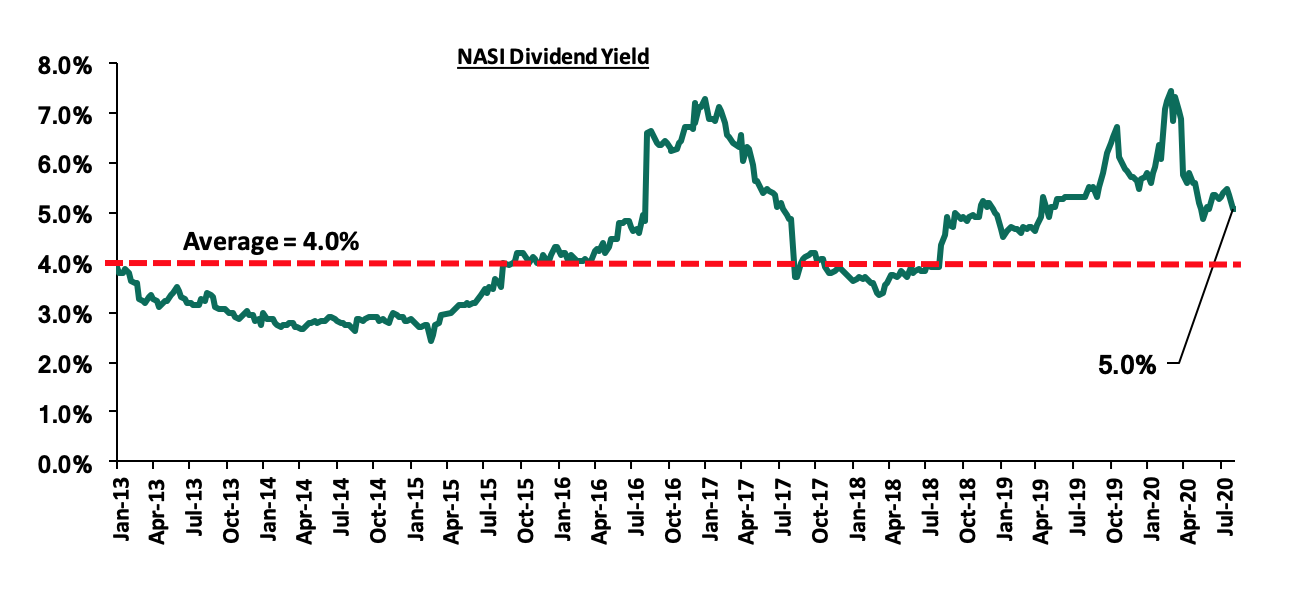

The market is currently trading at a price to earnings ratio (P/E) of 9.5, 26.7% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, unchanged from the previous week and 1.0% points above the historical average of 4.0%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.5x is 23.8% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Capital Markets Authority (CMA) published guidelines to Collective Investments Schemes on the valuation, performance measurement and reporting. CMA highlighted that given the inconsistencies in the performance measurement and presentation by the fund managers, there was a need for standardization by the Collective Investment Schemes in order to enhance the comparability and consistency of the information presented across the sector. The guidance will be applicable to all approved Collective Investment Schemes and will take effect on 1st January 2021.

The key takeouts from the guidance are;

- In the establishment of various funds, fund managers shall be guided by the following criteria:

- Money Market Funds – The fund shall invest only in interest bearing assets such as Fixed Deposits, Government Securities, Credit Rated Private Comercial Papers / Approved Public Commercial Papers, etc. with a maximum tenor of 13 months,

- Equity Fund - The fund shall invest a minimum of 60.0% of the Assets Under Management (AUM) in the equities market. Funds not invested in the equities market shall be invested in cash and cash equivalents,

- Balanced Fund - The fund shall maintain a maximum exposure of 60.0% of the AUM in the investments done in the Money Market, Fixed Income and Equities asset classes. Additionally, the maximum exposure in any other asset class shall comply with the limits provided under Regulation 78 of the Capital Markets Regulations, 2001,

- Fixed Income Fund - The fund shall invest a minimum of 60.0% of the AUM in fixed income securities, and,

- Special Funds – The funds shall invest based on the Fund Managers’s investments strategy.

- Fund Managers shall be required to prepare and submit their performance reports to CMA quarterly and the report shall be submitted within 21 days after the end of each quarter. Additionally, the report shall be made available to the fund managers existing and prospective clients,

- Fund Managers shall be required to disclose its historical fees for at least the past 2 years,

- In the determination of the total Assets Under Management (AUM), the fund manager will consider the aggregate fair value of all assets without double counting any assets, actual assets managed by the fund manager including fee-paying and non-fee-paying portfolios and assets outsourced to another fund manager, and,

- The fund managers portfolios will be valued daily and in accordance with the definition of fair value under International Financial Reporting Standards (IFRS 13). IFRS 13 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price).

