Currency and Interest Rates Outlook, & Cytonn Weekly #20/2020

By Cytonn Research, May 17, 2020

Executive Summary

Fixed Income

During the week, T-bills were slightly oversubscribed, with the subscription rate coming in at 100.4%, up from 62.6% the previous week. The oversubscription was partly attributable to favorable liquidity in the market due to government payments, which saw the average interbank rate decline to 4.1%, from 4.2%. For the month of May the government shall be reopening the 5 year, FXD1/2020/5 and issuing a new infrastructure bond IFB1/2020/6, for a total value of Kshs 30.0 bn for the FXD1/2020/5 and Kshs 25.6 bn for the IFB1/2020/6, for budgetary support purposes and funding of infrastructure projects, respectively. Oil prices were revised downwards effective from 15th May 2020 to 14th June 2020. Petrol and diesel prices have declined by 10.3% and 19.7% to Kshs 83.3 and Kshs 78.4 per litre, respectively. Kerosene prices have risen by 3.2% to Kshs 79.8 per litre. The International Monetary Fund (IMF) raised Kenya’s risk of distress to “High” from “Moderate” due to the effects of the Coronavirus pandemic. Global credit rating agency Moody’s affirmed Acorn Group’s Kshs 5.0 bn guaranteed, Senior Secured medium term note programme (the MTN Programme) but downgraded the outlook from ‘B1 stable’ to ‘B1 negative’;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 recording losses of 3.9%, 2.9% and 5.2%, respectively, taking their YTD performance to losses of 18.7%, 25.6% and 22.5%, for NASI, NSE 20 and NSE 25, respectively. During the week, global rating agency Moody’s changed the outlook for KCB, Equity and Co-operative Bank to “Negative” from “Stable” but affirmed all three banks’ local currency deposit ratings at B2, citing the link between their rating and that of the state due to the top banks’ large exposure to government securities. During the week, KCB Group became the latest lender to disclose it had restructured loans amounting to Kshs 80.0 bn, equivalent to 14.9% of its net loans, which stood at Kshs 535.4 bn in FY’2019;

Real Estate

During the week, the Kitui County Government rolled out an affordable housing programme aimed at developing approximately 1,980 housing units. In the retail sector, Tuskys Supermarket, a local retailer, closed down their branch in Mtwapa, Mombasa, while Quickmart opened a new branch in the Nairobi CBD, along Tom Mboya Street, taking up space previously occupied by Choppies. In the industrial sector, local construction firm, Jilk Construction Company Limited, set up a new plant in Tatu Industrial Park, while Sameer Africa, a local company whose principal business is the importation and sale of tyres, announced that it would be turning its focus to its real estate business after closing down its tyre business. Finally, on statutory review, the Ministry Of Lands and Physical Planning issued a notice inviting public participation on the regulatory impact statement for the proposed Land Transactions (Electronic) Regulations 2020;

Focus of the Week

In our Q1’2020 Kenya Macroeconomic review, we analyzed the 7 macroeconomic factors and we ended up with a negative 2020 economic outlook mainly due to expected effects of the Coronavirus. We expect the currency and the interest rates to remain under pressure with the currency expected to depreciate. There remains a risk of an uptick in interest rates despite the continued downward revision of the Central Bank Rate;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.8% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.0% p.a. To subscribe, email us at sales@cytonn.com;

- Shiv Arora, Chief Operating Officer at Cytonn Investments, was on Metropol TV to talk about the impact COVID-19 has had on various sectors. Watch Shiv here;

- David King’oo, Senior Risk and Compliance Associate at Cytonn Investments, was on KBC Channel 1 to discuss Kenya’s 2020/2021 budget and how it has been impacted by the Coronavirus pandemic. Watch David here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To register for the training, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

During the week, T-bills were slightly oversubscribed, with the subscription rate coming in at 100.4%, up from 62.6% the previous week. The oversubscription was partly attributable to favorable liquidity in the market during the week, which saw the average interbank rate decline to 4.1%, from 4.2%, supported by government payments. The subscription rate of the 91-day, 182-day, and 364-day papers increased to 191.8%, 44.9%, and 119.3%, respectively, from 61.1%, 38.0%, and 87.8% recorded the previous week, respectively. The yields on the 91-day, 182-day, and 364-day papers all remained unchanged at 7.3%, 8.2%, and 9.2%, respectively, similar to what was recorded the previous week. The acceptance rate increased to 99.5%, from 98.5% recorded the previous week, with the government accepting Kshs 24.0 bn of the Kshs 24.1 bn bids received.

During the week, the National Treasury announced that it will reopen the recently issued FXD1/2020/5 and issue a new infrastructure bond IFB1/2020/6 with effective tenors of 5-years and 6-years respectively for a total value of Kshs 30.0 bn for FXD1/2020/5 and Kshs 25.6 bn for IFB1/2020/6, for budgetary support purposes and funding of infrastructure projects, respectively. The period of sale for FXD1/2020/5 is from 11th May 2020 to 19th May 2020, while the period of sale for IFB1/2020/6 is from 14th May 2020 to 26th May 2020. As per the historical trend, we expect the market to maintain a bias towards IFB1/2020/6 mainly attributable to its short tenor as well as the tax-free incentive for infrastructure bonds, translating to a higher return. Our recommended bidding range is 11.5% - 11.7% for FXD1/2020/5 and 10.5% - 10.8% for IFB1/2020/6 given that bonds with the same tenor are currently trading at 11.4% and 10.5%, respectively, on the yield curve.

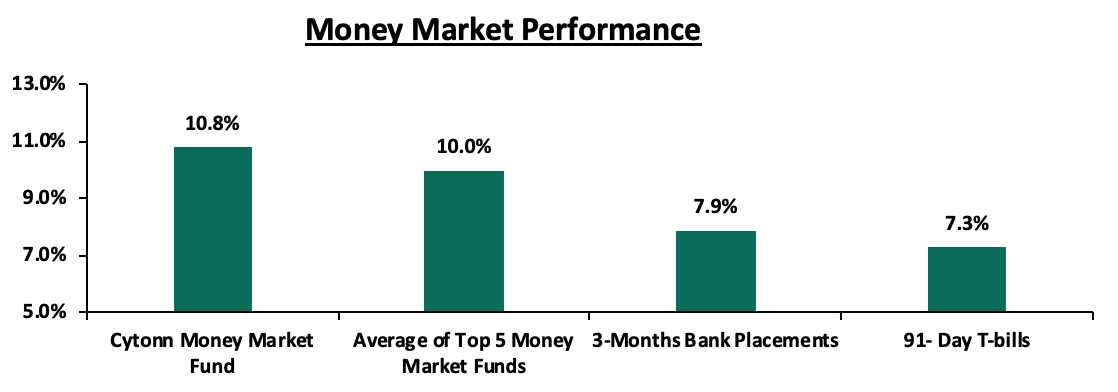

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.3%, similar to what was recorded the previous week. The average yield of Top 5 Money Market Funds declined by 0.1% points to 10.0% from 10.1% recorded the previous week. The yield on the Cytonn Money Market declined by 0.2% points to close the week at 10.8% from 11.0% recorded the previous week.

Liquidity:

During the week, liquidity eased in the money market with the average interbank rate declining to 4.1%, from 4.2% recorded the previous week, supported by government payments. The average interbank volumes increased by 66.5% to Kshs 12.9 bn, from Kshs 7.8 bn recorded the previous week. The improved liquidity in recent weeks has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up Kshs 35.2 bn to provide additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic. According to the Central Bank of Kenya, the reduction of the CRR in March 2020 had by the end of April 2020 freed Kshs 17.6 bn, which was granted to 11 commercial banks and 1 microfinance bank to be used for onward lending to distressed borrowers. Commercial banks’ excess reserves came in at Kshs 36.5 bn in relation to the 4.25% cash CRR.

