Kenya Mortgage Refinance Company (KMRC) Recap, & Cytonn Weekly #45/2020

By Cytonn Research, Nov 8, 2020

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 115.9%, up from 72.1% the previous week driven by high liquidity in the money markets. The highest subscription rate was in the 364-day paper, which came in at 210.0%, up from 110.1% recorded the previous week. The subscription for the 182-day paper increased to 45.5% from 33.1%, while that of the 91-day paper dropped to 56.9% from 74.9% recorded the previous week. The yields on the 182-day and 364-day both increased by 0.1% points to 7.1% and 8.0%, respectively, from 7.0% and 7.9% while the 91-day paper remained unchanged at 6.7%.

Also, during the week Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for October 2020, which came in at 59.1, up from the 56.3 seen in September 2020. Notably, Kenya has recorded the sharpest improvement in business conditions since the beginning of the survey in January 2014;

Equities

During the week, the equities market recorded mixed performance with both NASI and NSE 25 gaining by 0.9%, while NSE 20 recorded a loss of 0.8%, taking their YTD performance to losses of 15.1%, 22.0%, and 33.3%, for NASI, NSE 25 and NSE 20, respectively. The NASI performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded in Equity Group, Bamburi, Co-operative Bank and BAT of 3.2%, 2.9%, 2.7% and 2.3%, respectively. The gains were however weighed down by losses recorded by banking stocks such as NCBA Group and KCB Group, which declined by 3.1% and 1.2%, respectively. During the week, the Capital Markets Authority (CMA) approved the registration of ABSA Unit Trust Funds, which will be offered by ABSA Asset Management Limited (formerly Barclays Credit Limited). Key to note, ABSA Asset Management Limited is a fully owned subsidiary of Absa Bank Kenya PLC;

Real Estate

During the week, Tuskys Supermarket, a local retail chain, shut down four of its branches namely; Tuskys Magic branch in Nakuru Town, Tuskys Pioneer on Moi Avenue Street in Nairobi, Adams Arcade branch on Ngong Road, and the Kitengela branch.

In the infrastructure sector, the Kenyan government through the Kenya Rural Roads Authority, commenced the tarmacking of the first 7.0 km of Juja Farm Road in Kiambu County at a cost of Kshs 3.9 bn;

Focus of the Week

Kenya Mortgage Refinance Company (KMRC), a treasury backed lender, began lending in September 2020, following approval to operate by the Central Bank of Kenya. The facility is an initiative of the National Treasury and World Bank, formed in 2018 with the aim of supporting the affordable housing initiative, which is part of the government’s Big Four Development Agenda. KMRC provides secure, long-term funding to primary mortgage lenders such as banks, Sacco’s and other microfinance institutions within the country for onward lending to potential home owners. In this week’s topical, we recap KMRC by looking at its objectives, expected and current benefits and possible challenges, a case study of the Saudi Real Estate Refinance Company (SRC), and lessons that can be drawn from the case study.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.52%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.39% p.a. To invest, email us at sales@cytonn.comand to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry player’s talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 115.9%, up from 72.1% the previous week driven by high liquidity in the money markets. The highest subscription rate was in the 364-day paper, which came in at 210.0%, up from 110.1% recorded the previous week. The subscription for the 182-day paper increased to 45.5% from 33.1%, while that of the 91-day paper dropped to 56.9% from 74.9% recorded the previous week. The yields on the 182-day and 364-day both increased by 0.1% points to 7.1% and 8.0%, respectively, from 7.0% and 7.9% while the 91-day paper remained unchanged at 6.7%. The acceptance rate increased to 99.2%, from 95.5% recorded the previous week, with the government accepting bids worth Kshs 27.6 bn out of the Kshs 27.8 bn worth of bids received.

The Treasury plans to re-open two bonds, a 15-year and 20-year bond, FXD2/2013/15 and FXD2/2018/20, with effective tenors of 7.5 and 17.4 years, respectively for a total value of Kshs 40.0 bn. The bonds have fixed coupon rates of 12.0% for the 15-year, and 13.2% for the 20-year. The period of sale runs from 4th November 2020 to 17th November 2020 and our recommended bidding ranges are 12.5% - 12.7% for FXD2/2013/15 and 12.9% - 13.1% for FXD2/2018/20, given that bonds with a similar tenor are currently trading at 12.6% and 13.0%, respectively. Additionally, the treasury has offered a tap sale for a 25-year bond, FXD1/2018/25, with a fixed coupon rate of 13.4%, and an effective tenor of 23 years, for a total amount of Kshs 20.0 bn. The period of sale starts from 4th November 2020 to 10th November 2020, or upon attainment of the amount offered.

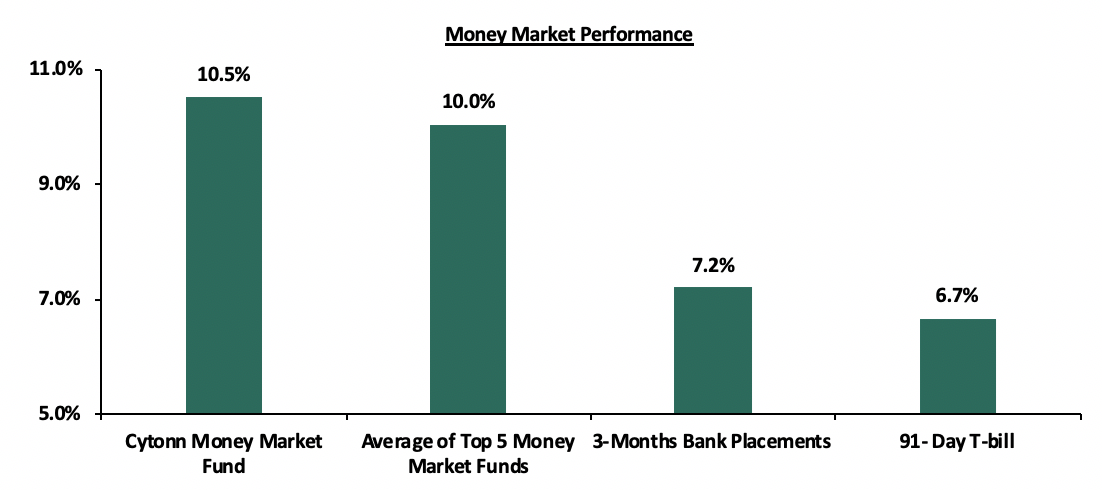

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day remained unchanged at 6.7% recorded the previous week. The average yield of the Top 5 Money Market Funds declined by 0.1% points to 10.0% from 10.1% as recorded the previous week. The yield on the Cytonn Money Market declined by 0.1% points to 10.5% from 10.6% as recorded the previous week.