We believe this is a commendable move of aligning the market players. As highlighted in our Cytonn Weekly #37/2020, we had highlighted that CMA needed to improve fund managers disclosures by requiring them to publish a periodic report of exactly where their funds are invested. We believe that these new guidelines are a step in the right direction, however, they present various shortcomings. For instance, fund managers are only required to report performance-related information on the general areas of investment for the fund and as such, investors will not be able to specifically identify where their funds are invested. These new guidelines also raise substantive issues with the law such as do these guidelines override the fund managers' trust deed, whether a regulator can determine asset allocation for fund managers etc. Additionally, the guidelines have not dealt with the issue as to what happens with existing investment contracts that run for longer periods of time. We shall have an in-depth analysis of the same in the coming weeks in our topicals.

Universe of Coverage:

|

Company |

Price at 11/09/2020 |

Price at 18/09/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

65.0 |

62.5 |

(3.8%) |

(42.7%) |

109.0 |

119.4 |

3.9% |

95.0% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.3 |

2.2 |

(1.3%) |

(26.4%) |

3.0 |

4.0 |

4.6% |

84.0% |

0.2x |

Buy |

|

Sanlam |

12.5 |

12.3 |

(1.2%) |

(28.5%) |

17.2 |

18.4 |

0.0% |

49.6% |

1.2x |

Buy |

|

Jubilee Holdings |

220.0 |

220.0 |

0.0% |

(37.3%) |

351.0 |

313.8 |

3.6% |

46.2% |

0.5x |

Buy |

|

NCBA*** |

22.6 |

22.2 |

(1.6%) |

(39.8%) |

36.9 |

30.7 |

1.0% |

39.3% |

0.6x |

Buy |

|

I&M Holdings*** |

46.0 |

45.0 |

(2.2%) |

(16.7%) |

54.0 |

57.8 |

5.1% |

33.6% |

0.7x |

Buy |

|

KCB Group*** |

37.9 |

37.9 |

0.0% |

(29.8%) |

54.0 |

46.4 |

9.9% |

32.4% |

0.8x |

Buy |

|

Equity Group*** |

37.0 |

36.2 |

(2.3%) |

(32.4%) |

53.5 |

44.5 |

5.9% |

29.0% |

0.9x |

Buy |

|

Standard Chartered*** |

165.8 |

164.5 |

(0.8%) |

(18.8%) |

202.5 |

197.2 |

7.8% |

27.7% |

1.2x |

Buy |

|

Co-op Bank*** |

11.5 |

12.0 |

4.3% |

(26.6%) |

16.4 |

14.2 |

8.4% |

26.8% |

0.8x |

Buy |

|

Liberty Holdings |

8.0 |

8.0 |

(0.2%) |

(22.9%) |

10.4 |

9.8 |

0.0% |

22.8% |

0.6x |

Buy |

|

Stanbic Holdings |

81.0 |

75.0 |

(7.4%) |

(31.4%) |

109.3 |

84.9 |

9.0% |

22.2% |

0.6x |

Buy |

|

ABSA Bank*** |

9.7 |

9.8 |

1.0% |

(26.3%) |

13.4 |

10.8 |

12.0% |

21.7% |

1.2x |

Buy |

|

Britam |

8.0 |

7.4 |

(7.8%) |

(18.2%) |

9.0 |

8.6 |

3.3% |

20.2% |

0.8x |

Buy |

|

CIC Group |

2.1 |

2.2 |

0.5% |

(19.8%) |

2.7 |

2.1 |

0.0% |

(2.3%) |

0.7x |

Sell |

|

HF Group |

4.1 |

4.4 |

7.9% |

(32.4%) |

6.5 |

4.1 |

0.0% |

(6.2%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Industry reports

During the week, Ministry of Tourism under the Tourism Secretary Najib Balala released the Tourism Performance August 2020. The key highlights were;

- The number of international arrivals came in at 13,894 for the month of August, 91.4% lower than the 161,723 arrivals recorded during a similar period last year, indicating the adverse effects of the Covid-19 pandemic on the tourism sector,

- The highest number of arrivals were from the United States and United Kingdom, coming in at 2,768 and 2,469, respectively, attributed to ease of travel advisories, and,

- In terms of the purpose of visit, 2,723 came in for business, 1,125 were in transit while 10,046 visited for leisure. We attribute the relatively high number of tourist arrivals for leisure to reopening of destination hospitality facilities such as the Maasai Mara and the wildebeest migration that has traditionally resulted in relatively high tourist numbers into the country.

Despite the relatively low numbers, the resumption of tourist arrivals is an indication of the gradual reopening of the tourism sector following the easing of travel restriction in and out of the country, opening up key tourism markets such as the USA, resumption of flight operations starting 1st August and reopening of hospitality facilities. The hospitality sector has been one of the worst hit by the COVID-19 pandemic owing to its heavy reliance on tourism and the MICE (Meetings, Incentives, Exhibitions and Conferencing) sectors. However, we expect the sector to gradually resume operations supported by the above mentioned factors, in addition to the continued relaxation of travel advisories by governments of key tourism market, repackaging of the tourism sector’s products to appeal to domestic tourists, and the Ministry of Tourism’s post-corona recovery strategy fund of Kshs 500.0 mn which will cushion the sector from the impact of the pandemic.