Kenya Eurobonds:

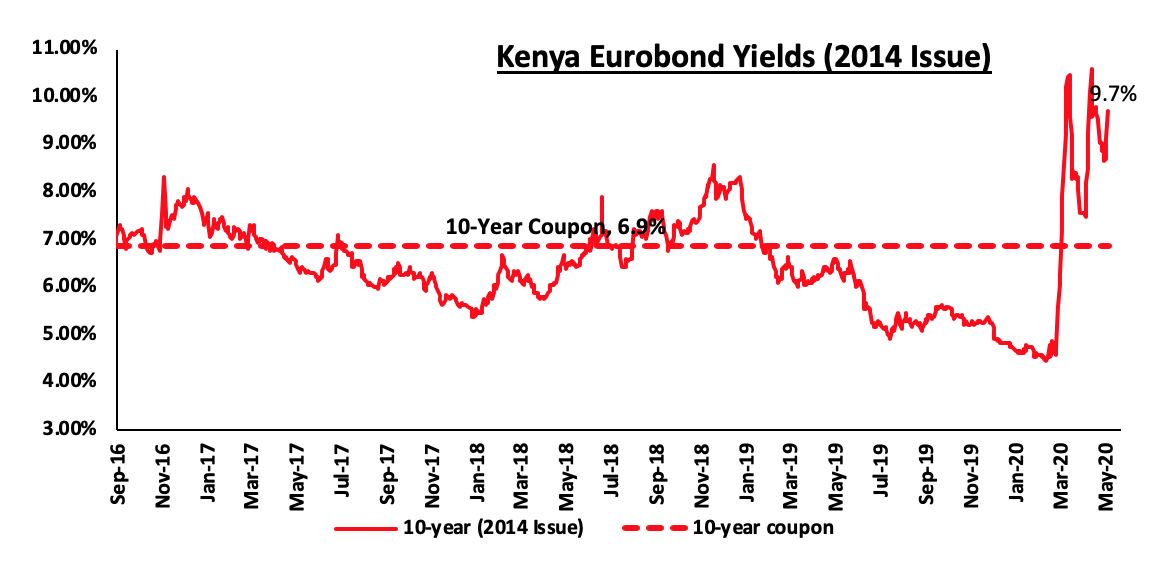

During the week, the yields on all the Eurobonds increased marginally owing to the markets reacting to the news by the International Monetary Fund (IMF) raising Kenya’s risk of distress to high from moderate. We anticipate investors to continue attaching a higher risk premium on the country due to

- The anticipation of slower economic growth attributable to the coronavirus pandemic as highlighted in our Q1’2020 Eurobond Performance Note and,

- The recent downgrade by Moody’s where Kenya’s sovereign credit outlook was downgraded to negative from stable.

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 0.8% points to 9.7%, from 8.9% recorded the previous week.

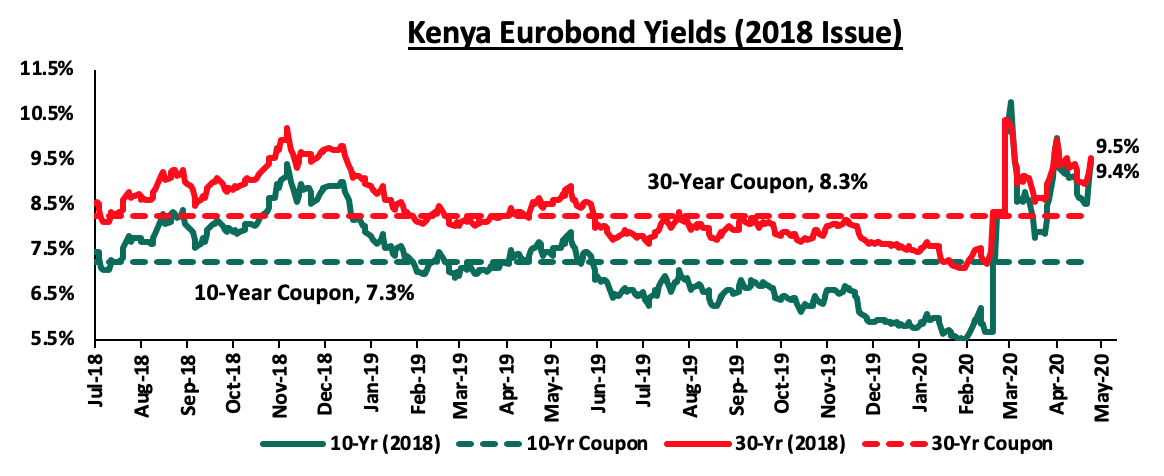

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 increased by 0.8% points and 0.5% points to 9.4% and 9.5%, respectively, from 8.7% and 9.0% recorded previous week, respectively.

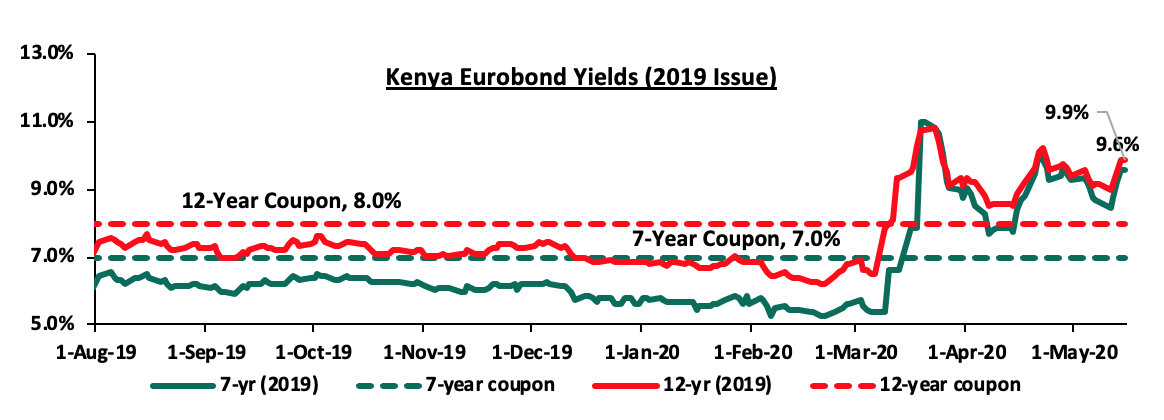

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 0.9% points and 0.7% points, to 9.6% and 9.9%, respectively, from 8.6% and 9.2% recorded the previous week, respectively.

Kenya Shilling:

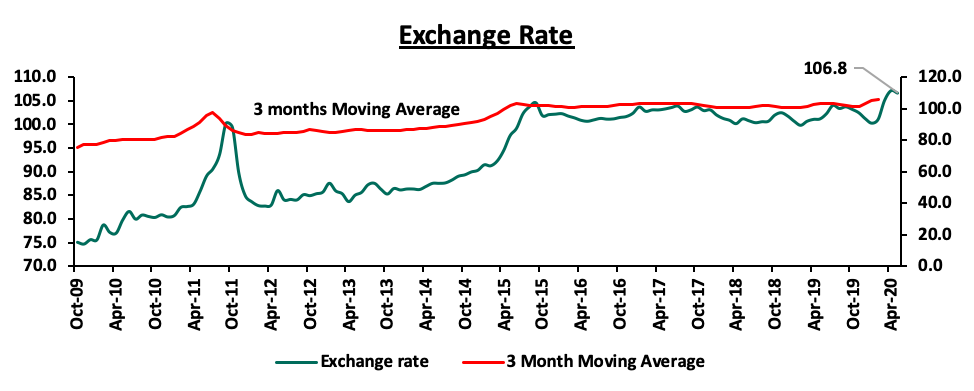

During the week, the Kenya Shilling depreciated by 0.8% against the US Dollar to close the week at Kshs 106.8, from Kshs 106.0 recorded the previous week, mainly due to an uptick in demand from businesses buying hard currency to meet their obligations as economic activity slowly resumes amid the novel coronavirus pandemic. On an YTD basis, the shilling has depreciated by 5.4% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens,

- Increased demand as merchandise and energy sector importers beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances due to the decline in economic activities globally coupled with increased prices of household items leading to lower disposable income.