Liquidity:

The money markets were relatively liquid during the week, supported by government payments, which partly offset tax receipts. However, the average interbank rate increasing to 3.3%, from the 3.0% and the interbank volumes decreased to Kshs 7.0 bn from Kshs 13.1 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, commercial banks’ excess reserves came in at Kshs 10.5 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

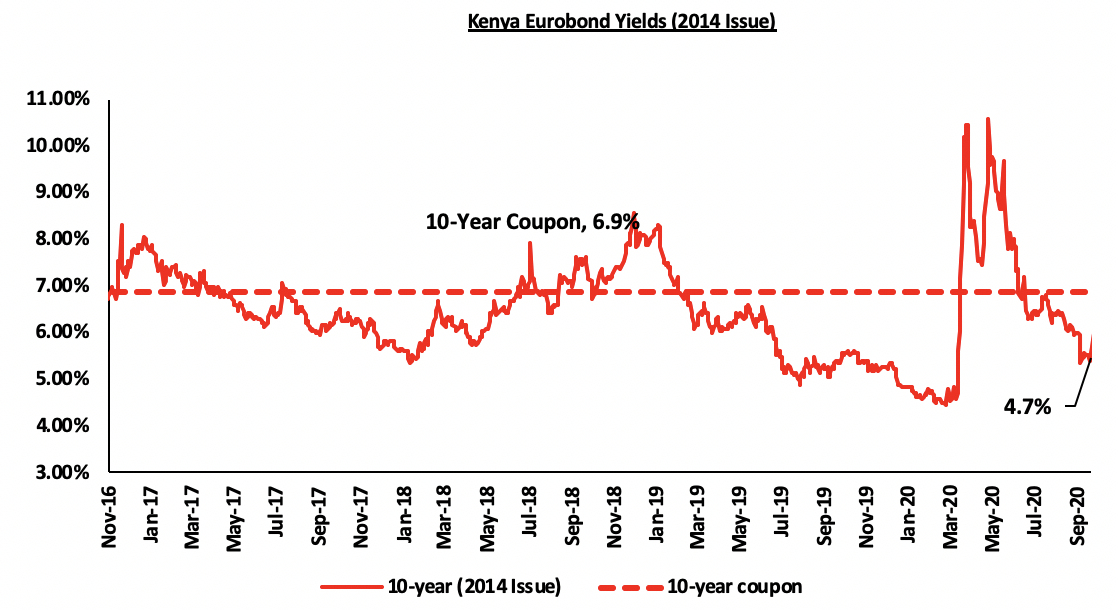

During the week, the yields on all Eurobonds declined pointing to improved investor sentiment and perception of decreased risk on the country’s outlook driven by the improvement in the PMI ratings which increased to 59.1 from 56.3, pointing out to an improving business environment. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.4% points to 4.7%, from 5.1% recorded the previous week.

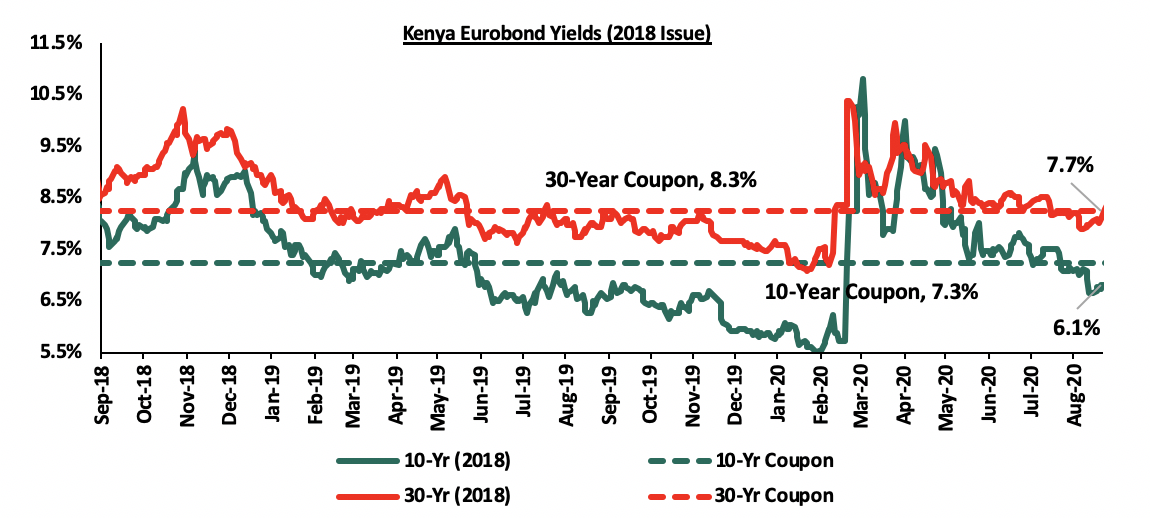

During the week, the yields on the 10-year and 30-year Eurobonds both declined by 0.4% points and 0.3% points to close at 6.1% and 7.7%, respectively.

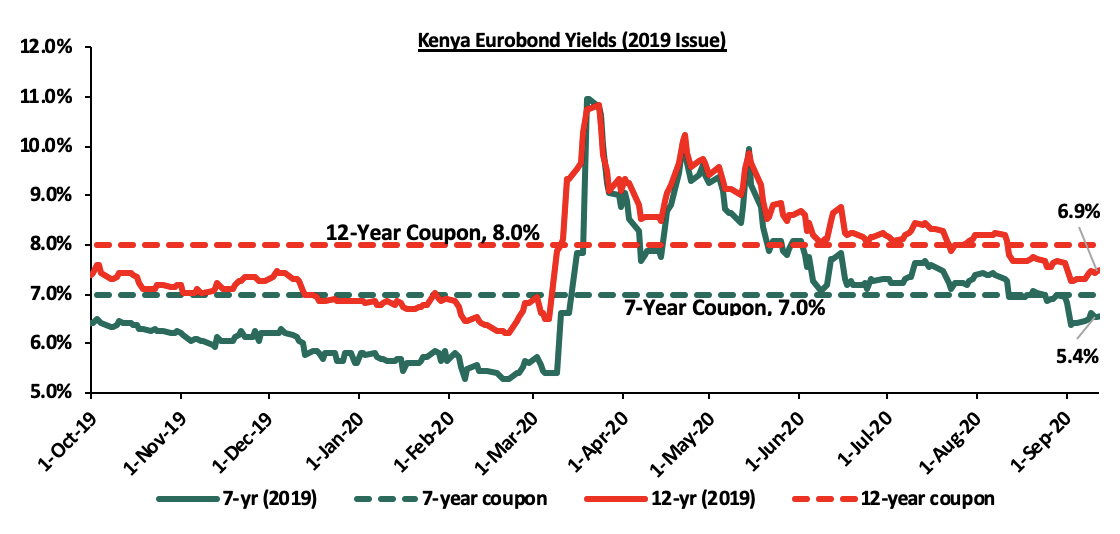

During the week, the yields on the 2019 dual-tranche Eurobonds issue declined. The 7-years Eurobond declined to 5.4%, from 6.1% the previous week, while the 12-year Eurobond declined to close at 6.9%, from the 7.3% recorded the previous week.