- Residential Sector

During the week, Nairobi Metropolitan Services Director of Housing Charles Sikuku announced that 1,562 low-cost housing units within the government’s affordable housing Pangani Estate were set for completion in December 2020. The Kshs 5.0 bn Pangani Estate being developed by Technofin Kenya is part of the Nairobi Urban Regeneration Plan aimed at delivering approximately 12,000 low-cost housing units in Nairobi’s old government estates by 2030, with other areas designated for the redevelopment being Jeevanjee/Bachelors Quarters, Ngong Road Phases I and II, Uhuru Estate, New Ngara, Old Ngara and Suna Road Estates. Despite the disruption caused by the Covid- 19 pandemic, the project which was launched in December 2018, has been encountering delays in its implementation due to bureaucracy and lack of land documentation. On completion, phase 1 of the project will comprise of five blocks with 1,562 housing units, out of which 952 units will be under affordable scheme while approximately 610 three bedroom units will be priced as per the market rates.

The table below gives a summary of the unit types, sizes and prices for the development;

|

Pangani Estate Affordable Housing Project |

||||

|

Unit type |

No. of bedrooms |

Unit size |

Unit price (Kshs) |

Price per SQM (Kshs) |

|

Social Housing Units |

1 |

25 |

1.0 mn |

40,000 |

|

2 |

50 |

2.5 mn |

50,000 |

|

|

Affordable Low Cost Units |

1 |

30 |

1.5 mn |

50,000 |

|

2 |

40 |

2.3 mn |

56,250 |

|

|

3 |

60 |

3.0 mn |

50,000 |

|

|

Market Priced Units |

3 |

90 |

7.5 mn |

83,333 |

Source: Cytonn Research

The affordable housing program has continued to take shape with approximately 228 housing units delivered in October 2019 through the Park Road Project Phase 1, while other projects such as Shauri Moyo, Makongeni and Starehe houses are still underway. Despite the growing demand for the affordable housing units, evidenced by the relatively high number of approximately 300,000 individuals who have registered through the boma yangu portal, the implementation of affordable housing projects has been sluggish and the initiative is expected to fall short of its 2022 target of delivering 500,000 housing units. Some of the challenges facing the initiation and implementation of the projects include; (i) bureaucracy and slow project approval processes, (ii) the pending operationalization of the Integrated Project Delivery Unit which was tasked with being a single point of regulatory approval for developments, infrastructure provision and developer incentives, (iii) failure to fast track incentives provided in support of the affordable housing initiative, (iv) ineffectiveness of Public-Private Partnerships, and, (v) the current economic slowdown due to the ongoing pandemic.

In our view, if successfully delivered, the Pangani Estate project will enhance Kenyans confidence in the affordable housing programme and thus encouraging more potential home owners to join the boma yangu platform. However, given the negligible number of units delivered compared to existing demand, we expect the housing deficit to expand even further driven by the relatively high population growth of 4.0% per annum, compared to the global average of 1.9% according to World Bank. Therefore, to accelerate the supply of housing units, the government must embark on resolving the above challenges in addition to investing in urban planning to enhance sustainability and also invest in infrastructure around the satellite towns to open them up.

During the week, the Kenya Mortgage and Refinance Company (KMRC), a Treasury backed lender, announced plans to lend approximately Kshs 37.2 bn out of the Kshs 40.0 bn raised from institutions such as World Bank and Africa Development Bank to Kenyans earning a maximum of Kshs 150,000 per month and seeking to purchase affordable housing units. The mortgage loans will be capped at Kshs 4.0 mn for those seeking residence within the Nairobi Metropolitan Area (NMA) which also covers Kiambu, Machakos and Kajiado and at Kshs 3.0 mn for all other areas outside the NMA. According to the facility’s CEO, Johnstone Oltetia, while 80.0% of the funds will be directed to affordable housing, the rest will be availed for upper-middle-income housing units at normal market lending rates.

KMRC aims at boosting the mortgage market by growing the number of mortgage accounts to 60,000 by end of 2020 from the current 26,504 as of 2018. The facility is set to lend money beginning end of September, to local financial institutions at an annual interest rate of 5.0%, enabling them to write home loans at 7.0%, 6.0% points lower than the market rate of approximately 13.0%. Though a great and noble idea we see a couple of challenges:

- The growth in lending is ambitious and may not be achievable given the current economic situations where people are suffering from job losses and salary cuts,

- Default rates likely to be high,

- The lending rates at 5.0% to 7.0% are unsustainably below market rate, it is yet to be clarified how KMRC expects to maintain those rate, and,

- Given the relatively low loan size provided by KMRC, potential homeowners will have few or no options of housing units within the NMA due to the relatively high property prices and low supply of affordable housing units thus forcing them to focus on housing units within satellite towns which are relatively affordable. The current NMA residential unit prices range from Kshs 6.3 mn to Kshs 16.6 mn for detached units and Kshs 7.4 mn to Kshs 10.4 mn for apartments. This is significantly higher than the KMRC range of Kshs 3mn to Kshs 4 mn.