The shilling is however expected to be supported by:

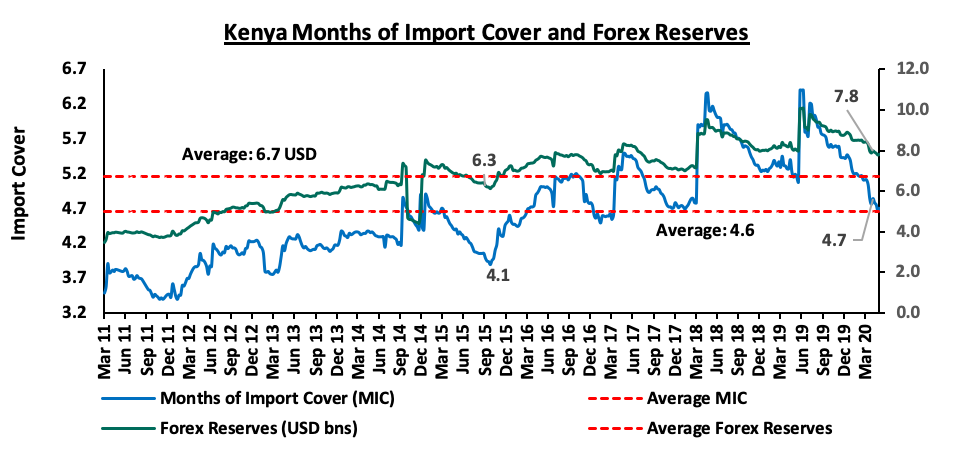

- High levels of forex reserves, currently at USD 8.5 mn (equivalent to 5.1-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. The inflows from the IMF Rapid Credit Facility (RCF) approved during the week is expected to add Kshs 78.7 bn to the forex reserves, and,

- CBK’s supportive activities in the money markets, with the CBK having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March 2020 to bolster the forex reserves.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices for various products for the period 15th May 2020 to 14th June 2020. Below are the key take-outs from the statement:

- Petrol prices were reduced by 10.3% to Kshs 83.3 per litre, from Kshs 92.9 per litre previously, while diesel prices were reduced by 19.7% to Kshs 78.4 per litre from Kshs 97.6 per litre. Kerosene prices however increased by 3.2% to Kshs 79.8 per liter, from Kshs 77.3 per liter previously,

- The changes in prices are attributed to the decline in the average landing cost of imported super petrol and diesel by 38.9% and 44.0% to USD 188.1 per ton and USD 242.1 per ton in April 2020, respectively, from USD 309.0 per ton and USD 432.7 per ton in March 2020. Landing costs for kerosene, however, remained unchanged at USD 262.4 per ton similar to what was recorded in March 2020,

- A 50.4% decline in Free on Board (FOB) price of Murban Crude Oil lifted to USD 17.6 per barrel, from USD 35.6 per barrel in March 2020, and,

- However, a 2.7% depreciation in the Kenyan shilling relative to the dollar to Kshs 106.8 recorded in April 2020 from Kshs 104.1 in March 2020 reduced the price benefits.

The reduction in oil prices is expected to provide reprieve on inflation as the oil prices have broadbased impact on the inflation basket. We will release our inflation expectations in our next weekly report.

During the week, the International Monetary Fund (IMF) raised Kenya’s risk of distress to “High” from “Moderate” due to the effects of the Coronavirus pandemic which has worsened the existing vulnerabilities within the Kenyan economy. Some of the key issues raised include:

- Increased budget deficits: This is as a result of the fiscal measures introduced for combating the pandemic amid subdued economic growth, and,

- Increased debt vulnerability: The country’s external debt to export ratio which is expected to come in at 288.1% in 2020 will be well above the recommended threshold of 240.0%. The IMF, however, expects the external debt to exports ratio to rebound as exports recover once the global shock dissipates. The debt service to exports ratio which is a measure of liquidity is expected to be above the threshold for the period between 2020-2028 due to large repayments of external debt and lower exports expected to emanate from subdued revenue in 2020. The country’s debt to GDP ratio is projected to be at 61.7% at the end of 2019 which is above the recommended threshold of 50.0%.

Kenya received USD 739.0 mn (Kshs 78.7 bn) from the IMF last week to be drawn under the Rapid Credit Facility (RCF) to help the country address the impact of COVID-19 on the economy. We believe the RCF funds will help bridge the financing gap that exists in the country as well as help to finance the Balance of Payment deficits for the year due to the expectations of a decline in the value of exports following reduced global demand.

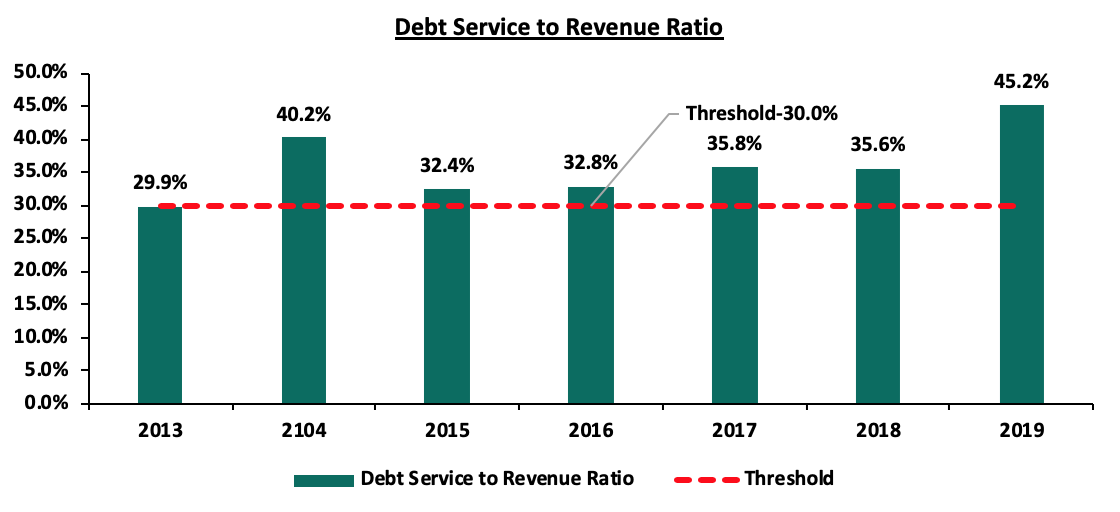

In our view, the move by the IMF to raise the country’s risk of distress was well in line with our expectations. The high debt to GDP ratio could cause liquidity problems for the country given that Kenya’s service to revenue ratio has been above the recommended threshold of 30.0% since 2014. One of the key elements of debt sustainability in any economy is the ability to service debt, and this is usually measured by revenue collection to total outstanding payments required, both in principal and interest payments. The pandemic has so far had a negative impact on revenue collection and borrowing costs and the situation is expected to worsen given the fiscal measures put in place by the government to cushion the economy against the economic effects of the pandemic. Below is a chart showing the evolution of the country’s debt service to revenue ratio.

Source: IMF Country Report & National Treasury Annual Public Debt Report

Given that Kenya’s foreign debt which accounts for 51.0% of the total debt is mostly denominated in foreign currency, the volatility of the Kenya Shilling due to the uncertainty created by Coronavirus will make external debt more expensive. For more information on Kenya's debt position given the Coronavirus pandemic, see our topical on Debt Relief Amidst the COVID-19 Pandemic.

During the week, global credit rating agency Moody’s changed Acorn Group’s Kshs 5.0 bn green bond outlook from ‘B1 stable’ to ‘B1 negative’. The bond had a rating of B1 stable when it was issued in 2019 higher than Kenya’s sovereign rating of B2 stable at the time. The initial higher rating was informed by a partial guarantee to investors through GuarantCo which assured investors of recovery of up to 50.0% of principal and interest in the case of a default. According to Moody’s, the negative outlook on the green bond is in line with the sovereign government’s downgrade and is as a result of the negative effects witnessed in the construction, marketing, and subdued demand of the bond’s asset base, which is climate-resilient student accommodation.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 18.7% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 290.9 bn against a prorated target of Kshs 357.7 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 recording losses of 3.9%, 2.9% and 5.2%, respectively, taking their YTD performance to losses of 18.7%, 25.6% and 22.5%, for NASI, NSE 20 and NSE 25, respectively. The performance of the NASI was driven by losses recorded by large-cap stocks such as NCBA, Equity, KCB, DTBK, and Bamburi of 14.2%, 13.9%, 8.7%, 7.2% and 7.1%, respectively. The decline recorded in most banking stocks is partly attributable to increased foreign investor sell-offs following Moody’s changing the outlook for Kenya’s top banks to negative from stable, due to their large exposure to government securities, which poses a risk to their credit profile, following the agency’s decision to change the outlook on the Government of Kenya’s ratings to negative from stable.