Kenya Shilling:

During the week, the Kenyan shilling marginally depreciated against the US dollar by 0.1% to Kshs 108.9 from Kshs 108.8, mainly attributable to the dollar importer demand being matched by supply. On an YTD basis, the shilling has depreciated by 7.4% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 8.1 bn (equivalent to 4.9-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which has seen a 39.9% decline during Q2’2020, coming in at Kshs 82.2 bn, from Kshs 136.9 bn in Q2’2019, equivalent to 7.0% of GDP from the 10.9% of GDP recorded in Q2’2019.

October PMI:

During the week Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for October 2020, which came in at 59.1, up from the 56.3 recorded in September 2020. Key to note, a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Notably, Kenya recorded the sharpest improvement in business conditions during the month since the beginning of the survey in January 2014. This points towards robust improvements in the private sector, production and demand in the month of October. This comes after the government eased further lockdown restrictions related to the coronavirus pandemic. Rising output and demand saw firms levelling up their staff numbers, ending a seven-month sequence of job cuts. This was noted as the highest employment growth rate in 11 months. As such, selling prices rose as firms passed higher cost burdens to customers backing on staff cost inflation although the rise was minimal. Pre-production inventories increased remarkably as a result of increased input buying by companies. Consequently, purchase costs rose at a considerable rate attributable to higher raw material prices. A sequential increase in stocks with improved investor perception in future demand was also noted. The record increase is an indication of business confidence and improved business conditions. Lockdown restrictions re-imposed by international trading partners could however hinder growth witnessed in the recent months. We have a cautious outlook in the short term owing to the increase in COVID-19 infections, which has also seen the government extend the curfew hours by one hour and for a further two months. We expect this to lead to a subdued economic performance.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 63.5 % ahead of its prorated borrowing target of Kshs 130.9 bn having borrowed Kshs 214.0 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market recorded mixed performance with both NASI and NSE 25 gaining by 0.9%, while NSE 20 shed 0.8%, taking their YTD performance to losses of 15.1%, 22.0%, and 33.3%, for NASI, NSE 25 and NSE 20, respectively. The NASI performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded in Equity Group, Bamburi, Co-operative Bank and BAT of 3.2%, 2.9%, 2.7% and 2.3%, respectively. The gains were however weighed down by losses recorded by banking stocks such as NCBA Group and KCB Group, which declined by 3.1% and 1.2% respectively.

Equities turnover increased by 86.6% during the week to USD 28.8 mn, from USD 15.4 mn recorded the previous week, taking the YTD turnover to USD 1.2 bn. Foreign investors remained net sellers during the week, with a net selling position of USD 11.1 mn, from a net selling position of USD 3.7 mn recorded the previous week, taking the YTD net selling position to USD 278.0 mn.

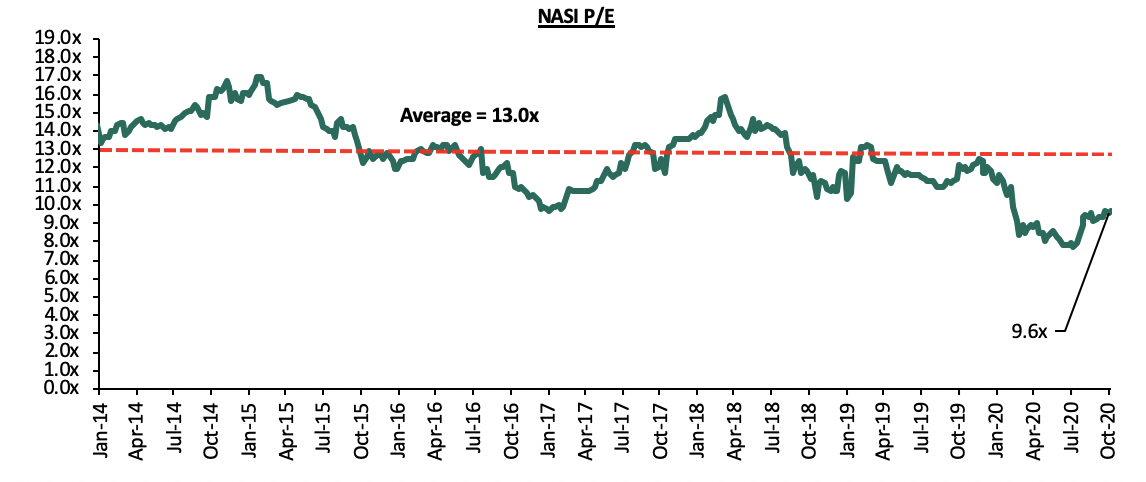

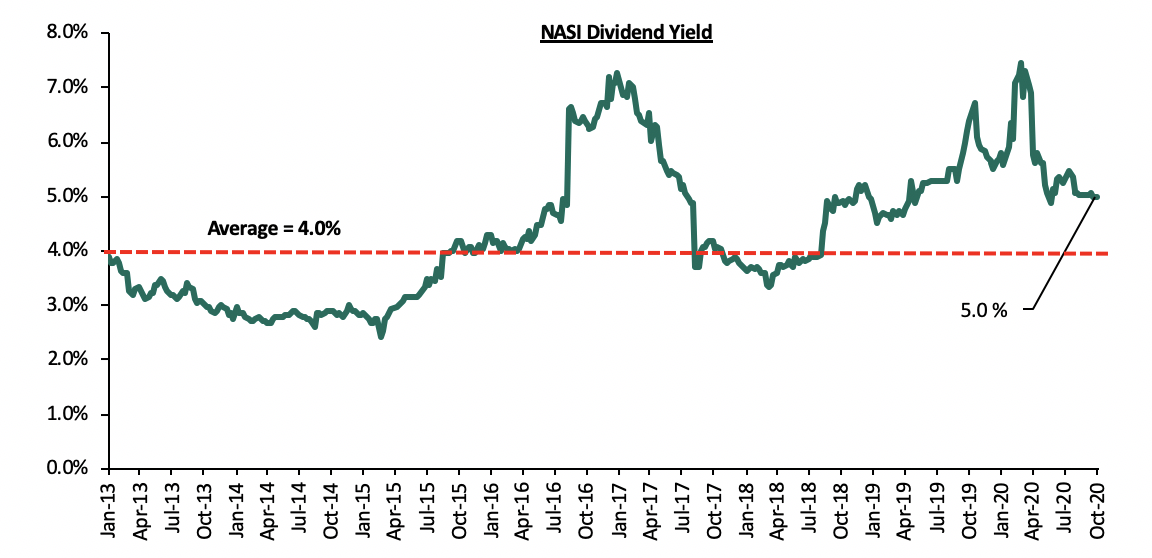

The market is currently trading at a price to earnings ratio (P/E) of 9.6x, 25.6% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, unchanged from the previous week, and 1.0% points above the historical average of 4.0%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.6x is 25.3% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Capital Markets Authority (CMA) approved the registration of ABSA Unit Trust Funds, which will be offered by ABSA Asset Management Limited (formerly Barclays Credit Limited). ABSA Asset Management Limited is a fully owned subsidiary of Absa Bank Kenya PLC. The fund will offer the following Collective Investment Schemes (CIS); ABSA Shilling Fund, ABSA Dollar Fund, ABSA Fixed Income Fund, ABSA Equity Fund, and, ABSA Balanced Fund. As at Q2’2020, there were 23 approved Collective Investment Schemes made up of 93 funds in Kenya. Out of the 23 however, only 19 were active while 4 were inactive. According to the recently published data by the Regulator, the top five Fund Managers control 81.7% of the market leaving approximately 18.3% of the market to the other 14 active fund managers. As such, we are of the view that given that Absa Unit Trust Fund is a subsidiary of ABSA Bank Kenya, the fund will be able to leverage on the Bank’s brand recognition to acquire a piece of the market share.