The table below shows the residential market average price of units within the NMA;

All values in Kshs unless stated otherwise

|

NMA Residential Market Rates and Performance 2020 |

|||||

|

Segment |

Unit Size (SQM) |

Average Price per SQM |

Price |

Average Y/Y Price Appreciation |

Average Total Returns |

|

Detached units |

|||||

|

High-End |

90 |

184,843 |

16.6 mn |

0.0% |

4.2% |

|

Upper Mid-End |

90 |

140,642 |

12.7 mn |

0.9% |

5.6% |

|

Lower Mid-End |

90 |

69,484 |

6.3 mn |

(0.5%) |

4.1% |

|

Apartments |

|||||

|

Upper Mid-End |

90 |

116,093 |

10.4 mn |

(0.7%) |

4.6% |

|

Lower Mid-End |

90 |

90,939 |

8.2 mn |

0.1% |

5.9% |

|

Satellite Towns |

90 |

81,833 |

7.4 mn |

(0.1%) |

5.3% |

|

Residential Market Average |

|

113,972 |

10.3 mn |

(0.1%) |

5.0% |

|

* the above assumes a 90sqm housing unit |

|||||

Source: NMA Residential Report 2020

At current market prices, the average unit price in Nairobi Metropolitan Area is Kshs 10.3 mn for a 90sqm unit, and with KMRC’s mortgage loan range being relatively lower than that, it raises the questions of whether one can pay approximately Kshs 6.3 mn deposit for the subject unit, and secure the balance of Kshs 4.0 mn from KMRC.

We expect the residential sector to record increased activities going forward driven by the ongoing affordable housing projects, and the lending by KMRC which is set to provide the much-needed housing finance for low and middle-income earners.

- Retail Sector

During the week, Tuskys, a local retail chain, was forced to shut down two of its outlets, at Juja City Mall in Juja and at Nairobi’s Greenspan Mall in Donholm, due to rent arrears. This brings the total number of Tuskys operational outlets to 55, highlighting the depth of the retailer’s financial woes, despite reopening two of its branches in Malindi and Kilifi last week. The retailer’s current financial strain is mainly attributed to reduced revenues amid reduced demand due to constrained consumer spending, and family wrangles among the retail chain’s shareholders thus affecting its operations. In the strive to support its operations, the retailer in August 2020 claimed it had secured financial support amounting to Kshs 2.0 bn following the signing of terms of agreement with an undisclosed Mauritius-based private equity fund. The move to secure debt financing was expected to cushion the retailer against financial shocks amid reduced revenues and boost investor confidence, especially in Kenya’s retail sector. However, in our view, the continued shutting down of the retailer’s outlets is an indication that the retailer will need to mobilize more funds to stabilize its operations and repay suppliers’ debt. Hotpoint Appliances has so far filed a petition against the troubled retailer in a bid to recover approximately Kshs 250 mn debt.

The table below shows local and international retailers that have exited or closed down outlets in Kenya;

|

Local and international retailers that have exited or closed down outlets in Kenya |

||

|

Name of Retailer |

Initial no. of branches |

Current no. of branches |

|

Nakumatt Holdings |

65 |

0 |

|

Botswana’s Choppies |

15 |

2 |

|

South Africa’s Shoprite |

4 |

2 |

|

Uchumi |

37 |

4 |

|

Tuskys |

63 |

55 |

|

Total |

184 |

63 |

Source: Online Research

Despite the exit of retailers such as Tuskys, the sector’s performance will continue being cushioned by several key local and international players entering the market and taking up the prime spaces left behind. Some of the new entrants during the year include;

|

Main Local and International Retail Supermarket Chains opened in 2020 |

|

|

Name of Retailer |

Number of branches |

|

QuickMart supermarket |

3 |

|

French retailer, Carrefour |

1 |

|

South Africa’s Game Stores |

1 |

|

Naivas Supermarket |

4 |

|

Chandarana Foodplus Supermarket |

1 |

|

Total |

10 |

We expect the real estate sector to record activities mainly on the affordable housing front as the government projects continue to take shape, and the hospitality sector as the economy gradually reopens.

In July 2020, a committee appointed by the Principal Secretary, State Department for Housing and Urban Development, recommended the establishment of the Real Estate Developers Regulatory Board, “REDRB” by October 2020 through an executive order subject to the Cabinet’s approval. In this week’s topical, we focus on the Board by covering;

- A Brief Overview of the Kenya Real Estate Sector;

- Functions of the Real Estate Developers Regulatory Board;

- Expected Benefits and Challenges of the Regulatory Board;

- Case Studies;

- United Arabs Emirates (UAE)-Dubai Real Estate Regulatory Agency (RERA)

- Jamaica Real Estate Board

- Lessons for Kenya from the case of UAE and Jamaica;

- Conclusion.