Equities turnover increased by 1.5% during the week to USD 46.3 mn, from USD 45.6 mn recorded the previous week, taking the YTD turnover to USD 649.0 mn. Foreign investors remained net sellers during the week, with the net selling position increasing by 631.9% to USD 24.0 mn, from a net selling position of USD 3.3 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing riskier assets in favour of safe havens.

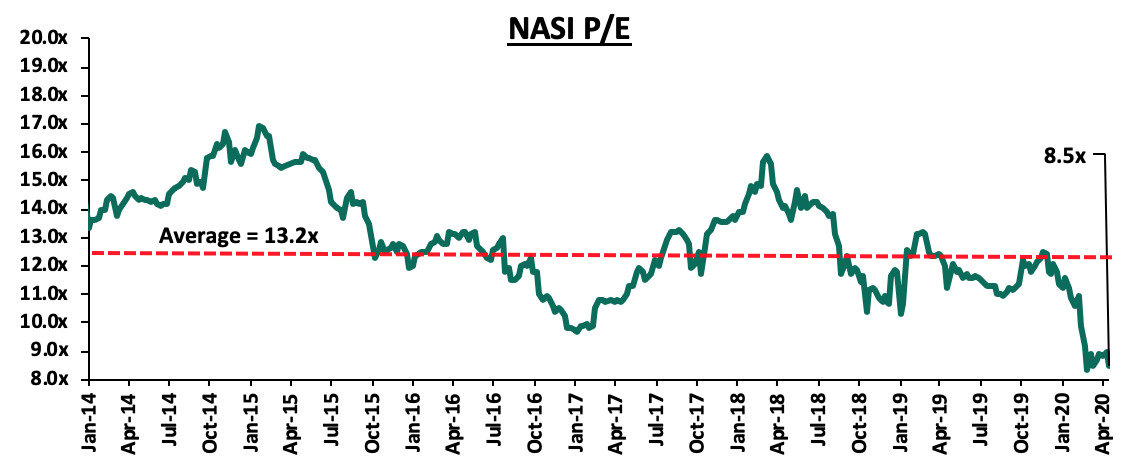

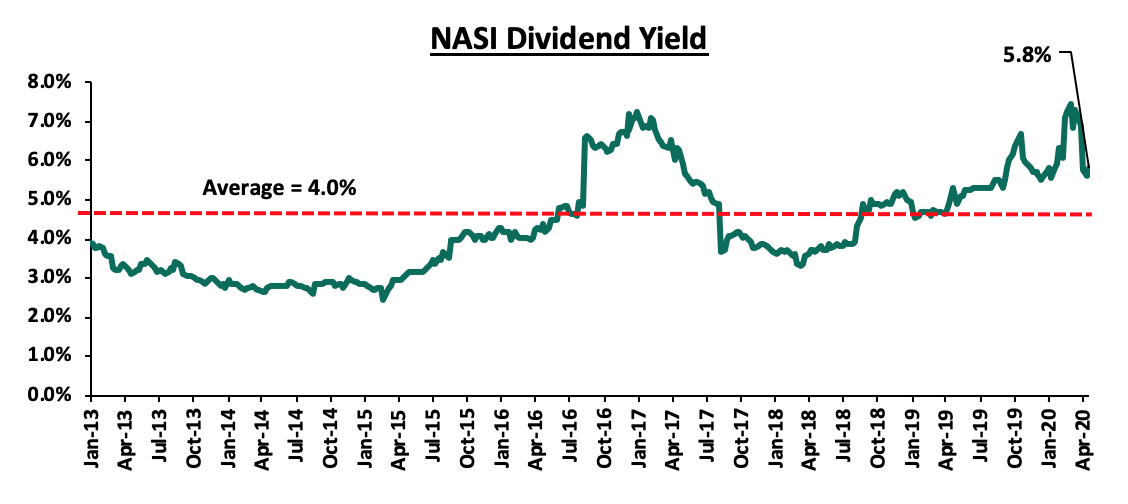

The market is currently trading at a price to earnings ratio (P/E) of 8.5x, 35.4% below the historical average of 13.2x. The current dividend yield is at 5.8%, 1.8% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 8.5x is 1.2% above the most recent trough valuation of 8.4x experienced in the last week of March 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, global rating agency Moody’s changed the outlook for KCB, Equity and Co-operative Bank to “Negative” from “Stable” but affirmed all three banks’ local currency deposit ratings at B2, citing the link between their rating and that of the state due to the top banks’ large exposure to government securities, which poses a risk to their credit profile. Also as a general rule (the Sovereign Ceiling Policy) companies often cannot have a rating higher than the credit rating of the country where they operate in, even if the company is a better credit risk than its home country due to the assumption that the performance of institutions within a particular sovereignty is largely dependent on the country’s economic performance. The rating action follows the rating agency’s decision to change the outlook on the Government of Kenya’s ratings to negative from stable, reflecting the rising financing risks posed by Kenya’s large gross borrowing requirements at a time when the fiscal outlook is deteriorating. In FY’2019, the three banks raised their government securities to Kshs 117.8 bn from Kshs 80.3 bn in FY’2018 for Co-operative Bank, Kshs 169.2 bn from 120.1 bn in FY’2018 for KCB and Kshs 138.6 bn from 130.4 bn in FY’2018 for Equity, translating to growths of 46.8%, 41.0% and 6.2%, for Co-operative, KCB and Equity, respectively, indicating the banks’ continued preference towards investing in government securities, which offered better risk-adjusted returns during the interest rate cap era as highlighted in our FY’2019 Kenya Listed Banks Report. Below is a table showing the growth in the banks’ allocation to government securities compared to the listed banks average for listed banks in FY’2019.

|

Bank |

Govt Securities (Kshs Bns) |

Shareholders Equity ( Kshs Bns) |

|

Co-operative |

117.8 |

79.34 |

|

KCB |

169.2 |

129.7 |

|

Equity |

138.6 |

110.7 |

|

Listed Banks Average |

109.5 |

65.0 |

According to the rating agency, the negative outlook for the lenders reflects the substantial holdings in sovereign debt securities, which are between 1.3X to 2.0X, their shareholders’ equity, linking their creditworthiness to that of the government. Moody’s also noted to a lesser degree the negative outlook depicted the high risk of Non-Performing Loans (NPLs) which will result in deteriorated asset quality and profitability, amid the Coronavirus pandemic. However, according to Moody’s, the banks’ retain resilient financial profiles despite the challenging operating environment due to their deposit-funded profiles, strong liquid assets and high profitability. In our view, the downgrade of the three banks will result in an increased cost of capital for both debt and equity and will have a potential impact on the banks’ share prices.

During the week, KCB Group became the latest lender to disclose it had restructured loans amounting to Kshs 80.0 bn, equivalent to 14.9% of its net loans, which stood at Kshs 535.4 bn in FY’2019. The loan restructuring involves placing moratoriums on both interest and principal payments for three months, in effect giving reprieve to its customers who found it difficult to repay their loans due to the impact caused by the pandemic. As highlighted in our Cytonn Weekly #19, the Central Bank of Kenya (CBK) in their presentation to the Senate Ad Hoc Committee on the COVID-19 situation, disclosed that Kenya’s seven largest banks had restructured loans amounting to Kshs 176.0 bn in the month of April, equivalent to 6.4% of the industry’s total gross loan book which stood at Kshs 2.8 tn in January 2020. In our view, high Non-Performing Loans (NPLs), which stood at 10.5% as at the end of FY’2019, compared to the 5-year average of 8.2%, for the listed banking sector, continues to be an area of concern and is expected to increase in FY’2020 as businesses continue to be impacted by the pandemic.