The consent granted to ABSA Asset Managers for the registration of the fund, follows a similar move by the regulator where African Diaspora Asset Managers (ADAMS) was granted a Fund Manager’s license towards the tail end of Q3’2020, as highlighted in our Cytonn Weekly #37/2020. In our view, these actions by CMA will work towards opening up Kenya’s capital markets. However, there is still a lot of work to do to make our capital markets functional. According to World Bank data, in well-functioning economies, businesses rely on banks for just 40.0% of their funding with the larger percentage of 60.0% coming from Capital Markets. However, in Kenya businesses rely on banks for a staggering 99.0% of their funding, with less than 1.0% coming from Capital Markets. This makes funding difficult to access, and when accessed, it’s exceedingly expensive. Lack of capital is the primary reason why the housing agenda has not taken off. To stimulate capital markets, CMA needs to engage market participants to remove the myriad of obstacles that impede market growth. Specifically;

- Remove conflicts of interest in the governance of capital markets and create a governance structure that is more responsive to market participants so that the market can grow,

- Removed conflicts in the governance of fund structures so that funds can be innovative and grow,

- Reduce the minimum investments for real estate finance vehicles – the minimum of Kshs. 5 million per investor for the formation of a development REIT is too high for a country where the median income is just Kshs. 50,000, hence the minimum investment is 100 times higher than the median income, no wonder there is not a single Development REIT formed so far, making it hard to finance real estate initiatives such as the President’s housing agenda,

- Make it easy for funds to on-board clients by allowing them to have as many banking partners as they so wish, the current requirement that funds must choose just one bank as their custodian is unnecessarily restrictive,

- Allow for the formation of sector funds; the current regulations only support diversification. In this day and age, sector funds such as a technology fund, a financial services fund or a real estate fund are key to stimulating specific areas of the economy,

- Improve fund transparency to provide investors with more information – each Unit Trust Fund should be required to publish their portfolio holdings on a quarterly basis, and,

- Fairness in application of regulations; CMA needs to be seen to be consistent and fair in their interpretation and application of regulations to market participants. In a recent ruling, the High Court found an instance where CMA was dispensing a sanction that is not in even provided for in law.

Capital Markets are essential to funding businesses, which in turn create jobs, growth economy and uplift the standards of living. We believe that the above reforms would open our capital markets, stimulate fund formation and ultimately provide financing for businesses as an alternative to bank funding.

Universe of Coverage:

|

Company |

Price at 30/10/2020 |

Price at 06/11/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.0 |

(10.2%) |

(33.3%) |

3.0 |

4.0 |

5.4% |

103.5% |

0.2x |

Buy |

|

Diamond Trust Bank*** |

61.3 |

61.0 |

(0.4%) |

(44.0%) |

109.0 |

119.4 |

4.4% |

100.2% |

0.3x |

Buy |

|

Sanlam |

12.3 |

12.8 |

3.7% |

(25.9%) |

17.2 |

18.4 |

0.0% |

44.3% |

1.2x |

Buy |

|

NCBA*** |

22.7 |

22.0 |

(3.1%) |

(40.4%) |

36.9 |

30.7 |

1.1% |

41.0% |

0.6x |

Buy |

|

KCB Group*** |

36.1 |

35.6 |

(1.2%) |

(34.1%) |

54.0 |

46.4 |

9.8% |

40.2% |

0.8x |

Buy |

|

I&M Holdings*** |

44.0 |

43.2 |

(1.8%) |

(20.0%) |

54.0 |

57.8 |

5.9% |

39.7% |

0.7x |

Buy |

|

Standard Chartered*** |

158.3 |

157.0 |

(0.8%) |

(22.5%) |

202.5 |

197.2 |

8.0% |

33.6% |

1.2x |

Buy |

|

Equity Group*** |

33.9 |

35.0 |

3.2% |

(34.6%) |

53.5 |

44.5 |

5.7% |

32.9% |

0.9x |

Buy |

|

Co-op Bank*** |

11.3 |

11.6 |

2.7% |

(29.1%) |

16.4 |

14.2 |

8.6% |

31.0% |

0.8x |

Buy |

|

Liberty Holdings |

7.6 |

7.5 |

(1.1%) |

(27.5%) |

10.4 |

9.8 |

0.0% |

30.7% |

0.6x |

Buy |

|

ABSA Bank*** |

9.4 |

9.5 |

0.6% |

(28.8%) |

13.4 |

10.8 |

11.6% |

25.3% |

1.2x |

Buy |

|

Jubilee Holdings |

269.5 |

269.0 |

(0.2%) |

(23.4%) |

351.0 |

313.8 |

3.3% |

20.0% |

0.5x |

Accumulate |

|

Britam |

7.4 |

7.5 |

1.6% |

(16.7%) |

9.0 |

8.6 |

3.3% |

18.0% |

0.8x |

Accumulate |

|

Stanbic Holdings |

77.0 |

80.0 |

3.9% |

(26.8%) |

109.3 |

84.9 |

8.8% |

14.9% |

0.6x |

Accumulate |

|

HF Group |

3.7 |

3.7 |

(1.1%) |

(42.9%) |

6.5 |

4.1 |

0.0% |

11.1% |

0.2x |

Accumulate |

|

CIC Group |

2.3 |

2.2 |

(3.1%) |

(18.7%) |

2.7 |

2.1 |

0.0% |

(3.7%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Retail Sector

During the week, Tuskys Supermarket a local retail chain, shut down four of its branches namely; Tuskys Magic branch in Nakuru Town, Tuskys Pioneer on Moi Avenue Street in Nairobi, Adams Arcade branch on Ngong Road and the Kitengela branch. This brings the number of the retailer’s operational outlets to 50 having shut down its Shiloah Kakamega branch last week; Tuskys has shut down 14 branches this year. Tuskys has been battling financial woes amid supplier debts and mounting rent arrears despite securing financial support amounting to Kshs 2.0 bn from an undisclosed Mauritius-based private equity fund in August. In October, the retailer got reprieve as the High Court barred Hotpoint, a home appliances and electronic dealer, from trying to dissolve the troubled chain, over a Kshs 248.0 mn debt.

In our view the retailer’s ability to bounce back is unpredictable having failed to stabilize its operation even after allegedly receiving Kshs 500.0 mn in September 2020 to pay off landlords, suppliers, and facilitate other immediate working capital requirements. We believe that only a significant infusion of significant equity capital by a strategic or financial investor can save the brand right now.