- A Brief Overview of the Kenya Real Estate Sector

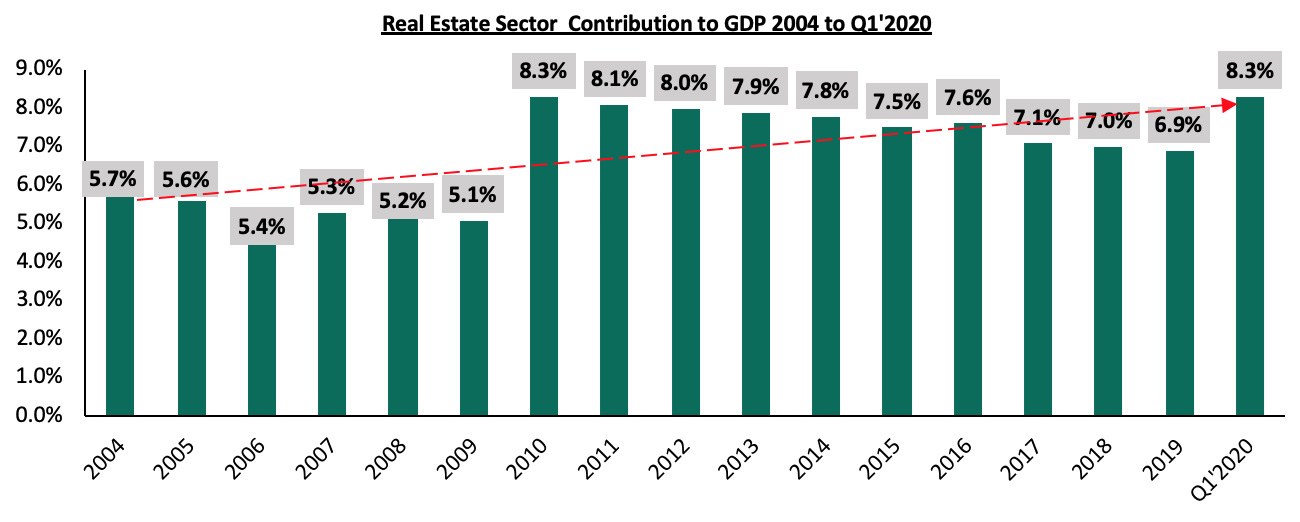

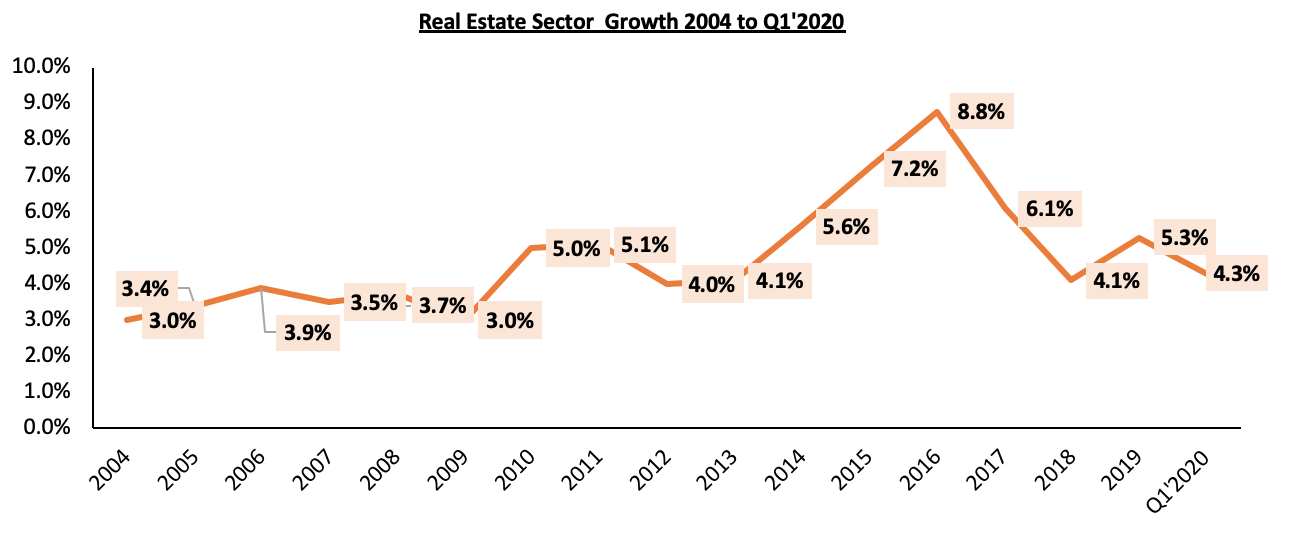

The Kenya real estate sector has experienced significant growth over the past years starting from 2004 through to 2016, with a marginal decline in 2017 due to political instability during the electioneering period as seen from the growth in its contribution to GDP. The graph below shows the real estate sector contribution to GDP 2004 to Q1’2020;

Below is a representation of the growth of the sector over the years;

Source: Kenya National Bureau of Statistics

The growth can be attributed to:

- The existing housing deficit which has remained at around 2 million as per the World Bank,

- Increased urbanization with the country having an urbanization rate of 4.3% compared to the global average of 2.0%,

- Supporting demographic with many people being in their productive years fueling demand of properties,

- Nascent real estate sector, and,

- The economic growth and the ease of doing business with Kenya being ranked #56 out of 190 by World Bank as at 2020 in the ease of doing business ranking.

The above opportunities have contributed to growth in the sector as real estate developers come in to seize them. In a bid to walk the journey, home ownership especially in urban areas where prices of properties have been increasing people have taken different paths to home ownership among them: purchase of land and construction of own houses, Sacco and Chama investments to pull together resources for land buying and home construction, taking mortgages and purchase through off plan offers.