Universe of Coverage

|

Banks |

Price at 08/05/2020 |

Price at 15/05/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

83.0 |

77.0 |

(7.2%) |

(29.4%) |

109.0 |

179.7 |

3.5% |

136.9% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.4 |

2.4 |

(3.3%) |

(22.4%) |

3.0 |

4.8 |

4.7% |

108.9% |

0.2x |

Buy |

|

Jubilee Holdings |

268.0 |

249.5 |

(6.9%) |

(28.9%) |

351.0 |

453.4 |

3.6% |

85.3% |

0.9x |

Buy |

|

Equity Group*** |

39.2 |

33.7 |

(13.9%) |

(37.0%) |

53.5 |

55.3 |

7.4% |

71.5% |

1.2x |

Buy |

|

KCB Group*** |

39.1 |

35.7 |

(8.7%) |

(34.0%) |

54.0 |

55.8 |

9.8% |

66.3% |

0.9x |

Buy |

|

I&M Holdings*** |

51.0 |

49.3 |

(3.3%) |

(8.7%) |

54.0 |

73.6 |

5.2% |

54.5% |

0.7x |

Buy |

|

Co-op Bank*** |

13.1 |

12.9 |

(1.1%) |

(21.1%) |

16.4 |

18.2 |

7.8% |

48.8% |

1.0x |

Buy |

|

NCBA |

31.7 |

27.2 |

(14.2%) |

(26.2%) |

36.9 |

39.4 |

0.9% |

45.8% |

0.7x |

Buy |

|

Sanlam |

16.0 |

15.4 |

(3.8%) |

(10.5%) |

17.2 |

21.7 |

0.0% |

40.9% |

1.3x |

Buy |

|

Standard Chartered |

184.3 |

176.0 |

(4.5%) |

(13.1%) |

202.5 |

223.6 |

11.4% |

38.4% |

1.4x |

Buy |

|

Liberty Holdings |

8.2 |

7.5 |

(8.1%) |

(27.5%) |

10.4 |

10.1 |

0.0% |

34.2% |

0.7x |

Buy |

|

Stanbic Holdings |

88.0 |

88.0 |

0.0% |

(19.5%) |

109.3 |

109.8 |

8.0% |

32.8% |

1.0x |

Buy |

|

ABSA Bank*** |

11.0 |

10.5 |

(4.5%) |

(21.3%) |

13.4 |

12.6 |

10.5% |

30.5% |

1.2x |

Buy |

|

CIC Group |

2.3 |

2.2 |

(6.1%) |

(19.0%) |

2.7 |

2.6 |

0.0% |

21.6% |

0.8x |

Buy |

|

Britam |

6.9 |

6.0 |

(12.5%) |

(33.1%) |

9.0 |

6.8 |

4.2% |

16.3% |

0.7x |

Accumulate |

|

HF Group |

4.0 |

4.0 |

(0.5%) |

(38.2%) |

6.5 |

4.3 |

0.0% |

7.8% |

0.2x |

Hold |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim

- Residential Sector

During the week, the Kitui County Government rolled out an affordable housing programme aimed at developing approximately 1,980 modern houses for its residents. The two housing projects situated at Kalawa Road and Manyenyoni, in Kitui County will be undertaken under a public-private partnership between the county and two private developers, namely, Tecnofin Kenya Limited and Keiwa Group, respectively. The county will provide the development land while the developers will mobilise funding for development. The county will then receive housing units equivalent to the value of the land whereas the remaining units belonging to the developers will be sold off to the public. The Kalawa Road project will consist of 680 units while the Manyenyoni project will consist of 1,300 units. The above is an indication of the government’s efforts to drive the Big Four Agenda on provision of affordable housing at the county levels. This follows the signing of a memorandum of understanding, in June 2019, between the National Government and 26 counties to build affordable housing, a deal that will see each of the counties construct at least 2,000 housing units. Some of these counties include; Kiambu, Kitui and Nairobi. So far, several counties have launched their projects such as the Nairobi County’s Urban Renewal Project which has 2 projects under construction: a 1,800 unit-project in Ngara to be developed by Jabavu Limited, and a 1,434 unit-project in Jevanjee Pangani being developed by Tecnofin Kenya Limited. Kenya has a relatively high population growth rate at 2.2% p.a. and an urbanization rate of 4.3% compared to the global averages of 1.2% and 2.0%, respectively and this has resulted in an overall increment in pressure on land and housing especially in urban areas. According to the National Housing Corporation, Kenya has an existing housing deficit of approximately 2.0 mn units, growing annually by 250,000 units, yet the annual supply stands at 50,000 units only. This has continued to necessitate the need for the government to partner with private developers with the aim of resolving this deficit through development of approximately 500,000 affordable housing units by 2022. However, despite the progress made towards achieving its goal, in our view, the government may not realize its target due to the current COVID-19 pandemic that has seen the National Government adapt various fiscal consolidation measures such as the redeployment of funds meant for the National Development Fund towards efforts to mitigate the impact of COVID-19 on the economy. Nevertheless, we expect to see private sector developers undertaking affordable housing projects targeting the low and middle income earners as the segment presents an investment opportunity supported by the growing demand and the tax incentives associated with the same.

- Retail Sector

During the week, local retailer, Tuskys Supermarket, closed down their branch in Mtwapa, Mombasa. The closure of the branch follows the recent closure of 3 other branches: along Tom Mboya in Nairobi’s CBD, the Mega Branch in Kitale, and at Digo in Mombasa with the retailer citing consolidation of its services to other branches which are more spacious so as to implement social distancing and personal hygiene measures more effectively. The closure of the Tuskys Mtwapa branch is however mainly attributed to strained revenues due to reduced demand as a result of constrained spending power among consumers due to a tough financial environment. We expect, occupancy rates of major retail centers to drop during this period as most retailers are shutting down their operations to cushion themselves against the impact of the pandemic. However, we expect to see retailers invest in their e-commerce infrastructure and also decentralize to locations that are easily accessible from people’s homes.

Quickmart Supermarket, a local retailer, opened its first store in Nairobi’s Central Business District (CBD), along Tom Mboya Street. The retailer has occupied space previously occupied by Botswana-based Choppies who have since exited the Kenyan market due to financial difficulties in an increasingly competitive retail market. This marks Quickmart’s 29th store locally. The retailer seeks to venture into the city centre despite a decreasing footfall as Kenyans comply with the government’s travel restrictions and stay at home directive. In our view, the retailer will leverage from the relatively high footfall within the CBD, and we expect the government to gradually ease the restrictions of movement especially within Nairobi Metropolitan Area, resulting in a slight surge in activity in the CBD and other retail nodes thus providing valuable market for the city’s retailers.

- Industrial Sector

During the week, local construction firm, Jilk Construction Company Limited set up a new plant in Tatu Industrial Park. The plant is expected to produce asphalt concrete, paving blocks and road furniture for civil works and construction projects across Kenya thus signalling the continued growth of local production of construction materials. The ongoing push for industrial expansion, as highlighted by the government’s overarching Big Four Agenda, has witnessed a number of positive developments over the past year. With manufacturing being one of the pillars of the government’s big four agenda, some of the government efforts put in place to support the same include the establishment of Special Economic Zones (SEZs) such as Tatu City, Africa Economic Zones Limited in Eldoret County, Northlands City to the north of Nairobi, Dongo Kundu in Mombasa, Naivasha Industrial Park, Konza City and Lamu Port-South Sudan-Ethiopia Transport (LAPPSET). We expect this to support local production of construction materials which will lead to availability of relatively cheaper construction inputs for use by local developers. In addition, the current disruption of global supply chains due to the ongoing COVID-19 pandemic might act as an incentive for increased local production of construction inputs. This will boost local supply chains, which will ultimately help reduce construction costs which accounts for approximately 60%-70% of development costs in Kenya. This would relieve the financial burden on developers and thus boost the government’s goal of providing affordable housing.