The table below shows the summary of the number of stores of the key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||

|

Name of Retailer |

Initial number of branches |

Number of branches opened in 2020 |

Closed branches |

Current number of Branches |

Branches expected to be opened |

Projected total number of branches |

|

Naivas Supermarket |

66 |

5 |

0 |

66 |

4 |

70 |

|

Tuskys |

64 |

2 |

14 |

50 |

0 |

50 |

|

QuickMart |

32 |

5 |

0 |

34 |

0 |

34 |

|

Chandarana Foodplus |

20 |

1 |

0 |

20 |

0 |

20 |

|

Carrefour |

8 |

1 |

0 |

8 |

3 |

11 |

|

Uchumi |

37 |

0 |

33 |

4 |

0 |

4 |

|

Game Stores |

3 |

1 |

0 |

3 |

0 |

3 |

|

Choppies |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

4 |

0 |

2 |

0 |

0 |

2 |

|

Nakumatt |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

314 |

15 |

127 |

187 |

7 |

198 |

Source: Online research

We expect the exit of the retailer to cause an increase in the supply of retail space whose current oversupply stands at 2.8 mn SQFT as at 2019. However, entry and expansion by local and international retailers taking up prime retail space left by troubled retail chains is expected to cushion performance of the retail sector.

- Infrastructure

During the week, the Kenyan government through the Kenya Rural Roads Authority, a state corporation within the State Department of Infrastructure, commenced the tarmacking of the first 7.0 km of Juja Farm Road in Kiambu County at a cost of Kshs 3.9 bn. The road is part of Kshs 30.0 bn Mau Mau roads that are being constructed in Murang’a, Nyeri and Kiambu Counties to open up the region, contracted to H Young Construction Company to be completed in six months starting November. The Juja Farm Road transverses through Ma-store, Athi and Gatuanyaga in Thika and is expected to open up the areas thus spurring growth of industries and real estate developments. The undertaking of infrastructural projects in Kenya has been occasioned by the reduced budget allocation through the National Budget, where the sector was allocated Kshs 172.4 bn for financial year 2020/2021 budget, the lowest allocation in the last 10 financial years, and 60.4% lower than the Kshs 435.1 bn allocated in the 2019/2020 budget, attributed to diversion of funds towards the mitigation of the spread of the COVID-19 pandemic. Despite the reduced allocation, we expect the government to continue with the implementation of select projects, opening up areas for development and thus boosting the real estate sector. Other ongoing infrastructural projects include construction of; i) Nairobi Expressway, ii) Nairobi Western Bypass, and, iii) Lamu Port Access Road among many others.

The real estate sector is expected to record increased activities supported by continued government implementation of infrastructural projects thus opening up areas for investment. On the retail we expect the performance to cushioned by the projected entry and expansion of retailers taking up prime space left behind by troubled retailers.

Kenya Mortgage Refinance Company (KMRC), a treasury backed lender, began lending in September 2020, following approval to operate by the Central Bank of Kenya. The facility was established in 2018 and we have since written two topical on the same before it became operational, the Kenya Mortgage Refinancing Company Note and the Kenya Mortgage Refinancing Company Update. In this week’s topical, we do a recap on the facility by covering the following;

- Overview of Housing Sector in Kenya,

- Home Financing in Kenya,

- Introduction to KMRC,

- The KMRC Objectives,

- Benefits and Challenges of KMRC,

- Case Study of Saudi Real Estate Refinance Company,

- Lessons Learnt from The Case Study, and,

- Conclusion.

- Overview of Housing Sector in Kenya

Kenya currently has a housing deficit of approximately 2.0 mn units which grows by 200,000 units per year according to the National Housing Corporation. This is mainly attributed to the rapid urbanization and population growth rates of around 4.0% and 2.2%, respectively against a global average of 1.9% and 1.1%. The current housing deficit is attributed to factors such as; inadequate supply due the fragmented nature of the real estate sector, high development and land costs, focus on high end markets due to lack of profitability at the lower end of the market, and occasional delays in issuing building approvals in major towns such as Nairobi, Kisumu and Mombasa counties.

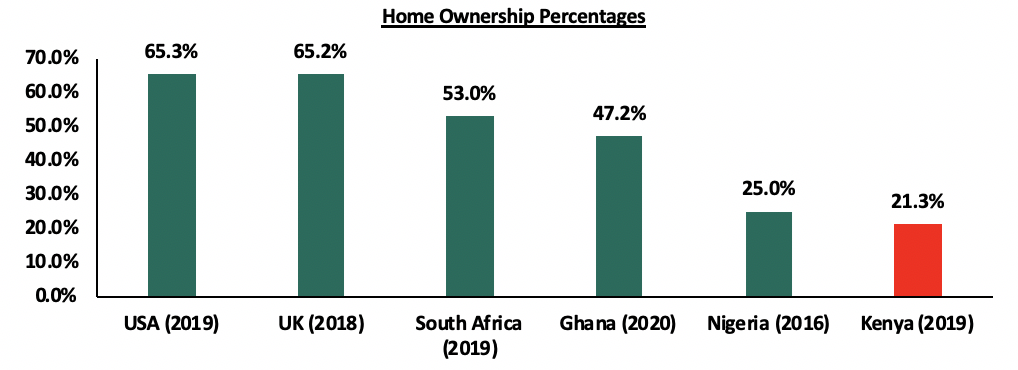

Home ownership in urban areas in Kenya has remained low at approximately 21.3% implying that more than 78.7% of the urban population are renters, compared to more developed countries such as South Africa which has more than 53.0% of its urban population owning homes. The relatively low rate of home ownership in Kenya is attributed to: i) high property prices, (ii) high initial transaction cost e.g. the initial deposit required to access mortgage, (iii) lack of credit risk information for those in the informal sector leading to their exclusion, (iv) high interest rates for mortgage loans, (v) lack of real estate finance to fund large scale developments, and, (vi) low income levels which has made it hard to service loans. The graph below shows the home ownership percentage of Kenya in comparison to other countries;

Source: Center for Affordable Housing Africa, Federal Reserve Bank

With the aim of addressing the housing deficit and improving home ownership, the Kenyan Government established the Affordable Housing Initiative (AHI) as one of its Big Four Development Agenda. Through the initiative, the government targets to deliver 500,000 housing units to the lower and middle income population segments by 2022. Some key projects under the initiative include; the Park Road, Ngara project, the Mavoko Sustainable Housing project, Kibera Soweto East Zone B project, NHC Stoni Athi View, Starehe Affordable Housing, and, Mariguini Informal Settlement.

The government has established several incentives and initiatives aimed at increasing home ownership in the country such as; (i) waiver on stamp duty for first time home buyers of affordable housing units, (ii) the affordable housing relief of 15.0% of gross emoluments up to Kshs 108,000 per annum or Kshs 9,000 per month for Kenyans buying houses under the Affordable Housing Scheme, (iii) exemption from tax for interest on mortgage repayments of up to Kshs 300,000 per annum provided that the taxpayer occupies the property, (iv) establishment of the National Housing Development Fund and the Kenya Mortgage Refinance Company.