Off plan purchasing has been on rise due to limited resources from both developers and home owners. There are many positive reasons why potential homeowners should consider investing in off plan investments as covered in our topical Off Plan Investment in Real Estate - What a Buyer Needs to Know. Despite the positive impact made by the private sector especially in resolving the existing housing deficit and on overall driving the economy, one of the main challenges facing the sector has been presence of a number of fraudulent developers who fail to deliver projects or delay the delivery as per agreed upon timelines, and without giving any remedy to investors. On the other hand, some buyers fail to honor their contractual obligations of paying up their monthly deposits as agreed with the developer, thus interrupting the project’s cash flows and cycles leading to delay or non-completion of projects. The above have resulted in legal tussles, loss of investor’s funds and lack of confidence in the sector.

There is currently no legal framework that governs the relation between the developers and buyers with regards to off plan developments despite the model gaining popularity over the years. However, there exists the proposed Housing Bill of 2019 which provides for regulation of developers. Despite being the most ideal way to regulate the developers, the bill is yet to be enacted due to the lengthy procedures to be followed before it becomes a law. However, a board can be established through an executive order to regulate the sector’s players as a short term measure.

In July 2020, a committee appointed by the Principal Secretary, State Department for Housing and Urban Development, recommended the establishment of the REDRB, by October 2020 through an executive order subject to the Cabinet’s approval. The establishment of the board is aimed at promoting a transparent, efficient and competitive real estate sector, protecting the interest of the sector players and restoring investor confidence through safeguarding buyers’ deposits as well as providing a speedy dispute resolution mechanism between developers and home buyers. According to the committee, the proposed regulatory board is a short term measure to curb the upsurge of cases of disputes currently occurring between developers and home buyers, through regulating the developers who undertake real developments for sale to the public, and this incorporates those that undertake off plan development. In the long term, the regulatory board should be anchored in the Housing Bill once it is enacted given that the provision for regulating developers is provided within the bill. The provisions in the proposed Housing Bill upon enactment will provide the Board with a legal framework that is expected to resolve the problem of rampant and protracted disputes between developers and home buyers especially in the case of off plan developments in the real estate sector.

- Functions of the Real Estate Developers Regulatory Board

The Key functions of the Real Estate Regulatory Board will include;

- Registering, licensing and regulating real estate developers- This is aimed at improving professionalism within the real estate sector and restoring investor confidence,

- De-registering rogue developers- Cases of developers who fail to deliver projects within agreed upon timelines, or fail to deliver at all leading to losses to buyers’ investments, have been on the rise with buyers seeking for court remedies and relying on sale agreements. The Board thus aims to protect the interest of the property buyers in the wake of increased off-plan developments, by de-registering fraudulent developers. Additionally, the Board will develop a regulatory mechanism to prevent loss of investments by unit buyers, introduce a dispute resolution mechanism and also provide guidelines on the collection of buyers’ deposits and subsequent payments for off-plan pre-sales,

- Registering housing projects intended for sale to the public by developers- This is intended to limit the sale of properties that are unlicensed or those considered unsafe for occupation and ensure that all the procedures required in building and advertising properties have been followed by the developers,

- Publishing and maintaining a website of records- The website will provide the public with information on all registered developers and housing projects. This will enhance transparency and thus protect property buyers from fraudulent transactions,

- Creating a transparent and robust dispute resolution mechanism between developers and buyers- This is intended to curb the upsurge of disputes especially related to delays or non-delivery of projects, which have been resulting in long legal tussles and court battles, and,

- Collecting and analyzing data on real estate development in the housing sector- The Board will maintain a database with details on housing projects in Kenya. This will be useful in tracking the activities and growth of the sector over the years.

- Expected Benefits and Challenges of the Regulatory Board

The establishment of the Board is expected to positively impact on the real estate sector. Some of the expected benefits include;

- Development of a clear regulatory framework for real estate development- The Board will provide guidelines that will govern both developers and unit buyers to ensure that each of the parties’ interest are protected. The framework will outline a robust disputes’ resolutions mechanism, thus reduce legal tussles, loss of investor’s investments and lack of confidence in the sector,

- Protection of deposits and interests of unit buyers- The Board will provide guidelines on collection of buyers’ deposits and subsequent payments for off-plan pre-sales, thus ensure that property buyer’s capital is not mismanaged,

- Protection of interests of real estate developers - The Board will put in place a mechanism to ensure that buyers honour their contractual obligations of paying up their monthly deposits as agreed with the developer to avoid interrupting project cash flows that could cripple development activities,

- Fostering transparency in the sector- This will be achieved through provision of a database of all real estate developers including the registered and de-registered rogue developers. Currently there exists no mechanism for investors to determine the reliability and authenticity of developers,

- Encouraging professionalism in the real estate sector by eradication of unscrupulous developers- We expect this to force developers to be more strategic when taking up projects to ensure ability to deliver as per the laid down agreements. This will go a long way in avoiding loss of investments and legal disputes among parties, and,

- Increase in delivery of property and especially housing units- The establishment of the Board is expected to restore investor confidence, thus increased activities especially on the residential front which is most prone to disputes resulting from project delays and non-delivery by some developers.

We expect the Board to face challenges in the strive towards regulating the real estate sector. Some of the key challenges include;

- Bureaucracy and delay in the registration process- Government agency delay in approval and registration may hinder the timely delivery of projects due to backlog in project approvals as the Board strives to ensure top-notch compliance by all developers,

- Corruption in the regulation process as some developers strive to cut down on the registration and approval process before undertaking development projects,

- Non-compliance by some developers who may be unwilling to adapt to the set guidelines and rules set to be introduced by the Board, and,

- Lack of adequate public sensitization on the existence of the Board and its functions which is likely to make it difficult for the Board to protect the public interest through a complicated legal structure.