Sameer Africa, a local company whose principal business is the importation and sale of tyres, announced that it would be turning its focus to its real estate business after closing its tyre distribution business citing losses as a result of stiff competition from cheap imports. The company’s current property investments include; (i) a 25% stake in the 500,000 SQFT Sameer Business Park, located along Mombasa Road, (ii) Muthaiga Heights, a residential development along Thika Road, (iii) Rivaan Center, a 58,000 SQFT office complex off Waiyaki Way in Brookside, along Muguga Green,(iv) various land holdings, and, (v) The Sameer Industrial Park situated on the main Nairobi-Mombasa highway. The company expects to return to profitability with returns gained from renting and leasing the various properties, which are spread between various real estate themes thus diversifying their returns. The move is an indication of investor confidence in the real estate sector which has continued to record growth despite a tough economic environment. According to Kenya National Bureau of Statistics (KNBS) Economic Survey 2020 Report the sector recorded improved growth of 5.3% in 2019 compared to 4.1% in 2018, and accounted for 6.9% contribution to GDP.

- Statutory Review

During the week, Ministry Of Lands and Physical Planning invited the public for participation on the regulatory impact statement for the proposed Land Transactions (Electronic) Regulations 2020. The proposed regulations seek to effect the development and implementation of a National Land Information System and the maintenance of a land register and land documents in a secure, accessible and reliable format. As per the proposed regulations;

- The National Land Commission (NLC) shall keep and maintain a data base of all public land in electronic form,

- The National Land Commission (NLC) shall require public institutions vested with the control, care and management of public land to submit an inventory in electronic form of all land under their control and actual occupation,

- Land rent shall be payable to the Cabinet Secretary of the Ministry of Lands and Physical Planning where the head lessor will be the national government and into the County Revenue Fund account where the county will be the head lessor,

- Various fees prescribed under the regulations may be paid through authorized electronic means as may be advised by the Cabinet Secretary from time to time, and,

- The decision to grant or not grant an extension of lease by the County Government shall be communicated to the Cabinet Secretary of the Ministry of Lands for implementation and not the NLC as it was earlier.

In our view, if approved, the regulations will enable Kenyans access information electronically through the use of online portals and carry out all registry transactions under the Act through the electronic registry system. The regulations will speed up land processes in the country, by reducing delays experienced by developers during the pre-construction period thus boosting the real estate sector. Overall, we expect the move to enhance the ease of doing business in Kenya as registration of property is one of the 11 life cycle stages of a business considered by the World Bank when ranking countries, thus attracting foreign investors. Other benefits to be realized upon approval of the regulations include; (i) an efficient and effective land administration system through the establishment of a digital National Land Information System (NLIS), (ii) improved revenue collection by eliminating revenue leakages through the establishment of an electronic payment system, (iii) expediting the process of property registration thus improving the ease of doing business, (iv) cost-effective and reliable paperless transactions in land processes, (v) reduction of paper work and records thus saving space and reduced loss of records, and, (vi) promoting public confidence in the integrity and reliability of electronic records and electronic transactions.

During the week, the Nairobi City County Government announced the disbandment of current Nairobi City County Pre-Technical Committee and the Nairobi City County Urban Planning Technical Committee, where new ones to be constituted within 7 days (from 13th May 2020). Other changes include:

- The suspension of the existing e-construction development application pending development of a new system, and,

- Annulment all applications processed through the e-construction development management system from 18th March 2020 going forward. This includes change of user, extension of user, subdivision and amalgamation, advertisements and renewal of leases.

The new changes come after functions of the Nairobi County Government were handed over to the National Government in February this year. The formation of a new committee will likely speed up approval processes by the county. In our view, the continued delay in the processing of construction permits by the Nairobi County Government continues to affect developers by prolonging project implementation timelines. Currently, construction permits in Kenya can take as long as two years, and the lack of improvements of the administration system has continued to cripple the ease of doing business in the construction industry. Delays in the approval system ultimately lead to unnecessarily high development costs for private developers and loss of revenue for the county. The value of building plans approved in the Nairobi County Government decreased by 1.3% from Kshs 210.3 bn in 2018 to Kshs 207.6 bn in 2019 according to the KNBS Economic Survey 2020. We thus expect the development of the e-system to resolve delays, reduce human interference and thus enhance easy and timely approval.

Other highlights during the week;

- During the week, pension administrators’ body, Association of Retirement Bodies Authority (ARBS), through a letter to the Retirement Benefits Authority (RBA), announced that it would be seeking an extension of the public participation time to discuss the published draft regulations by the National Treasury Cabinet Secretary, Ukur Yatani, aimed at guiding the new amendment to Section 38 of the Retirement Benefits Act which was amended in the Tax Act 2020. If approved, the amendment will allow pensioners to access up to 40% of their savings to purchase houses, in a bid to improve home ownership in Kenya. This is in addition to the existing law that allows retirement schemes’ members to allocate up to 60% of their benefits towards securing a mortgage loan. Please see our note on Using Pension for Housing Purchase for more details.

We expect the real estate sector’s growth to continue being supported by continued public-private partnerships between County governments and private developers with the aim of driving the affordable housing initiative, continued expansion of retailers, investor confidence and advancement in technological infrastructure aimed at boosting productivity and maximizing revenue collection.

In our Q1’2020 Kenya Macroeconomic review, we analyzed the 7 macroeconomic indicators namely; Government Borrowing, Exchange Rate, Inflation, Interest rate, GDP, Security, and Investor Sentiment that we expected to influence Kenya’s economic growth. Based on these indicators, we switched our 2020 outlook to negative from positive with the decision mainly driven by the expected effects of the Coronavirus on the economy. On the interest rates, we gave a negative outlook since we anticipated upward pressure to emanate from the increased government borrowing. As the business environment becomes more challenging, we expect a dip in tax revenues amidst the Government being in dire need of funding to offer the requisite financial stimulus to the economy. The currency outlook was negative due to continued pressure on the shilling from the unfavorable balance of payments position, as we expected forex inflows to be impacted by the negative global economic outlook and the disruption of global supply chains. In this note, we shall be focusing in detail the factors that are expected to drive the performance of the Kenya shilling and the interest rates and thereafter give our outlook for 2020 based on these factors. We shall cover the following:

- Historical Performance of the Kenyan Shilling,

- Evolution of the Interest Rate Environment,

- Factors Expected to Drive Currency Performance,

- Underlying Factors Expected to Drive The Interest Rate Environment, and,

- Conclusion and Our View Going Forward

Section I: Historical Performance of the Kenyan Shilling

Over the past 5 years, the Kenya Shilling has been relatively stable against the US Dollar, as the Central bank has continuously maintained high forex reserves at above the statutory target of 4.0-months import cover, having averaged USD 6.7 bn equivalent to 4.6 months average import cover. The chart below shows the trend of the evolution of the forex reserves:

The healthy forex reserves have been supported by:

- Strong diaspora remittances, which have grown by a 9-year CAGR of 13.8% to USD 228.8 mn in March 2020 from USD 71.6 mn recorded in March 2011,

- The narrowing of the current account due to the increased value of the country’s principal exports with a key focus on the value of tea exports which have grown by a 9-year CAGR of 4.8% to an estimate of Kshs 11.0 bn in February 2020 from Kshs 7.2 bn recorded in February 2011, and,

- Recovery of the tourism sector.

We have seen the shilling depreciate significantly since the onset COVID-19 pandemic. The shilling recorded an all-time low of Kshs 107.3 against the dollar on April 30th 2020. This was mostly attributable to the high dollar demand from foreigners exiting the market as they directed their funds to safer havens as well as merchandise, and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows.

The chart below is the Kshs Vs the USD over the last 10 years:

Source: Central Bank of Kenya

The Kenyan shilling has been on a depreciation streak having lost 5.4%, year to date, ending the week at Kshs 106.8. The recent depreciation has raised concerns, with the International Monetary Fund (IMF) indicating that Kenya’s debt structure increases the currency’s vulnerability to external shocks. In the past 5 months, forex reserves have declined by 3.4% to USD 8.5 bn (5.1-months import cover) from USD 8.8 bn (5.4-months imports cover) in January 2020. The depreciation has mainly been attributed to:

- A 6.3% reduction in diaspora remittances to USD 228.8 mn in March 2020 from USD 244.8 mn recorded in December 2019 attributable to Coronavirus pandemic,

- A decline in demand for Kenya’s exports due to lockdowns in major markets,

- Flight to safety by foreign investors invested in the Kenyan market,

- Increased demand from importers as they stock up dollars, and,

- The dwindling forex reserves have also exerted pressure on the shilling causing a depreciation of the currency. However, we note that the Kshs 78.7 bn disbursement from the IMF will assist in cushioning the shilling from external volatility.