- Home Financing in Kenya

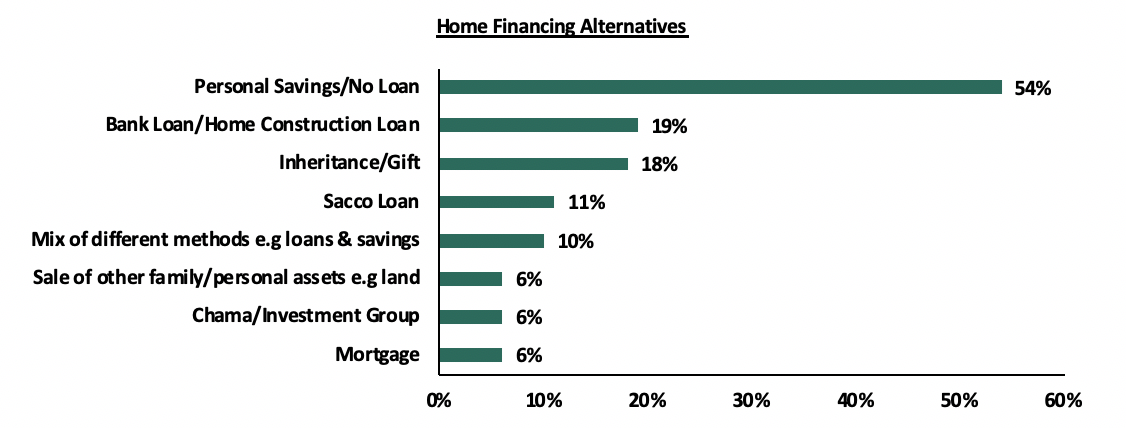

Availability of affordable housing finance continues to be the key challenge towards home ownership in Kenya. According to the Kenya Bankers Association, the main home financing option in Kenya is personal savings, as shown below;

Source: Kenya Bankers Association

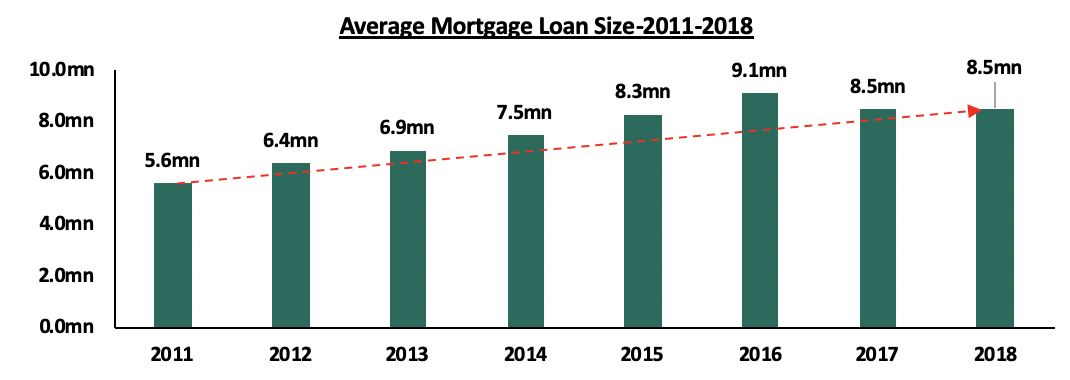

Mortgage is the least popular alternative for home financing evidenced by the low uptake with approximately 26,504 accounts as at 2018 out of an adult population of more than 24 million. This is mainly attributed to; relatively high interest rates averaging 12.0% as at 2020. Additionally, the average mortgage loan size decreased from Kshs 8.52 mn in 2017 to Kshs 8.48 mn in 2018 as banks tightened credit standards to the mortgage market.

The graph below shows the average mortgage loan size from 2011 to 2018.

Source: Central Bank of Kenya (CBK)

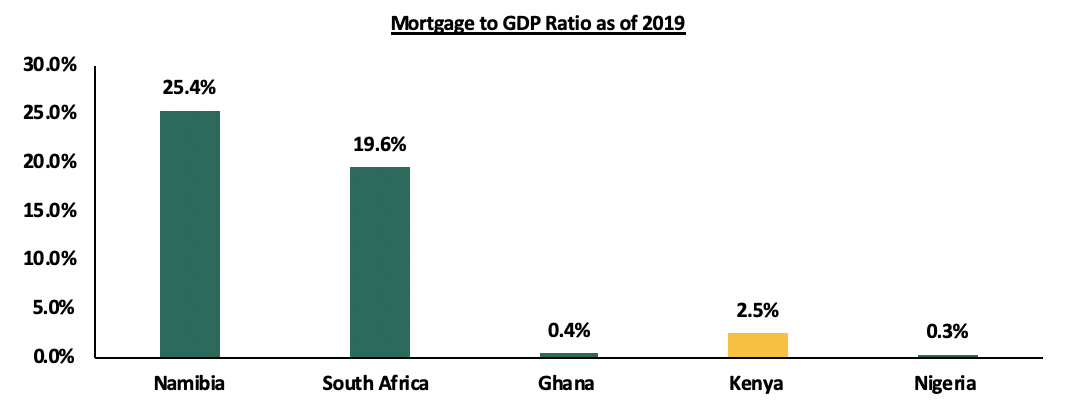

With an average mortgage size of Kshs 8.5 mn and interest rates at 12.0% and an average tenor of 12 years, one is required to make monthly repayments of approximately Kshs 111,640 per month which is unaffordable assuming a gross salary of Kshs 50,000 per month. Given the above, the Kenya mortgage to GDP ratio has continued to lag behind at 2.5% as of 2019 compared to countries such as Namibia at 25.4% as shown in the graph below;

Source: Center for Affordable Housing Africa

In Kenya, currently banks are the main providers of mortgage financing, according to the Central Bank of Kenya, Banking Sector Annual Reports, 2018, about 76.1% of lending to the mortgage market was by 6 institutions similar to 2017. Most financial institutions are reluctant to expand their mortgage portfolio attributed to; low supply of long-term capital due to limited access to capital markets funding, asset-liability mismatch by tenor due to the relatively long-term nature of mortgage loans and short-term nature of bank deposits, limited credit risk information especially for those in the informal sector, and, complex legal and regulatory framework as well as collateral requirements making mortgages exceedingly expensive. This shows that there has been the need to bridge the funding gaps by proving long term funding to the primary lenders to enhance their lending capabilities. This prompted the birth of the Kenya Mortgage Refinance company which is aimed at addressing liquidity issues affecting financial institutions through; (i) using the capital markets to raise funds to support the lending activities of Primary Mortgage Lenders (PMLs) at relatively low rates to enable onward lending to borrowers, and, (ii) increasing liquidity thus reducing risk premiums on mortgages for borrowers.