- Case Studies

Having looked at the formation, functions, benefits, and challenges likely to face the Kenya Real Estate Developers Regulatory Board, we now look into case studies of countries where similar boards exist and thus derive lessons Kenya can learn for the success of the same.

- United Arabs Emirates (UAE)-Dubai Real Estate Regulatory Agency (RERA)

The Real Estate Regulatory Agency (RERA) is a UAE government agency established with the intent of regulating the real estate sector in Dubai. The agency was formed in July 2007 and is anchored under the Dubai Land Department. The agency was established through an executive order by his Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the United Arab Emirates and Ruler of Dubai.

The main functions of RERA include;

- Licensing all real estate activities- The agency licenses the activities by the agencies, agents and developers by providing the necessary certifications to ensure smooth transitions of properties from the developers to the buyers,

- Managing real estate developers' trust account- The trust account exists particularly to protect buyers by setting a requirement for developers selling off-plan units to deposit all amounts paid by purchasers into an escrow account with an escrow agent accredited by the Dubai Lands Department. The amounts deposited in the escrow account are exclusively allocated for the purposes of construction of the particular real estate project and any other directly related activities. Failure to comply may lead to penalties and even revoking of license to operate,

- Regulating and registering rental agreements- RERA lays out the responsibilities of both the landlords and the tenants and once a contract has been made between a tenant and a landlord for occupancy, RERA enforces these agreements to ensure full compliance,

- Regulating and supervising the owner’s associations- The agency regulates the activities by landlords or property owners to ensure that they provide transparent pricing policies and plans for the buyers. It does this by stipulating relevant rules and regulations to home owners to create a balance between protecting their interests and that of the buyers,

- Regulating real estate advertisements in the mass media-RERA works through establishing laws on how property developers advertise through the media. In the laws, adverts for developers especially the sales on specific projects must display the details of the company’s RERA’s registration number, the escrow accounts used in receiving payments and details of the agent overseeing the sale of the properties,

- Regulating and licensing real estate exhibitions- RERA gives licenses to all the real estate exhibitions organized by developers within Dubai. It also controls the activities when doing exhibitions such as ensuring relevant rules to displaying products are followed and that all the necessary procedures such as registration by the exhibiters have been done prior to the events,

- Publishing studies for the sector- RERA formulates, processes, documents and places standard procedures associated with property. The agency also provides statistical data on the property market for consumption by both the government and the public, and,

- RERA also informs people on regulatory acts when buying and renting the real estate in Dubai- RERA designs its laws and regulation to provide an easy legislative system to control Dubai real estate market. It is also eligible for recommending new property laws to the government.

One of the main challenges facing RERA is;

- Non-compliance- Some developers dodge being regulated thus affecting the Board’s operations as it limits its ability to streamline the real estate sector. Some developers also fail to follow the rules and regulations that have been stipulated thus affecting the interest of the buyers. The developers’ failure to adhere to all the rules and regulations have negatively impacted the agency’s schedule of activities which in the long run affects the delivery of projects procedures taken before projects can be licensed.

Achievements of RERA include;

- RERA has helped real estate professionals’ transition to the new regulatory standards by working closely with the government & industry stakeholders to oversee the development of a National Real Estate Policy, improve consumer protection and streamline real estate services within Dubai,

- RERA successfully created a system that has established the rights of landlords, sellers, buyers, tenants as well as property management companies operated in Dubai. The rights acts as the foundation of the legal system and they are in place to protect the interest of the key players in the real estate market,

- RERA has successfully created a system where developers can register to become legally certified to either rent or sell their properties. Once successfully registered, a developer is issued with a certified identity card,

- The Agency has designed its laws and regulation to provide an easy legislative system to control Dubai real estate market, for example the Interim registration law -Law 13 of 2008 which stipulates that all sales and clearances of off-plan units need to be registered on the provisional real estate register that is sustained by the Dubai Land Department and the trust account law - Law 8 of 2007, which protects buyers by setting a requirement for developers selling off-plan units to be registered with RERA, and ,

- The Dubai real estate sector has been expanding evidenced by a 5.6% points increase in the sector’s contribution to GDP which stood at t 13.6% in 2019 compared to 8.0% in 2007, according to the Dubai Land Department. The growth can be partially attributed to the existence of the Agency which has streamlined the sector.

- Jamaica Real Estate Board

The Jamaica Estate Board was operationalized on 1st September 1988 following an Act of Parliament and consists of a 12-member Board of Directors appointed by the Minister of Economic Growth and Job Creation. The introduction of the legislation to regulate the real estate profession had been the subject of much public debate and ministerial attention for over two decades and was necessary in order to protect members of the public who use the services of real estate dealers to purchase property or who contract with private land and housing developers for the acquisition of units in housing schemes.

Functions of the Jamaica Real Estate Board;

- To consider and determine applications for;

- Registration as real estate dealers and real estate salesmen, and,

- Licensing and the renewal of licenses of real estate dealers and real estate salesmen.