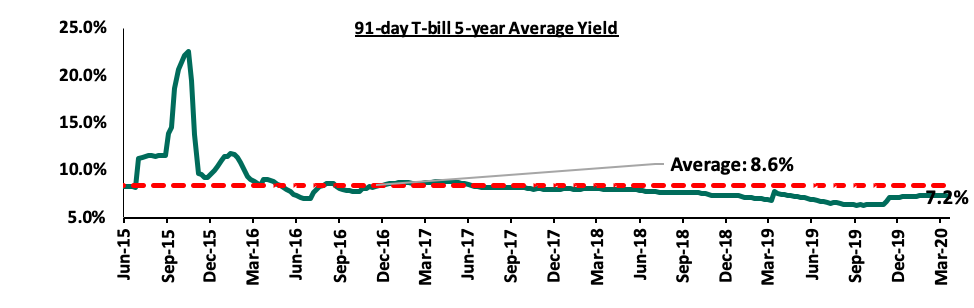

Section II: Evolution of the Interest Rate environment in Kenya

The Interest rates in Kenya have witnessed high volatility in 2011 and 2015 as seen by the significant increase in yields in the government papers. The yield on government papers largely follow what is happening in the economy and in times of expected high borrowing, lending rates tend to shoot up as was seen in September 2015 where, the yields on the 91-day papers increased to 18.6%, a 4-year high from the last recorded high yields of 20.9% recorded in 2011. The high borrowing target in the high cost of credit environment saw the government offer attractive rates on its papers.

Over the last 5 years, the rates on government papers have remained relatively stable despite the continuous high budget deficit. The capping of the interest rate through the Banking Amendment Bill (2016) saw banks not keen to lending to the private sector as the regulation limited their credit pricing, and so most of the cash was channeled towards government debt, which offered better returns on a risk adjusted return basis.

Source: Central Bank of Kenya

With the expected economic slowdown we expect to see more borrowing locally as the governments seeks to plunge in the budget deficit brought about by the slow-down in revenue collections. It shall also be difficult and expensive to raise funds from the international markets.

To address the Coronavirus pandemic that has dampened economic activities leading to significant revenue underperformance, The National Assembly on 22nd April approved the supplementary budget for the fiscal year 2019/20, paving the way to a Kshs 9.7 bn decline in the gross total supplementary budget. Despite the Kshs 9.7 bn reduction, the overall fiscal deficit has increased to an estimate of 7.8% of GDP from the earlier estimated deficit of 6.3% of GDP for FY 2019/20. The table below illustrates the allocation of the Supplementary Budget 2019/20, showing how much has been collected:

|

Item |

FY'2019/2020 Approved Estimates (Kshs bn) |

Collected Amount March 2020 (Kshs bn) |

% Met |

|

Total Revenue |

1,893.9 |

1,332.2 |

70.3% |

|

Grants |

44.6 |

13.6 |

30.5% |

|

Total Revenue & Grants |

1,938.5 |

1,345.8 |

69.4% |

|

Recurrent Expenditure |

1,248.6 |

1,154.4 |

92.5% |

|

Development Expenditure |

367.5 |

471.9 |

128.4% |

|

County Government |

316.5 |

214.8 |

67.9% |

|

Total Budget (Inclusive of CFS) |

2,803.1 |

1,841.1 |

65.7% |

|

Fiscal Deficit (Inclusive of Grants) |

(864.6) |

(495.3) |

- |

|

Deficit (Inclusive of grants) as a % of GDP |

7.8% |

- |

- |

|

Net Foreign Borrowing |

455.0 |

98.4 |

21.6% |

|

Net Domestic Borrowing |

404.4 |

290.9 |

65.0% |

|

Total Borrowing |

859.4 |

385.7 |

45.3% |

As seen above, the government has been able to raise 65.7% (Kshs 1,841.1 bn) of it’s total budget (Kshs 2,803.1 bn). With less than two months to the end of the fiscal year, the government will be under pressure to borrow domestically. We believe that in order for the government to ease pressure on the interest rate, they should;

- Consider seeking for debt restructuring to reduce the debt serving cost. In 2019, the debt to service ratio stood at 45.2% above the 30.0% recommended threshold, and

- Relook at the budget and consider shelving some of the projects that are not very urgent. Despite the Kshs 9.7 bn decline in the gross total supplementary budget for 2019/2020, the fiscal deficit remains high at an estimate of 7.8% of GDP, and,

- As highlighted in our Debt Relief Amidst the COVID-19 pandemic topical, the government should consider negotiating for a temporary debt stand still as well as look for concessional loans that will provide additional liquidity and serve as a bridge special purpose vehicle for commercial debt servicing

Section III: Factors expected to drive currency performance

In this section, we will analyze the key factors expected to drive the performance of the Kenyan Shilling:

- Balance of payments

According to the Economic Survey 2020 released by the Kenya National Bureau of Statistics, the current account deficit grew by 10.9% to a deficit of Kshs 567.0 bn in 2019 from a deficit of Kshs 511.3 bn recorded in 2018, attributed to a 2.9% decline in the value of exports despite 2.3% increase in the value of imports. Currently, the export sector has continued to suffer significant losses (it is estimated that the floriculture sector will lose Kshs 60.0 bn by the end of 2020) due to reduced demand for Kenyan exports and the decline of global commodity prices. Despite the easing of the lockdown measures in Kenya’s trading partners, we expect the business environment to have a sluggish growth towards the end of 2020. The tourism sector, one of the key foreign exchange earners, has suffered significant losses due to the ban on international travel. In March 2020, Kenya Airways announced a Kshs 8.0 mn revenue loss following the travel restrictions. On the plus side, however, Kenya could be facing a lower import bill on account of the reduced oil prices as well as the reduction in the imports of goods and services as many firms have scaled down their operations in light of the Coronavirus. The low import bill will however not be able to offset the current account deficit thereby and as such, we expect continued pressure on the shilling due to the high dollar demand.

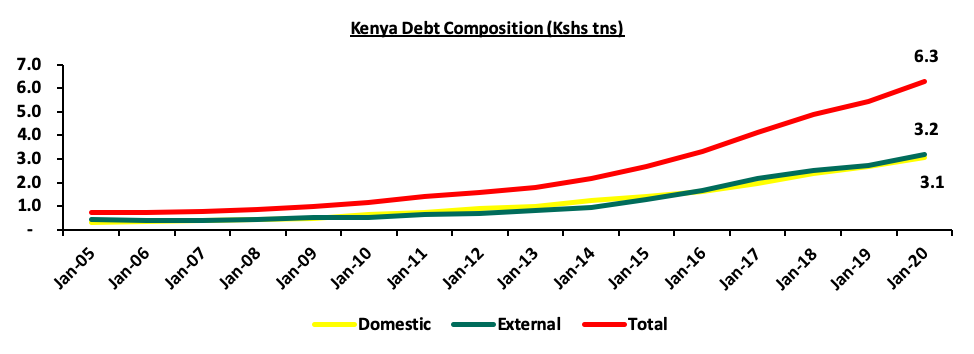

- Government debt

Currently, Kenya’s debt stands at Kshs 6.3 tn comprising of Kshs 3.2 tn in external debt and Kshs 3.1 tn in domestic debt as highlighted in the chart below:

In the recently approved Supplementary Budget II Estimates for the fiscal year 2019/20, Kenya is scheduled to pay a total of Kshs 253.4 bn comprising of Kshs 121.5 bn in external debt redemptions and Kshs 131.9 bn in external debt interest payments. In the 2018/19 fiscal year, the debt service to export earnings ratio came in at 30.2%, an increase from the 20.0% recorded the previous fiscal year, an indicator of increased pressure on the foreign exchange receipts that are being redirected to service debt. Given the poor performance in the export sector, we expect the debt service to export earnings ratio to continue rising this year due to the underperformance on the denominator side, which will in the essence put more pressure on the forex reserves as the country meets external debt obligations.