- Introduction to KMRC

The KMRC is an initiative of the National Treasury and World Bank aimed at supporting the affordable housing initiative, through providing secure, long-term funding to mortgage lenders thus increasing the availability and affordability of mortgage loans in Kenya. KMRC as a financial services company has specialized in lending to Primary Mortgage Lenders (PMLs) such as banks, Sacco’s and other microfinancing institutions within the country for onward lending to potential home owners. The facility is supervised and regulated by the Central Bank of Kenya. KMRC has so far raised funds in form of loans and equity, and also plans to issue a green bond next year. The World Bank extended approximately Kshs 25 bn to KMRC in the form of a concessional loan through the National Treasury, while the African Development Bank (AfDB) injected Kshs 10 bn. KMRC has also received additional funding from 19 undisclosed financial institutions comprising of seven commercial banks, 11 Sacco’s and one micro financer (Kenya Women Microfinance Bank) which bought shares through a participating programme amounting to Kshs 2.0 bn. As at September 2020, KMRC had raised funds worth Kshs 37.3 bn. The facility lends to PMLs at an annual interest rate of 5.0%, thus enabling them to write home loans at 7.0% lower than the market average rate of 12.0%. The facility has revealed that so far, it has eight lenders who participated in the first phase of the refinancing programme. These institutions submitted a pool of mortgages application amounting to Kshs 21.0 bn but only Kshs 4.5 bn qualified.

KMRC has two main types of products, they include;

- Affordable Housing Loans: These are loans that are extended to Primary Mortgage Lenders (PML) to refinance mortgage loans capped at Kshs 4.0 mn for Nairobi Metropolitan Area (Nairobi, Kiambu, and Machakos & Kajiado) and Kshs 3.0 mn elsewhere, at a 7.0% interest rate to individual borrowers whose monthly income is not more than Kshs 150,000.

- Market Housing Loans: These are loans that are extended to Primary Mortgage Lenders to re-finance mortgage loans above the affordable housing loans threshold. The market housing loans have a limit of above Kshs 4.0 mn, and will be issued at interests determined by the average market rates.

The applicable terms and conditions for the above loans include;

- The properties eligible must be a residential unit meant for occupation by the owners or immediate family of the occupants,

- The loans are eligible for both self-employed individuals and the employed,

- The loan to value (LTV) ratio of all the eligible properties is up to 90.0% of the value of the properties, and this implies that a minimum deposit rate of 10.0% is required to be eligible for the loans,

- The payment terms of the mortgage loans are fixed for 25 years for both the salaried and the non-salaried applicants, and,

- The properties that qualify for financing needs to be valued for purposes of giving a quotation before the loan is approved.

- The KMRC Objectives

Some of the key objectives of KMRC include:

- Assisting in the standardization of mortgage practices in Kenya through capacity building to member institutions. - This will be achieved through training individuals in member institutions, since the training will be from a centralized institution, the member institutions will be in a position to adopt uniform practices when it comes to mortgages, these includes the terms of repayments and interest rates,

- Contributing to the growth of Kenyan capital markets through the issuance of KMRC bonds as a source of sustainable long-term fund-So far, KMRC has announced that it plans to issue a green bond towards the end of next year,

- Contributing to the growth of the mortgage market in Kenya through support to PMLs- KMRC lends money to PMLs who in turn lends the funds to individuals seeking for home financing, this has the potential of increasing mortgage uptake as the facility offers mortgages at relatively affordable rates both to the PMLs and applicants,

- Facilitating member institutions to extend the mortgage maturity in line with the objective of long-term finance- One of the main factors that has limited uptake of mortgages is unfavorable payment terms, facilitating institutions to offer longer mortgage tenors will provide mortgage applicants with favorable terms as the repayment periods will be longer, and,

- Facilitating the entry of new mortgage lenders in the market in order to broaden the scope of mortgage issuance and increase competition- As at 2018, according to the Central Bank of Kenya about 76.1% of lending to the mortgage market was by only 6 institutions. With the facility providing long term funding to financial institutions, we expect an increase in the number of firms lending funds to mortgage borrowers. Additionally, this will most likely result in increased competition among various institutions thus the possibility of providing relatively attractive terms and conditions for competitive advantage.

- Benefits and Challenges of KMRC

-

- Benefits

- Increased Home Ownership: One of the key objectives of KMRC is to increase home ownership among Kenyans through offering mortgages at affordable rates. Home ownership has remained relatively low at 21.3% in urban areas and the lending by KMRC will thus enable potential home buyers access affordable mortgages enabling them acquire homes,

- Increased Mortgage Uptake: The KMRC is expected to promote the growth of the Kenyan mortgage market with a targeted mortgage account of 50,000 homes within 5 years,

- Increased Liquidity to Mortgage Lending Institutions: KMRC provides long term funding to banks and other mortgage lending institutions like Sacco’s hence creating liquidity for the institutions, and,

- Spur Competition in the Mortgage Market: KMRC lending at low rates will create competition especially with other lending institutions offering higher interest rates. The low interest rates will attract borrowers giving the institution a competitive advantage over other financial institutions thus prompting the lenders to revise their terms of lending to remain competitive in the market. In addition, the higher number of PMLs in the market, the higher the competition, thus institutions will resort to revising their terms amid the competition.

-

- Challenges

Key challenges likely to face by KMRC;

- Limited Housing Options: Given the relatively low loan size provided by KMRC, potential homeowners will have few or no options of housing units within the NMA due to the relatively high property prices and low supply of affordable housing units thus forcing them to focus on housing units within satellite towns which are relatively affordable. The current NMA residential unit prices ranges from Kshs 6.3 mn to Kshs 16.6 mn for detached units, and Kshs 7.4 mn to Kshs 10.4 mn for apartments. This is significantly higher than the KMRC range of Kshs 3.0 mn to Kshs 4.0 mn.

The table below shows the residential market average price of units within the NMA;

All values in Kshs unless stated otherwise

|

NMA Residential Market Rates and Performance 2020 |

|||||

|

Segment |

Unit Size (SQM) |

Average Price per SQM |

Price |

Average Y/Y Price Appreciation |

Average Total Returns |

|

Detached units |

|||||

|

High-End |

90 |

184,843 |

16.6 mn |

0.0% |

4.2% |

|

Upper Mid-End |

90 |

140,642 |

12.7 mn |

0.9% |

5.6% |

|

Lower Mid-End |

90 |

69,484 |

6.3 mn |

(0.5%) |

4.1% |

|

Apartments |

|||||

|

Upper Mid-End |

90 |

116,093 |

10.4 mn |

(0.7%) |

4.6% |

|

Lower Mid-End |

90 |

90,939 |

8.2 mn |

0.1% |

5.9% |

|

Satellite Towns |

90 |

81,833 |

7.4 mn |

(0.1%) |

5.3% |

|

Residential Market Average |

113,972 |

10.3 mn |

(0.1%) |

5.0% |

|

Source: NMA Residential Report 2020

- Lack of clarity on how to Maintain the Low Lending Rates: The lending rates by the facility are at 5.0% to 7.0% significantly lower than the market rate and KMRC is yet to clarify how it will sustain the rates,