- To monitor the activities of developers or real estate salesmen,

- To take lawful measures necessary or desirable to assist it in protecting the mutual interests of persons entering into land transactions,

- To ensure adherence to the strict regulations for monies held in a trust account where buyers pay their monies, and,

- To exercise the powers to authorize withdrawals from the trust fund account for the purposes of protecting the purchaser’s monies.

Achievements of the Real Estate Board of Jamaica;

- Facilitation of the establishment of a clear regulatory framework that includes a dispute resolution mechanism between developers and buyers. They clearly stipulate how off-plan buying should be undertaken, i.e.;

- The developer under the prepayment contract should be registered,

- The developer must deposit authenticated copies of the project approvals to the Board together with all plans, drawings, and specifications,

- A signed copy of every prepayment contract be forwarded by the developer to the Board within fourteen days from the signing of the contract by the parties involved,

- The developer must pay the money received from a prepayment contract into a trust account to be maintained by him with an authorized financial institution and the money shall be held on trust until completion or recession of the contract,

- The developer is allowed to withdraw the money from the trust upon completion of the development scheme or if the developer terminates the contract it by reason of default of the purchaser and the authorized financial institution, must write a notice of such withdrawal to the Board,

- The Board has ensured that a high standard of professional conduct is maintained by persons in the industry, as well as by those seeking to join by providing licensing courses before registering developers, subjecting developers to prosecution if they default their agreements with buyers and ensuring that the monies deposited by buyers are protected when held I trust until the projects are complete. These actions have therefore contributed to reduced rogue developers, and,

- Provision of a database search of registered developers to the public thus ensuring investor or property buyer confidence.

Challenges facing the Real Estate Board of Jamaica;

- Inadequately trained real estate practitioners therefore the need to offer pre-licensing courses to avoid registering unskilled personnel,

- Inexperienced and unsystematic real estate developers who seek registration. Some of the requirements are police and bankruptcy clearance, Certified copies of Certificate of Incorporation and Articles of Incorporation (for companies only), evidence of ownership of land being developed, evidence of approval of the development scheme and evidence of scheme financing whether personal or through an authorized financial institution or both, and,

- The inadequacy of the public’s knowledge and education on the roles and responsibilities of real estate developers and the Real Estate Board which reduces the transactional volumes as investors lack knowledge on how their interests are protected.

- Lessons for Kenya from the case of UAE and Jamaica

In places like Dubai in UAE, the real estate sector accounts for approximately 13.6 % of the GDP according to the Dubai Land Department as of 2019, this is compared to an average of around 7.0% for most countries. We attribute this partially to the existence of the regulatory board which has streamlined the sector making it more attractive to investors.

Some of the lessons that the Kenya Real Estate Regulatory Board can learn from the case of Dubai and Jamaica include;

- There is a need to create public awareness- Just like for the case of RERA, the Kenya’s Real Estate Developers Regulatory Board should work towards educating the public on the existence of the board, its functions and the relevant regulatory frameworks in the real estate sector. This will enable them understand their rights, obligations and procedures to follow in the case of arising disputes during transactions in the property market,

- Establishment of rules and regulations for managing real estate developers trust accounts- In both Dubai and UAE, the monies paid by property buyers are deposited in a trust account overseen by the regulatory board. In the case of Jamaica, the funds cannot be withdrawn by the developer until contract completion. However it provides for a window where a developer may apply for utilization of 90% of monies held in trust account subject to a valuation of works by a registered professionals e.g. architect. Similarly, the Kenya Board could manage the real estate developers trust accounts and have the powers to authorize withdrawals from the trust fund account for the purposes of protecting the buyers’ investments,

- The Board must purpose to work with the government and industry stakeholders in the transition to new regulatory standards- The Real Estate Developers Regulatory Board should establish an effective transition to new regulatory standards in the real estate sector by working with the government and key industry stakeholder to oversee activities such as protecting the interest of the buyers, ensuring delivery of projects, regulating advertisements and publishing real estate related data as done by RERA. In addition, we recommend that the Board be eligible for recommending new property laws to the government, and,

- Establishment of clear and strict guidelines in the regulation of developers, with heavy penalties for the non-compliant parties- Non-compliance to the rules and regulations is one of the challenges that has been impacting the functionality of the regulatory boards and agencies, as in the case of the Real Estate Regulatory Board of Dubai. To mitigate against this, the Kenya Real estate Developers Regulatory Board should establish strict guidelines to be adhered to, with heavy penalties for the non-compliant parties.

- Conclusion

Real Estate developers have successfully been regulated in other jurisdictions through the establishment of either an authority or a Board. Therefore, the establishment of the Kenya Real Estate Developers Regulatory Board is a step in the right direction especially in the wake of a booming property market, amid increasing cases of fraudulent market players. Once formulated and operational, we expect the Board to promote the growth of an impartial, transparent, efficient, and competitive real estate sector that will be essential in restoring investor confidence and enhancing the growth of the economy in general. In our view, the success of the Board in achieving its objectives is subject to operating independently, being corruption-free, having a clear regulatory framework which includes a dispute resolution mechanism, and being anchored under the Housing Bill in the long run as per the recommendations of the committee.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.