- Forex Reserves

Kenya’s Forex Reserves have been declining in 2020 so far they have witnessed a 3.4% decline to USD 8.5 bn (5.1-months import cover) in May 2020, from USD 8.8 bn (5.4-months imports cover in January 2020. The decline is due to low inflows amidst increased dollar demand. There shall be continued pressure on the reserves due to low exports of goods and lower diaspora remittances amidst increases in demand for dollars to service Kenya debt and as foreign investors flee to safer havens.

On the positive side, the IMF recently disbursed Kshs 78.7 bn (USD 739.0 mn) to help the country address the impact of Coronavirus pandemic. These funds will be used to provide budget-financing needs and allow the government to maintain an adequate level of foreign reserves to support the economy as well as cover the balance of payment gaps. Despite this, we still expect forex reserves to continue declining with our sentiments being on the back of (i) reduced diaspora remittances, (ii) continued investor capital outflows in the money market, and (iii) increased foreign debt repayments.

- Monetary Policy

Central Banks play an instrumental role in determining price stability and economic growth of a country. Depending on the economic cycle, Central Banks can either adopt an accommodative or a tight monetary policy. Given the current economic environment that has greatly been affected by the Coronavirus pandemic, the MPC implemented an accommodative policy by lowering the CBR by 25 bps to 7.00% from 7.25%. As a result, domestic investment activities will decline as Kenya’s financial and capital assets become less appealing to investors on account of their lower real rate of return. Consequently, the shilling will continue to depreciate as the demand for the dollar increases. We do not expect the CBK to increase the rates as the Central Bank is mainly focused on reviving the economy. Given that the Inflation rates have remained within the government’s target of 2.5% - 7.5% supported by the lower fuel prices and favorable weather conditions, the Central Bank will not be under pressure to increase the rates on this front, and as such, the shilling will continue to weaken.

Outlook:

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

|

Negative |

|

Government Debt |

|

Negative |

|

Forex Reserves |

|

Negative |

|

Monetary Policy |

|

Neutral |

From the above currency drivers, 3 are negative (forex reserves, balance of payment, and government debt) while is neutral (Monetary Policy) indicating a negative outlook for the currency.

Section IV: Underlying factors expected to drive the Interest Rate environment

- Fiscal Policies

In the recently approved Tax Amendment Bill 2020, the government reduced its expenditure by Kshs 9.7 bn and forfeited an estimated Kshs 122.0 bn of the earlier expected revenue, due to the current constrained economic conditions, and as such increasing the fiscal deficit to an estimate of 7.8% of GDP from the earlier estimated deficit of 6.3% of GDP for FY 2019/20. This saw the domestic borrowing target adjusted upwards to Kshs 404.4 bn from the earlier approved Kshs 300.3 bn to plug in the fiscal deficit. The government is currently 28.1% behind its domestic borrowing target of Kshs 404.4 bn having borrowed Kshs 290.9 bn against a prorated target of Kshs 357.7 bn. With less than 2 months remaining to the end of the FY’2019/20, we do not believe the government will be able to meet this target as it is also burdened by high levels of debt maturities currently standing at Kshs 148.9 bn (Kshs 117.9 bn in T-Bill maturities and Kshs 31.0 bn in T-bond maturities) and as such, the government may resort to accepting expensive bids and destabilize the interest rates in the process. To relieve the burden of debt maturities, the Government is seeking to restructure the maturities of the Treasury Bills by switching T-bill investors to the June Infrastructure bond. Given that the 364-day T-bill will be maturing on June 1st 2020, investors have the option of rolling over their maturities or investing their proceeds to the June Infrastructure Bond. Due to the revenue side constraints given the current reduced economic activity as evidenced by the declining PMI to 34.8 from the 37.5 seen in March 2020, we foresee the government increasing its borrowing activities in the local market with a bias towards an upward adjustment of the yields to incentivize investors thus putting pressure on interest rates.

- Liquidity

In the March 2020 sitting, the MPC lowered the Cash Reserve to Ratio (CRR) to 4.25% from 5.25% and increased the maximum tenor of Repurchase Agreements (Repos) to days from 28 days enabling banks to access long-term liquidity secured in their holdings in government papers. The CBK also availed Kshs 35.2 bn to commercial banks, which would be used to support borrowers affected by the Coronavirus pandemic. Consequently, this move has led to ample liquidity in the money market as evidenced by the low interbank rates of 4.1% recorded during the week. In an ideal situation, the ample liquidity in the money market, the lowering of commercial banks’ lending, and deposit rates would lead to increased money supply in the economy and an increase in consumers’ purchasing power.

The lowering of the CRR will contribute towards increasing liquidity in the short term. According to the Central Bank of Kenya, the reduction of the CRR in March 2020 had by the end of April 2020 freed Kshs 17.6 bn, which was granted to 11 commercial banks and 1 microfinance bank to be used for onward lending to distressed borrowers.

As the effects of the Coronavirus continue to be felt in the economy, we believe banks will find it difficult to lend to businesses and individuals as the risk levels have increased as such a large proportion of these funds may be channeled to government securities offering some reprieve on the Government yields due to reduced credit competition from the private sector.

- Monetary Policy

In the April 2020 sitting, the MPC cut the CBR rate by 25 bps to 7.00% from 7.25% in order to support economic growth, stabilize the financial markets and mitigate the economic and financial disruptions brought about by the virus. Of the Kshs 32.5 bn availed by the CBK to the Commercial Banks in March 2020, 43.5% of the funds were utilized with the Tourism, Real Estate, and Agricultural sector being the major beneficiaries. As a result of the adoption of the accommodative policy in 2020, commercial banks’ lending rates declined to 12.2% in February 2020 from 12.3% seen in December 2019. In our view, should the MPC continue to pursue an accommodative monetary policy in this tough operating environment, lending rates may remain constant on account of the bank’s credit pricing models, therefore, locking out borrowers from accessing credit.

Due to the low credit risk associated with Government securities, the value of their stream of future cash payments is simply a function of the investors required return based on the inflation expectations as inflation erodes the purchasing power of a bond's future cash flows. Put simply, the higher the current rate of inflation and the higher the (expected) future rates of inflation, the higher the yields will rise across the yield curve, as investors will demand this higher yield to compensate for inflation risk. Inflation in the country is expected to remain stable and within the government target of 2.5%-7.5% and as such this might aid in mitigating the upwards readjustment of Government securities as investors will not be attaching a higher premium to meet their required real rate of return.

Outlook:

|

Driver |

Outlook |

Effect on Interest Rates |

|

Fiscal Policies |

|

Negative |

|

Monetary Policy |

|

Neutral |

|

Liquidity |

|

Negative |

From the above basis, 2 of the drivers are negative (fiscal policies and liquidity) while 1 is neutral (monetary policy). We, therefore, expect upward pressure on rates in the coming months.

Section V: Conclusion and our view going forward

Based on the factors discussed above and factoring the adverse effects the ongoing Coronavirus pandemic on the Kenyan economy,

- We expect the Kenyan shilling to depreciate by 5.5% by the end of 2020 on a YTD basis on account of:

- Reduced exports earning due to the lockdown measures put in place by Kenya’s trade partners in the wake of the Coronavirus pandemic. The trade disruptions will see the cost of imports rise thereby widening the current account deficit,

- Declining diaspora remittances that have been brought about by reduced economic activity, the decline in disposable income, and the increasing cost of goods will see the forex decline. In turn, the shilling will be exposed to foreign exchange shocks due to lowered forex exchange reserves, and,

- High levels of government debt that has widened Kenya’s fiscal deficit, thus making it hard for the government to access foreign debt as investors attach a high-risk premium on the country.

- We expect a slight upward readjustment on the yield curve with our sentiments being on the back of:

- Increased pressure on the government to plunge in the budget deficit by meeting its increased domestic borrowing. There is a probability that the government will accept expensive bids and in turn destabilize the interest rate environment,

- Investors will demand higher yields to compensate for inflation and as such, as investors will attach a high-risk premium to meet their required real rate of return, and,

- Despite the increased liquidity in the country, banks will not be willing to lend to the private sector, and as such, the excess liquidity will be channeled back to government securities.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.