- Default Rates Likely to be High: This is attributable to the high level of job losses and tough economic times. According the Central Bank of Kenya, Banking Sector Annual Reports, mortgage defaults increased by Kshs 10.8 billion to Kshs 38.1 billion in December 2018 from Sh27.3 billion in December 2017,

- Competition from Government Instruments: KMRC is likely to face challenges raising funds through bonds as a result of competition from government instruments as they are offering much higher rates than the 5.0%. In addition, to be able to lend at 5.0%, the green bond will have to be issued at a relatively low rate which is likely to make it unattractive to investors noting that Acorn’s green bond was issued at 12.3% and attracted 85.0% subscription,

- Failure by Borrowers to Meet Mortgage Loan Eligibility Criteria thus Limiting Uptake: After the KMRC started its operations, more than three quarter of loans that were submitted by PMLs in the first phase of refinancing did not meet the stringent requirements that have been set by World Bank. The criteria for selection for approval for financial institutions requires that lenders applying for concessional funding from KMRC have at least 80.0% of the loans within the affordable housing threshold to create a balance between the affordable and non-affordable housing loans, and

- Bureaucracy and Inefficiencies from State Departments: The prolonged processes in government departments due to high levels of bureaucracy and delays in processes such as approvals, registration of properties and title deeds are likely to slow down the operations of KMRC.

- Case Study of Saudi Real Estate Refinance Company

Saudi Real Estate Refinance Company (SRC) was formed in 2017 with the primary goal of developing the housing finance market in Saudi Arabia. SRC is owned by the Public Investment Fund (PIF) and is licensed to operate in the secondary real estate market by the Saudi Arabian Monetary Authority. It was established to enable the originators offer long term and short term financing solutions to home buyers, SRC does not offer direct loans to buyers, it uses intermediaries mainly the financial institutions and lends to them at a rate of 6.0%. The company has two main products which include; i) the short-term funding, these are bridging loans for finance companies during a warehousing period, borrowers get immediate access to short-term loans of less than five years to leverage the balance sheet capacities for financial institutions enabling them to offer more loans, and, ii) the portfolio acquisitions and long term fixed rate mortgage, for this, SRC acquires residential mortgage portfolios from banks and mortgage finance companies with the aim of freeing up their balance sheet, improving their capital utilization, the loans have a fixed term of 25 years. The activities by the facility are in support of Saudi Arabia’s government vision of increasing the level of home ownership to 60.0% by the end of 2020, with a goal of 70.0% by the end of 2030. SRC is uniquely positioned to become the partner of choice for lenders helping them finance the primary mortgage market. So far, SRC has contributed to increasing the homeownership rates to 62.0% in 2020 from 47.0% in 2017 through indirectly availing mortgages to potential home owners. The facility raises finances through issuing bonds, loans from both local and international institutions, and, equity funding.

Some of the key functions of the Saudi Real Estate Refinance Company Include:

- Providing Financial Support to Money Lending Institutions: Banks and other financial institutions get financing directly from SRC, this enables them to provide mortgage loans to prospective home owners within the country,

- Offering Lenders Funding in the Form of Short or Long-Term Loans or Portfolio Acquisitions: SRC provides fundamental liquidity and capital to support the housing mortgage market development,

- Participating in the Securities Market: SRC accumulates portfolios of loans into mortgage backed securities to generate more funds for investments,

- Improving the Housing Market of Saudi Arabia: SRC facilitates the growth of the housing market and enhances increased home ownership in Saudi Arabia, and,

- SRC works by Creating an Effective Secondary Market: From these secondary markets home loans and servicing rights are bought from lenders (the mortgage originators) and sold to investors, to generate higher returns.

Key Challenges

- The high cost of properties including land and already built properties- Currently, the average price of land in Saudi Arabia within the capital is approximately Kshs 100,000 per SQM according to Riyadh Market Study Report by KPMG. The amount is regarded as significantly high and may exceed the loan limit that SRC can offer. This has impacted mortgage uptake mainly because the value of some properties may surpass the limit of the amount for financing, in such a situation, it becomes hard to fully finance a property through mortgage, and,

- Insufficient quality housing units which can qualify for loans as a result, most loan applicants end up being disqualified for the home loans.

Achievements

- SRC has attracted foreign banking institutions to participate in the real estate sector in Saudi Arabia through providing funding- An example of is the Saudi British Bank (SABB), which is 40.0% owned by the Hong Kong and Shanghai Banking Corporation (HSBC) holdings, a financial investments company,

- Boosted the growth in the number of financial institutions offering loans which has generally contributed to the growth of mortgage accounts in Saudi Arabia- According to Saudi Arabian Monetary Authority (SAMA), the total number of individual mortgage contracts until August 2019 stood at 96,787 compared to approximately 27,000 contracts during the same period in 2018,

- Following its inception, SRC has contributed to increased home ownership in Saudi Arabia which was at 47% in 2017 to 62% in 2020- This is primarily attributed to the fact that it is able to provide financing to potential home owners to construct or buy houses,

- The SRC has increased access to home financing- This grew significantly between 2018 and 2019 after its inception by 168.0% to reach approximately Kshs 72 trillion (USD 7.2 bn), as mortgage financing companies and commercial banks benefitted from subsidized financing designed to increase home ownership, and,

- The company has been able to increase its visibility and awareness of its existence in the market- This has enabled it to attract more mortgage applicants over time including educating borrowers on the existence of favorable mortgage rates in the market.

- Lessons Learnt from the Case Study

The SRC has been successful in improving the mortgage market in Saudi-Arabia which has resulted in the growth of home ownership in the country. Some key takes for Kenya from the case study are:

- KMRC must vigorously raise funds for sustainability- So far SRC has successfully attracted foreign banking institutions, issued bonds and secured loans to raise funds. This has helped to improve the capacity of the institution to channel funds for mortgage purposes. The KMRC can embrace this through approaching foreign investors to increase their pool of funds,

- Increasing awareness of its existence to potential home owner through awareness campaigns- This is likely help in increasing mortgage uptake in Kenya which has remained relatively low partially due to limited knowledge of affordable home financing options,

- SRC has successfully raised funds through bonds, KMRC on the other hand is planning to issue a green bond in the coming year, and if successful this could be a step in the right direction for KMRC, and,

- SRC has been lending to financing institutions, SRC has two main products, that is the short term loans with a tenor of 5 years and the long term loans with a fixed term of 25 years, in the long run KMRC can adopt the strategy by SRC to incorporate short term loans which most likely will help promote flexibility for those willing to pay back within shorter repayment periods, and with this, the company will be in a position to earn from interests paid from short repayment windows.

- Conclusion

KMRC is expected to; i) provide secure long-term funding at affordable interest rates, ii) contribute to the growth of the Kenyan capital markets, iii) facilitate entry of mortgage lenders, and, iv) improve home ownership in Kenya. To enhance sustainability of the lending terms, KMRC must ensure that the loan applications comply with the eligibility criteria provided. In addition, the facility will need to aggressively fund raise to ensure sustainability of relatively low lending rates.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.